Insights Ahead: Dollar Tree's Quarterly Earnings

Dollar Tree (NASDAQ:DLTR) is gearing up to announce its quarterly earnings on Wednesday, 2025-12-03. Here's a quick overview of what investors should know before the release.

Analysts are estimating that Dollar Tree will report an earnings per share (EPS) of $1.09.

Anticipation surrounds Dollar Tree's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

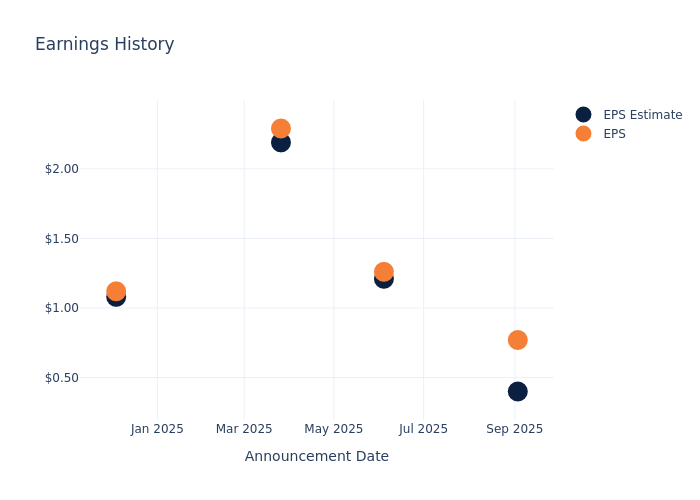

Historical Earnings Performance

The company's EPS beat by $0.37 in the last quarter, leading to a 1.74% drop in the share price on the following day.

Here's a look at Dollar Tree's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.40 | 1.21 | 2.19 | 1.08 |

| EPS Actual | 0.77 | 1.26 | 2.29 | 1.12 |

| Price Change % | -2.00 | 9.00 | 11.00 | -2.00 |

Performance of Dollar Tree Shares

Shares of Dollar Tree were trading at $109.89 as of December 01. Over the last 52-week period, shares are up 48.84%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Dollar Tree

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Dollar Tree.

The consensus rating for Dollar Tree is Neutral, derived from 20 analyst ratings. An average one-year price target of $109.75 implies a potential 0.13% downside.

Analyzing Analyst Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of Dollar General, BJ's Wholesale Club Hldgs and Target, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Dollar General, with an average 1-year price target of $114.6, suggesting a potential 4.29% upside.

- Analysts currently favor an Neutral trajectory for BJ's Wholesale Club Hldgs, with an average 1-year price target of $106.3, suggesting a potential 3.27% downside.

- Analysts currently favor an Neutral trajectory for Target, with an average 1-year price target of $95.54, suggesting a potential 13.06% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary outlines pivotal metrics for Dollar General, BJ's Wholesale Club Hldgs and Target, demonstrating their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Dollar Tree | Neutral | 12.33% | $1.57B | 5.02% |

| Dollar General | Neutral | 5.07% | $3.36B | 5.24% |

| BJ's Wholesale Club Hldgs | Neutral | 4.88% | $1.01B | 7.12% |

| Target | Neutral | -1.55% | $7.13B | 4.46% |

Key Takeaway:

Dollar Tree ranks first in revenue growth among its peers. It ranks lowest in gross profit and return on equity.

Delving into Dollar Tree's Background

Dollar Tree operates discount stores across the United States and Canada, with over 8,800 shops under its namesake banner. About 50% of Dollar Tree's sales in fiscal 2024 were consumables (including food, health and beauty, and cleaning products), around 45% variety items (including toys and homewares), and 5% seasonal items. Dollar Tree sells most of its merchandise at the $1.25 price point and positions its stores in well-populated suburban markets. The retailer has agreed to sell Family Dollar (with about 7,000 stores) to private equity investors for $1 billion.

Financial Milestones: Dollar Tree's Journey

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Dollar Tree's remarkable performance in 3 months is evident. As of 31 July, 2025, the company achieved an impressive revenue growth rate of 12.33%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Staples sector.

Net Margin: Dollar Tree's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.12% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 5.02%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Dollar Tree's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.19%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Dollar Tree's debt-to-equity ratio surpasses industry norms, standing at 2.04. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Dollar Tree visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal