Apollo Global Management (APO): Exploring Valuation After Morgan Stanley’s Upgrade and Bullish Analyst Growth Projections

Apollo Global Management (APO) shares drew investor attention following Morgan Stanley’s decision to upgrade the stock. The move highlights the firm’s anticipated growth in fee-related earnings and steady fundraising activity. This shift builds on broader optimism around expanding capital markets revenues.

See our latest analysis for Apollo Global Management.

Following a challenging year, with Apollo’s share price still down over 20% year-to-date, recent momentum seems to be returning with a 6.8% gain over the past month. While recent conference appearances in Singapore signal the firm’s ongoing global engagement, the longer-term story remains compelling. Apollo has delivered a notable 103% total shareholder return over the past three years, showing its ability to reward patient investors even through periods of volatility.

If you’re interested in finding what else might be gaining traction, now could be the perfect moment to see what’s out there through fast growing stocks with high insider ownership

With the stock recovering ground and analyst upgrades fueling optimism, the key question for investors is whether Apollo’s current price reflects its future growth potential or if there is still meaningful upside left to capture.

Most Popular Narrative: 16.7% Undervalued

Compared to Apollo Global Management’s last close of $131.85, the narrative fair value estimate of $158.22 points to notable upside. The gap reflects shifting forecasts for revenue growth and profit margins, fueling debate over what is driving the consensus view.

The company’s strategic focus on the global industrial renaissance, particularly in areas like energy and infrastructure, is anticipated to significantly boost origination volumes and enhance both revenue and earnings. Apollo’s expansion into retirement solutions and evolving products for guaranteed income, alongside legislative prospects, could stimulate strong growth in retirement inflows and positively impact net margins.

Want to know which assumption is getting the most attention in this narrative? There is a surprising growth driver and margin signal that is tilting the numbers. Get the full picture on what is truly moving Apollo’s fair value higher. Do not miss the breakdown behind this bold price target.

Result: Fair Value of $158.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps or intensified competition in the insurance space could stall Apollo’s growth and put pressure on profit margins in the coming years.

Find out about the key risks to this Apollo Global Management narrative.

Another View: What Do Market Multiples Say?

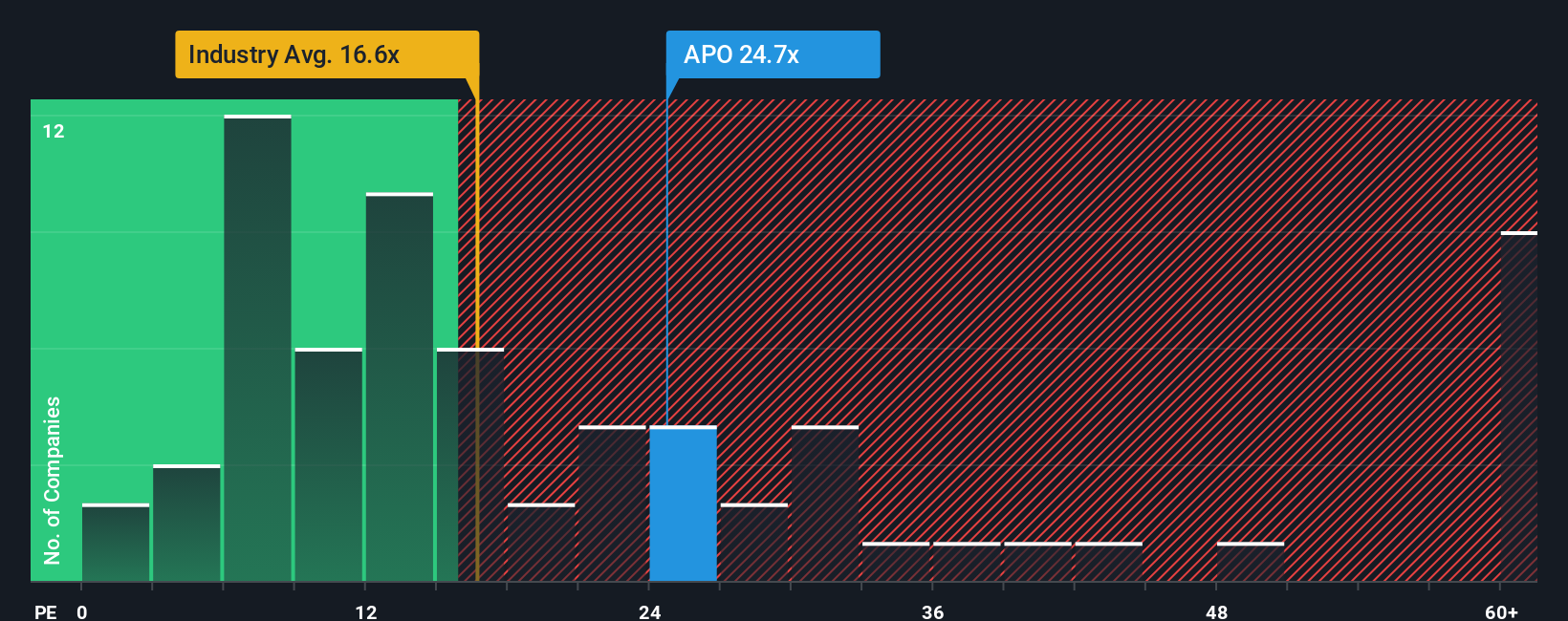

When looking at Apollo through the lens of typical market price-to-earnings ratios, a different picture emerges. The company trades at 18.8 times its earnings, which is higher than both the industry average of 14 times and the peer average of 13 times. However, the fair ratio—meaning what the market could shift toward—is 23.7 times. This makes Apollo appear expensive compared to its peers but also suggests there could be room for upward movement if conditions change. Is the market being too cautious, or is this a signal to proceed carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Apollo Global Management Narrative

If the current perspective does not align with your own, or you want to dig deeper on your terms, you can craft a personalized view in just a few minutes. Do it your way

A great starting point for your Apollo Global Management research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your investing journey and uncover opportunities that others might overlook. Seize the chance now as unique market movers await beyond Apollo Global Management.

- Capitalize on high-tech disruptors by checking out these 25 AI penny stocks for companies setting the pace in artificial intelligence advancements.

- Maximize your income potential and stability by evaluating these 15 dividend stocks with yields > 3% with market-beating yields above 3%.

- Position yourself ahead of trends in digital finance by exploring these 81 cryptocurrency and blockchain stocks leading the evolution of blockchain and cryptocurrency innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal