Should PPL’s (PPL) Approved Rate Hike and New Debt Offering Change the Investment Narrative?

- PPL Corporation recently declared a quarterly dividend of US$0.2725 per share payable on January 2, 2026, and announced an intention to offer US$1 billion in exchangeable senior notes due 2030 to institutional buyers.

- Additionally, the Pennsylvania Public Utility Commission has approved a nearly 4% increase in electric rates for PPL customers effective December 1, 2025, with a potential for further distribution rate hikes pending regulatory review.

- We will examine how the Pennsylvania rate increase for PPL customers could influence the company's growth outlook and investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

PPL Investment Narrative Recap

For investors to be PPL shareholders, they need to believe in a constructive regulatory environment that allows steady cost recovery, especially as data center demand drives major capital spending. The Pennsylvania rate hike just announced may support short-term revenue, but meaningful impact on the stock’s largest near-term catalyst, successfully passing and implementing large rate cases tied to $20 billion in upgrades, remains limited. The bigger immediate risk stays regulatory lag or rate decisions that lag investment pace.

Of the recent company developments, the announced quarterly dividend of US$0.2725 per share stands out as most relevant to the rate increase. Regular dividends can provide income stability for investors, but their sustainability still depends on ongoing, timely recovery of rising costs through each rate review process, which is the main near-term driver for earnings predictability.

On the other hand, investors should be aware that if regulatory approvals for future rate increases take longer or fall short of expectations…

Read the full narrative on PPL (it's free!)

PPL's narrative projects $9.6 billion in revenue and $1.7 billion in earnings by 2028. This requires 2.8% annual revenue growth and a $714 million increase in earnings from the current $986 million.

Uncover how PPL's forecasts yield a $40.60 fair value, a 11% upside to its current price.

Exploring Other Perspectives

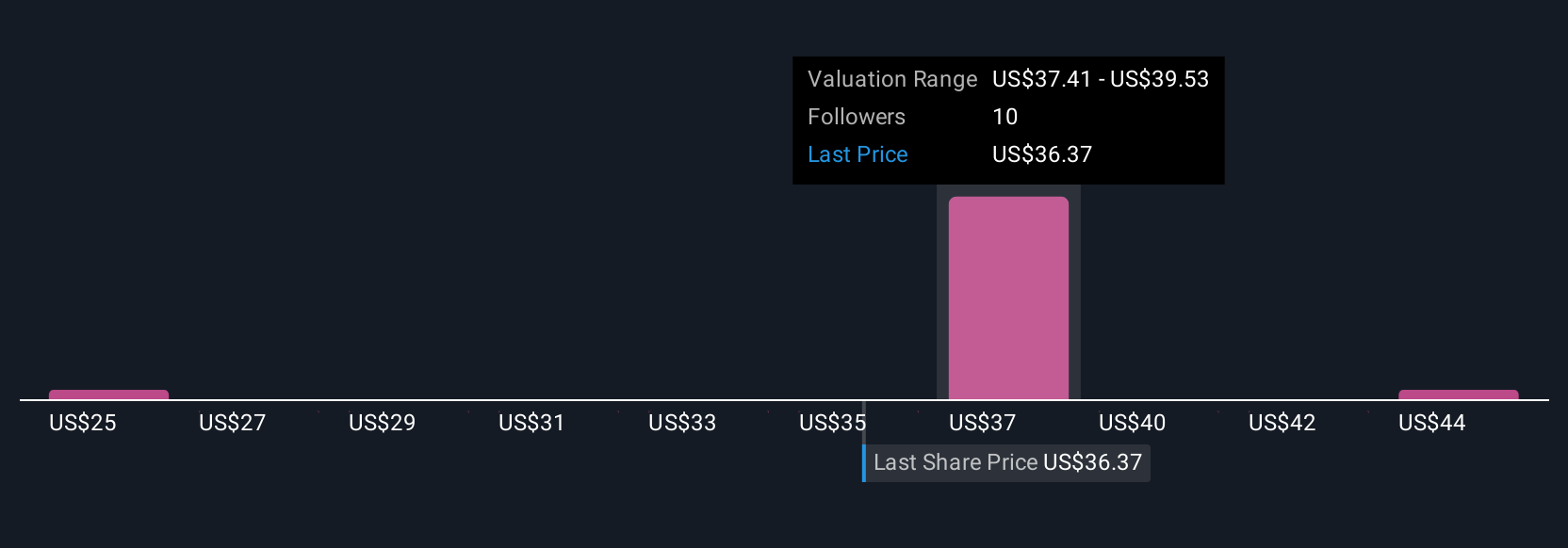

Simply Wall St Community members submitted two fair value estimates for PPL shares, ranging from US$40.60 to US$40.92. With future earnings tied closely to regulatory approvals for infrastructure upgrades, there are wide differences in how market participants view the company’s potential performance, explore these perspectives for a broader outlook.

Explore 2 other fair value estimates on PPL - why the stock might be worth as much as 11% more than the current price!

Build Your Own PPL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PPL research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PPL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PPL's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal