US Stock Outlook | Futures of the three major stock indexes soared after MongoDB's performance soared, Trump will issue a major statement

Pre-market market trends

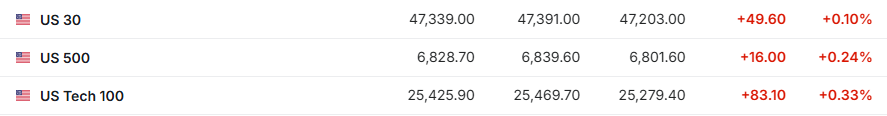

1. On December 2 (Tuesday), the futures of the three major US stock indexes rose sharply before the US stock market. As of press release, Dow futures were up 0.10%, S&P 500 futures were up 0.24%, and NASDAQ futures were up 0.33%.

2. As of press release, the German DAX index rose 0.62%, the UK FTSE 100 index rose 0.24%, the French CAC40 index rose 0.29%, and the European Stoxx 50 index rose 0.65%.

3. As of press release, WTI crude oil fell 0.19% to $59.21 per barrel. Brent crude oil fell 0.30% to $62.98 per barrel.

Market news

QT ends superimposing the Federal Reserve's dovish stance! “Wall Street magic operator” optimistic outlook: S&P points to a new high of 7,300 points before the end of the 500. Tom Lee, co-founder and head of research at Fundstrat, a financial market research institution known as the “magic operator of Wall Street,” predicts that US stocks will perform strongly in December, and that the S&P 500 index may rise to a high of 7,300 points by the end of the year, which means a 10% increase from current levels. Tom Lee said, “The S&P 500 needed only a 2% increase to reach 7,000 points. Judging from the current point, I think the index may increase by 5% or even 10% in December.” He pointed out that the end of quantitative austerity (QT) by the Federal Reserve will be the main driving force for the rise in the market. He compared the current situation to September 2019, when US stocks rose more than 17% within three weeks of the end of quantitative austerity. Tom Lee also believes that fluctuations in the US stock market in November contributed to a healthy reset of positions. Furthermore, Tom Lee believes that the Federal Reserve's dovish stance will continue to support the stock and cryptocurrency markets.

The “Cyber Monday” war has been reported as a cover for US consumption. Strong holiday shopping cannot hide hidden economic concerns. According to Saifushi data, consumers spent $17.3 billion online on the day of “Cyber Monday.” A series of data provides an important signal for executives, economists, and investors who are closely watching the holiday shopping season. The consumer resilience shown by American consumers on “Black Friday” and “Cyber Monday” this year exceeded market expectations, leading to steady growth in total retail sales, but this data masks the reality of weak actual purchasing power growth and increasing economic differentiation in an environment of high inflation. Despite the rise in overall spending, the consumption behavior of the wealthy and low-income groups showed a “K-type economy,” and inflation anxiety and price sensitivity became the core variables dominating market sentiment. Despite the increase in overall spending, the increase in sales was largely driven by rising commodity prices rather than increasing sales volume.

The real money in the market is betting on Hassett, who is “pigeon to the extreme”, to take the lead! US President Trump has decided who will succeed Powell as the next chairman of the Federal Reserve. The prediction website shows that Kevin Hassett, director of the White House National Economic Council, is most likely to be the successor. According to the prediction market website Kalshi, the probability of Hassett being elected is about 82%, and the probability of former Federal Reserve Governor Kevin Walsh being appointed is about 13%. The Polymarket website estimates Hassett's chance of succeeding Powell at about 73%. However, Nick Timiraos, known as “the Federal Reserve's speaker,” recently published an article saying that if Trump finally nominates Hassett, it will be because he has met Trump's two core standards: loyalty and market credibility. However, this potential position is extremely dovish, and the US Federal Reserve candidate who strongly supports Trump's decisions has also raised serious doubts about whether it can maintain the independence of the central bank under political pressure.

Warning signs flashed! Silver soared 8% and then cooled down, and technical indicators issued an “overheating” alarm. On Tuesday, the price of silver fell from an all-time high. A key technical indicator showed that this six-day round of gains had brought silver into the overbought range. As of press time, the price of spot silver is around $57.45 an ounce. Traders previously bet that the tight supply situation will continue and that the Federal Reserve is expected to cut interest rates again. This expectation provided upward momentum for unprofitable precious metals. However, the 14-day Relative Strength Index (RSI) shows that the recent speculative boom may have been excessive and too fast. A reading of the index above 70 usually means that market momentum is overheating.

Individual stock news

The “Google AI Ecosystem Chain” bull market logic has been strengthened again! Demand for cloud AI computing power soared, and MongoDB (MDB.US)'s performance greatly exceeded expectations. MongoDB, a database software manufacturer that provides database platform services on the Google Cloud platform, reported that total revenue for the third fiscal quarter increased 19% year over year to US$628 million, far exceeding market expectations of US$592 million; adjusted earnings per share were US$1.32, far exceeding market expectations of US$0.80. The revenue of the core cloud product Atlas cloud database product increased 30% year over year (20%-25% increase higher than Wall Street average expectations), accounting for about 75% of the company's total revenue for the third fiscal quarter, and is the absolute main force driving the overall high growth trend. The company also raised its full-year performance forecast, raising its full-year revenue guidance for FY2026 to the range of US$2,434 billion to US$2,439 billion. The previous forecast was US$2.34 billion to US$2.36 billion, which is also significantly higher than market expectations of approximately US$2.36 billion. As of press release, MongoDB surged nearly 23% in the premarket on Tuesday.

Apple (AAPL.US) lost the EU Supreme Court and faces the threat of a class-action lawsuit. The EU's Supreme Court ruled that users of Apple's app stores can file a class action lawsuit in the Netherlands for their suspected monopoly behavior, which increases the risk of Apple facing more class-action damages claims in the EU. Apple previously defended that the Dutch courts had no jurisdiction over the case because the alleged infringement did not occur in the Netherlands, particularly in Amsterdam.

Amazon (AMZN.US) AWS Annual Conference Highlights: Implementing multi-industry cooperation to promote cloud security, finance, and sustainable development. During the opening of the Re:Invent 2025 conference held in Las Vegas, Amazon's cloud services division, announced a number of initiatives to establish new partnerships or expand existing collaborations with many industries. AWS announced new partnerships with companies such as CrowdStrike, BlackRock, S&P Global, Trane Technologies, and Visa.

“Big Short” Bury turns his finger on Tesla (TSLA.US)! Pointing directly to “absurdly overestimation,” he named Musk's sky-high pay dilution of equity. Well-known bear Michael Berry recently took another shot at an overvalued stock — Tesla. He called the electric car maker “ridiculously overrated.” He slammed the “pathetic calculation” based on stock compensation, citing Tesla as an example. He said that Tesla dilutes 3.6% of its shares by issuing new shares every year and does not repurchase shares. He added that CEO Elon Musk's $1 trillion compensation package would further dilute Tesla's stock.

Rumor has it that Maywell Technology (MRVL.US) plans to spend 5 billion US dollars to acquire Celestial AI, betting on photonic connectivity to break the “memory wall.” According to people familiar with the matter, US chipmaker Maywell Technology is in in-depth negotiations to acquire chip startup Celestial AI in a multi-billion dollar cash plus stock deal. The total transaction price, including the product's milestone earnings, may exceed 5 billion US dollars. Celestial AI is committed to developing Photonic Fabric, an optical interconnection platform designed to solve the “memory wall” bottleneck in today's AI computing architectures. By utilizing optical interconnect, Celestial AI provides high-bandwidth, low-latency, and low-power solutions that support the expansion of AI accelerators from within a chip to multi-rack deployments.

Key economic data and event forecasts

At 23:00 Beijing time, Federal Reserve Governor Bauman testified before the House Financial Services Committee

US President Trump issued a major statement at 03:00 Beijing time the next day

Performance Forecast

Wednesday morning: CrowdStrike (CRWD.US), Mywell Technology (MRVL.US)

Wednesday pre-market: dollar tree (DLTR.US), yuan insurance (YB.US)

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal