Dominion Energy (D): Evaluating Whether Recent Gains Signal Undervalued Opportunity

See our latest analysis for Dominion Energy.

Dominion Energy’s share price has built solid momentum this year, now sitting at $62.54 after a 14.96% gain year-to-date. While the stock has weathered some long-term volatility, its recent performance suggests investors are growing more confident in the company’s stability and outlook, as seen in a one-year total shareholder return of 9.75%.

If Dominion’s steady run has you wondering what else is on the move, this is a great time to broaden your search and discover fast growing stocks with high insider ownership

Given Dominion Energy’s recent rally and its strong fundamentals, the next question for investors is whether there is still value to be found in the shares, or if the market has already reflected the company’s growth prospects in its current price.

Most Popular Narrative: 2% Undervalued

Dominion Energy’s narrative fair value of $64 per share sits just above its last close at $62.54, reflecting cautious yet optimistic expectations about future growth and returns. This latest valuation weighs positive momentum against measured analyst projections and offers a nuanced outlook on where the stock could be heading.

Regulatory support and grid modernization investments provide visibility into long-term earnings and revenue growth potential. Rising project costs, regulatory uncertainties, capital demands, fossil fuel dependency, and operational risks threaten long-term profitability and growth prospects.

Curious how robust cash flows and aggressive infrastructure upgrades factor into this target price? The calculation behind this valuation blends ambitious earnings goals with a classic sector multiple, suggesting that deeper industry assumptions are driving analysts’ conviction. See the fine print propelling Dominion’s fair value forecast.

Result: Fair Value of $64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution delays or mounting project costs, particularly with the Coastal Virginia Offshore Wind initiative, could pose challenges to Dominion Energy's earnings outlook and undermine recent momentum.

Find out about the key risks to this Dominion Energy narrative.

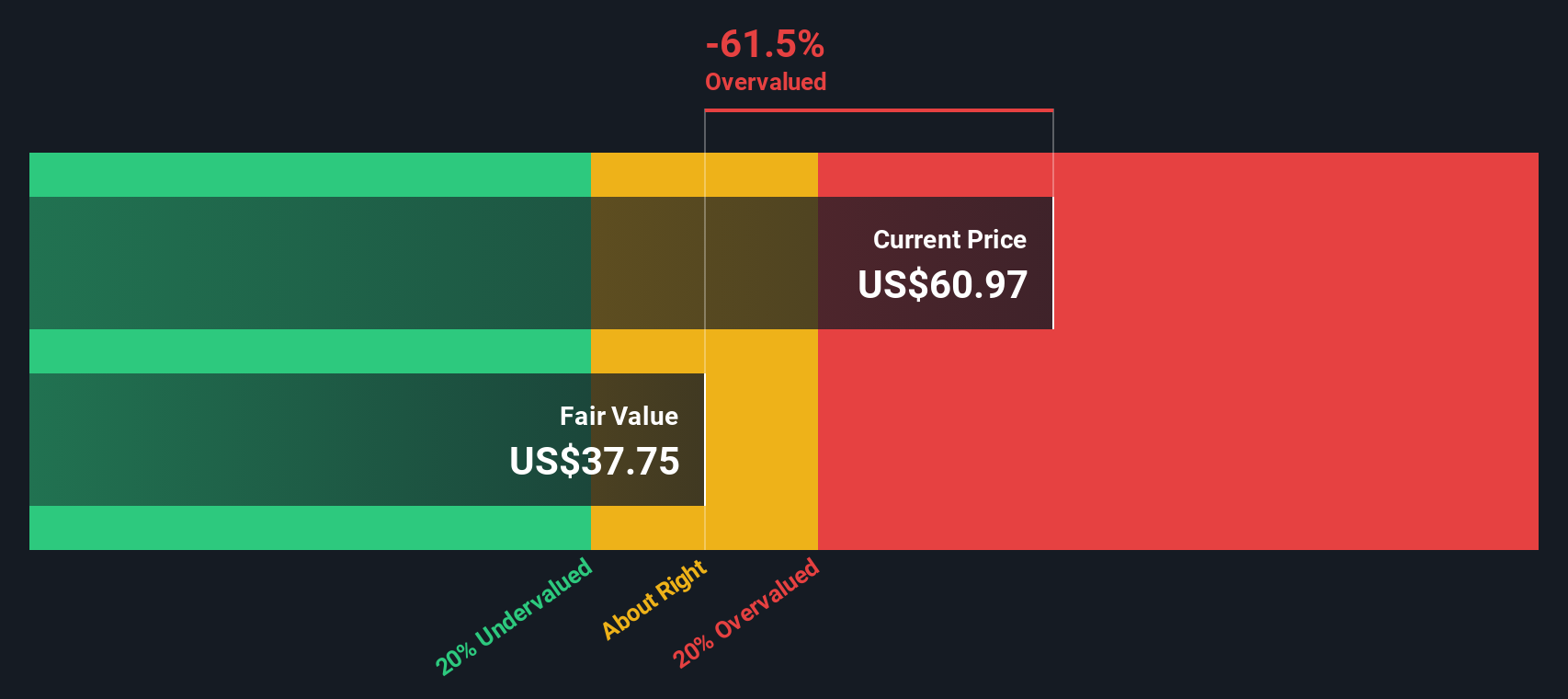

Another View: Discounted Cash Flow Suggests Caution

While analyst forecasts portray Dominion Energy as slightly undervalued, our DCF model points in a different direction. The SWS DCF model estimates a fair value below the current share price. This indicates the stock could be trading at a premium based on intrinsic cash flow assumptions. Which scenario plays out depends on whether future profits materialize as expected or if the market has gotten ahead of itself.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dominion Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dominion Energy Narrative

If you see the story differently or want to dig deeper into Dominion Energy’s numbers yourself, it’s easy to craft your own perspective in minutes. Do it your way

A great starting point for your Dominion Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Those who act on fresh market trends and top-performing stocks often find new possibilities. Don’t let opportunity pass you by. Take charge of your portfolio with these handpicked picks:

- Tap into unique technology breakthroughs and stay ahead by checking out these 27 quantum computing stocks, making real strides in quantum computing and innovation.

- Maximize your income potential by finding these 15 dividend stocks with yields > 3%, offering robust yields over 3% for reliable cash returns.

- Get exposure to tomorrow’s most transformative companies by reviewing these 25 AI penny stocks, poised for rapid growth in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal