Why Texas Instruments (TXN) Is Up 5.3% After Beating Estimates But Issuing Cautious Guidance

- Earlier this month, Texas Instruments reported quarterly results that surpassed consensus estimates for both revenue and earnings, but also issued a cautious outlook for the next quarter amid uncertainties such as semiconductor tariffs.

- While the company’s recent operational outperformance drew investor attention, concerns remain as Texas Instruments holds a low analyst rating despite its strong industry reputation.

- We'll look at how management's cautious forward guidance and tariff concerns may shape Texas Instruments' investment narrative going forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Texas Instruments Investment Narrative Recap

At its core, an investment in Texas Instruments hinges on the belief that the company’s leadership in analog and embedded chips, coupled with expanding end-market demand in industrial and automotive sectors, supports stable long-term growth. The recent cautious outlook, shaped by concerns over semiconductor tariffs, is weighing on short-term sentiment but does not appear to materially alter the immediate growth catalysts or the most pressing risk: macroeconomic and policy headwinds that could disrupt global sales and margins.

Among recent announcements, Texas Instruments’ plan to invest over US$60 billion in new U.S. semiconductor fabs is particularly relevant in light of supply chain and tariff risks. This move may help secure manufacturing resilience and preferred-supplier status, supporting future revenue streams even as near-term demand visibility remains uncertain. However, the scale of these investments underscores exposure to the risk of excess capacity if projected demand falls short.

Yet, while guidance focused on tariffs and demand caution, investors should be mindful that continued capital spending could mean...

Read the full narrative on Texas Instruments (it's free!)

Texas Instruments' narrative projects $22.3 billion revenue and $7.9 billion earnings by 2028. This requires 10.1% yearly revenue growth and a $2.9 billion earnings increase from $5.0 billion today.

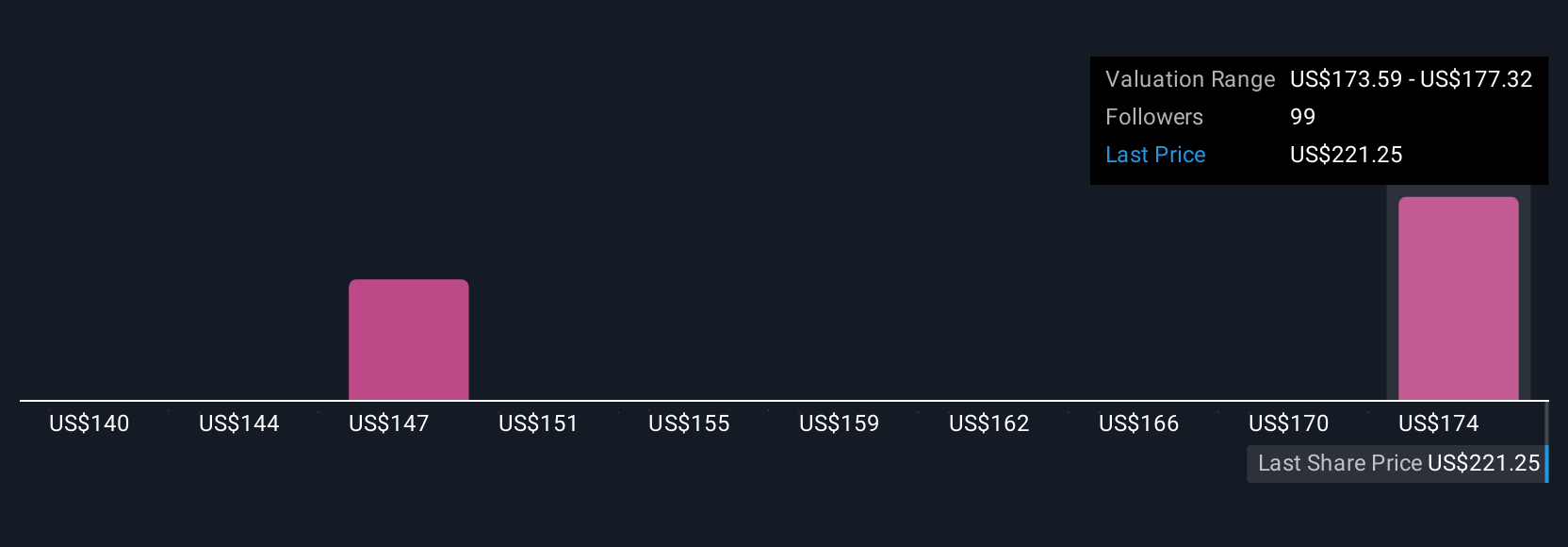

Uncover how Texas Instruments' forecasts yield a $189.56 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts have previously forecast Texas Instruments’ yearly revenue could approach US$27,900,000,000 and annual earnings could reach US$11,700,000,000 by 2028. Unlike the cautious consensus, these projections reflect a belief in far higher industrial and automotive recovery and robust margin growth. Depending on how recent news affects these assumptions, your view could differ sharply, so it’s important to compare these perspectives for a full picture.

Explore 6 other fair value estimates on Texas Instruments - why the stock might be worth as much as 15% more than the current price!

Build Your Own Texas Instruments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Instruments research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Texas Instruments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Instruments' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal