Circle Internet Group’s 40% Drop and New Partnerships Spark Fresh Debate on Share Value

- If you have ever wondered whether Circle Internet Group’s current share price offers a true bargain or signals caution ahead, you are not alone. Let’s break down what’s really going on beneath the surface.

- In the past week, the stock bounced up 4.4%. Looking back over the last month, it’s dropped by a striking 40.2%, hinting at both volatility and shifting risk sentiment.

- One driving force behind these wild price swings is a series of headlines related to regulatory changes in the digital payments market and the company’s expanded partnerships with major fintech players. Both factors have attracted investor attention and altered sentiment quickly.

- Right now, Circle Internet Group’s valuation score stands at 3 out of 6. There is nuance to each method we’ll unpack in this article, plus an approach to valuation you might not have considered, coming up at the end.

Approach 1: Circle Internet Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting those amounts back to their present value. This method relies on both analyst forecasts and longer-term estimates to determine what the business is really worth based on fundamentals, not just market sentiment.

For Circle Internet Group, the current Free Cash Flow stands at $329.2 Million. Analyst projections see this figure climbing steadily, reaching $1.42 Billion in 2029. Beyond five years, Simply Wall St’s model extrapolates cash flows further, forecasting growth up to 2035. These comprehensive cash flow projections are processed using the two-stage Free Cash Flow to Equity approach, which is well suited to businesses like Circle with strong expected growth and evolving industry dynamics.

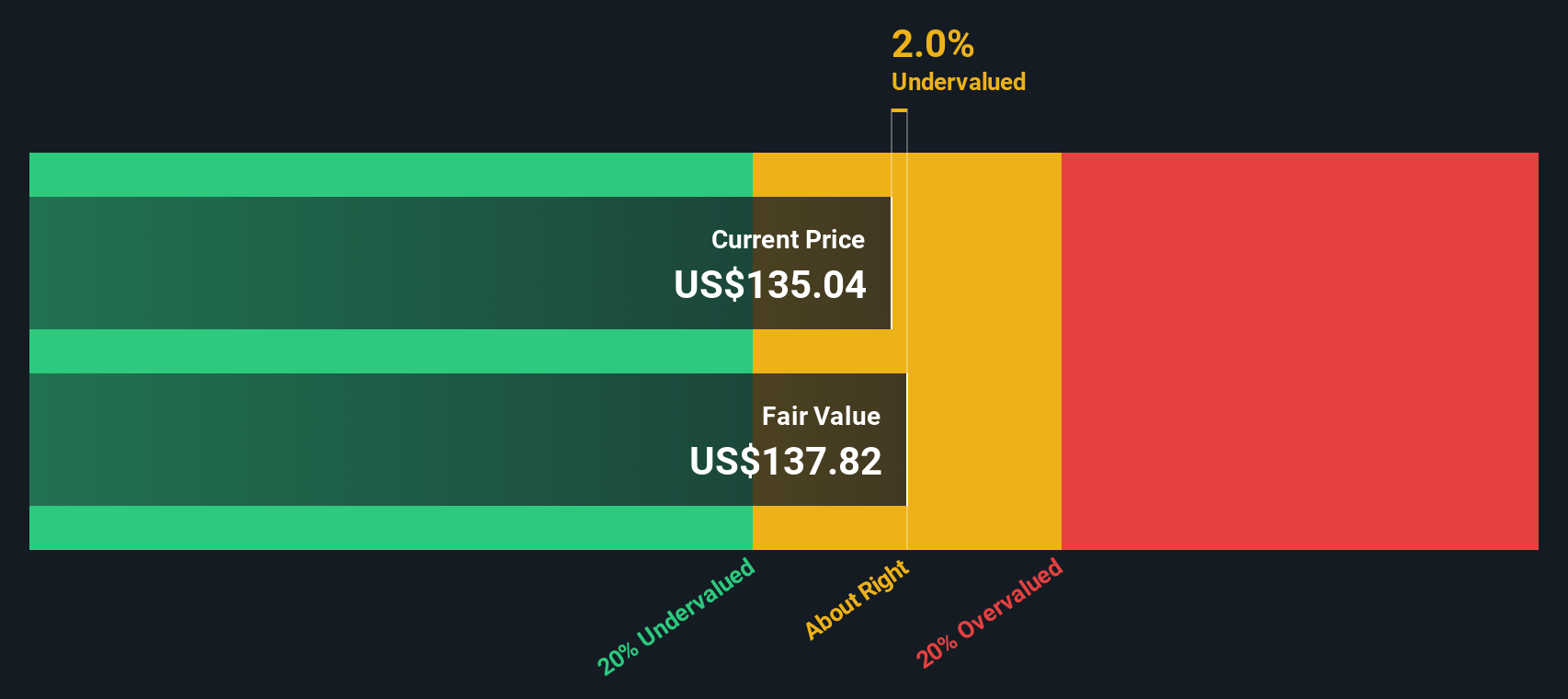

Based on these calculations, the estimated intrinsic value per share is $140.28. Compared to current trading levels, this implies a substantial 45.9% discount, indicating that the stock may be significantly undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Circle Internet Group is undervalued by 45.9%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

Approach 2: Circle Internet Group Price vs Sales (P/S)

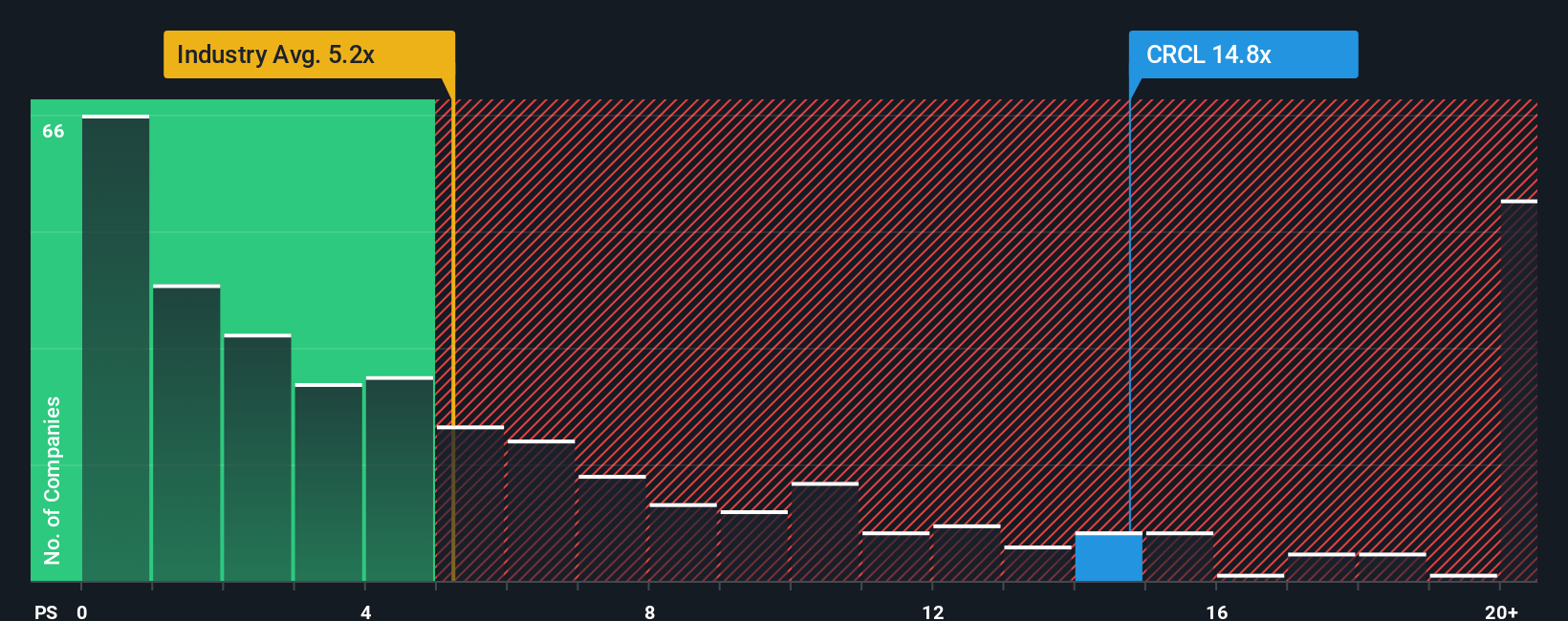

The Price-to-Sales (P/S) ratio is a widely used valuation metric for companies like Circle Internet Group, especially when they are generating significant revenue but may not yet have meaningful or consistent earnings. This multiple focuses on top-line performance, which is particularly relevant for technology and software companies in high-growth phases.

A “normal” or “fair” P/S ratio is shaped by a company’s expected growth and risk profile. Companies with higher growth expectations or lower risks often command a higher P/S ratio. At the same time, heavy competition or high uncertainty tends to push this multiple lower, even for sector leaders.

Circle Internet Group currently trades at a P/S ratio of 7.41x. For context, this stands above the Software industry average of 4.74x and below the average of its direct peers at 11.69x. To provide a more tailored assessment, Simply Wall St calculates a proprietary “Fair Ratio” of 4.62x for Circle. This Fair Ratio incorporates not just peer and industry comparisons but also factors in the company’s margin profile, estimated earnings growth, risk, and market capitalization to arrive at a benchmark that is more attuned to Circle’s unique position.

Relying solely on peer or industry multiples can be misleading, as these do not account for company-specific fundamentals or forward-looking risks. The Fair Ratio, in contrast, provides a more nuanced yardstick for fair value. When comparing Circle’s current P/S of 7.41x with its Fair Ratio of 4.62x, the stock appears to be trading above the level that would be justified by its fundamentals.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Circle Internet Group Narrative

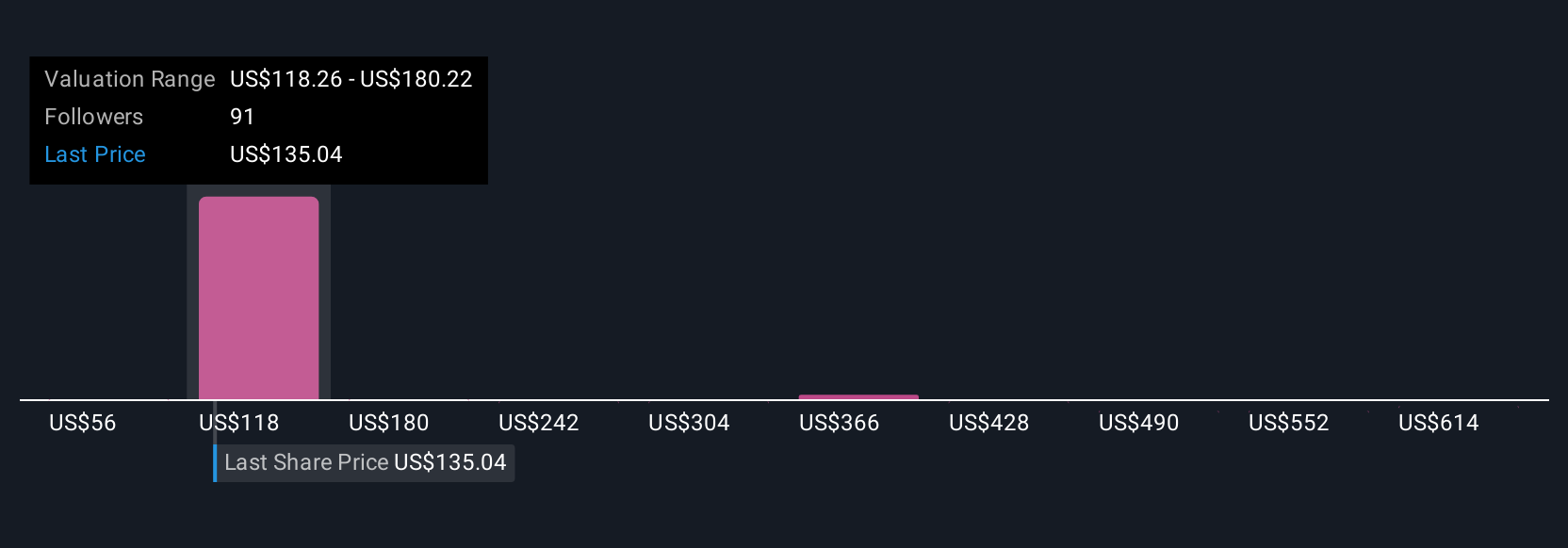

Earlier we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives, a simple tool that empowers you to connect your story and outlook for a company with your financial forecast, bringing context and personal conviction to the numbers behind a stock’s fair value.

A Narrative is more than just a forecast. It lets you express why you believe Circle Internet Group’s future will look a certain way, defining your assumptions about future growth, risks, and profit margins, and showing how these perspectives shape what you think the shares should really be worth.

On Simply Wall St’s Community page, millions of investors use Narratives to clarify their decision making, comparing their own fair value to the latest market price and seeing in real time whether their investment thesis supports a buy, hold, or sell action.

Narratives update dynamically whenever fresh news, earnings, or financial data arrives, so your view stays current as the story evolves.

For example, some investors see Circle Internet Group as a long-term play on the infrastructure of digital finance and have set high fair values based on aggressive growth assumptions. Others, wary of new regulatory constraints and competitor advantages, anchor their valuations at much lower levels.

Do you think there's more to the story for Circle Internet Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal