How Coca-Cola’s Sustainability News Impacts Its 2025 Stock Valuation

- Wondering if Coca-Cola’s stock is still a refreshing investment, or if the price has lost its fizz? You’re not alone. Let’s dive into what’s really behind the numbers.

- The stock has climbed 17.4% year-to-date and delivered a 16.1% return over the past year, showing strong momentum that has captured investors’ attention.

- Recent news around Coca-Cola’s strategic partnerships, sustainability initiatives, and high-level management changes has helped drive optimism, hinting at new growth directions. Headlines highlighting the company’s progress on environmentally-friendly packaging and expansion into emerging markets have kept the spotlight on KO shares.

- Currently, Coca-Cola scores 2 out of 6 on our valuation checks, suggesting there are both strengths and weaknesses in how the market views its value. We’ll break down these traditional approaches to valuation next. Stick around, because there’s a smarter way to assess fair value coming up at the end of the article.

Coca-Cola scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Coca-Cola Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value. This method helps investors determine what a company is truly worth, based on its potential to generate cash in the future.

For Coca-Cola, the most recent reported Free Cash Flow is approximately $5.6 Billion. Analysts project this figure will more than double over the next decade and reach around $15.2 Billion by the end of 2029. It is important to note that analyst visibility only covers about five years, while the remaining projections are based on Simply Wall St's own long-term modeling.

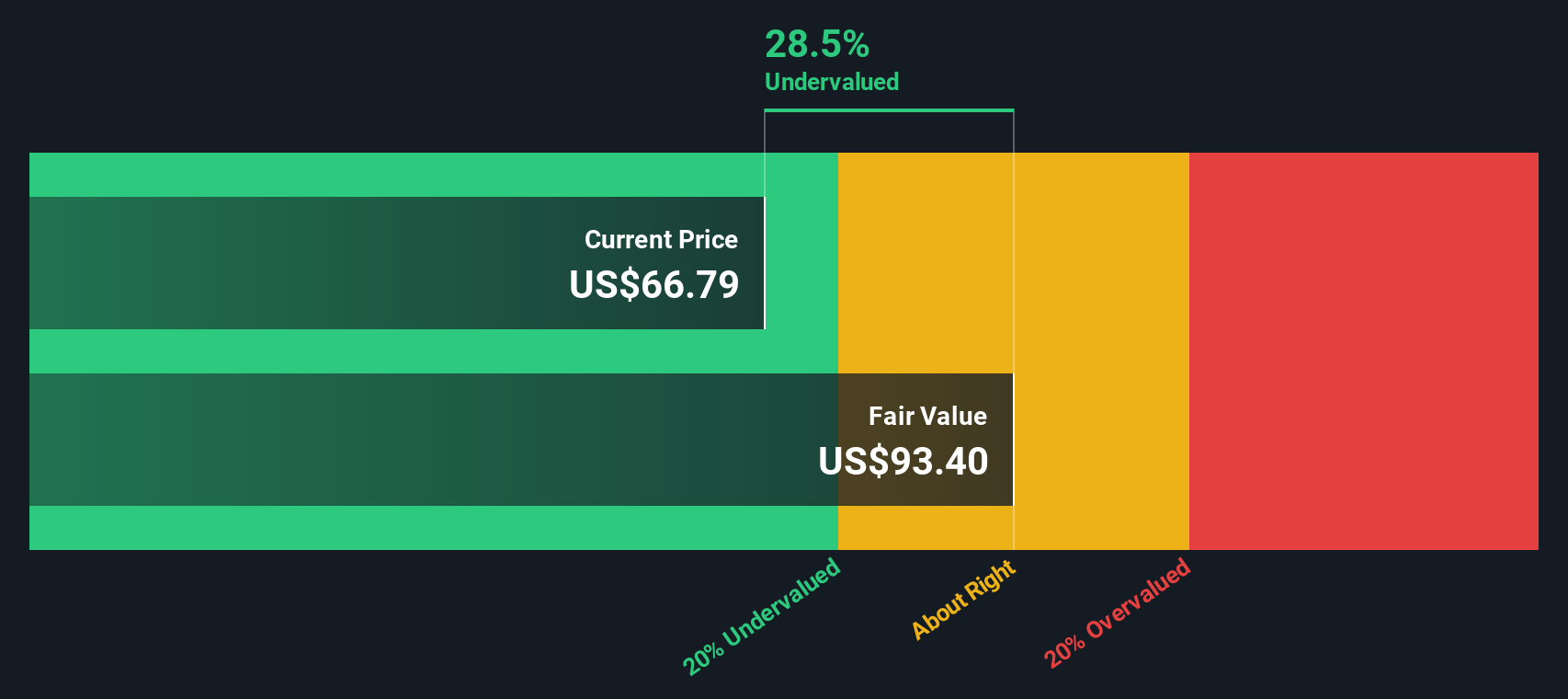

The projected cash flows are then discounted to reflect their worth today, resulting in an estimated intrinsic fair value for Coca-Cola of $89.90 per share.

Given the intrinsic discount calculated by the model, Coca-Cola stock appears to be 19.3% undervalued compared to its current market price. This indicates that, based on cash flow fundamentals, there could be room for upside if the company's growth continues as projected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coca-Cola is undervalued by 19.3%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Coca-Cola Price vs Earnings

For profitable companies like Coca-Cola, the Price-to-Earnings (PE) ratio is a preferred valuation metric because it directly links a company's share price to its earnings performance. This offers investors a simple way to see how much they are paying for each dollar of earnings, which is especially useful when the business has a solid, consistent profit base.

Growth expectations and risk levels play a key role in what counts as a "normal" or "fair" PE ratio. Generally, faster-growing companies or those with steadier earnings justify higher PE ratios, while more mature or riskier firms tend to deserve lower multiples. This is why context is crucial when reading into valuation multiples.

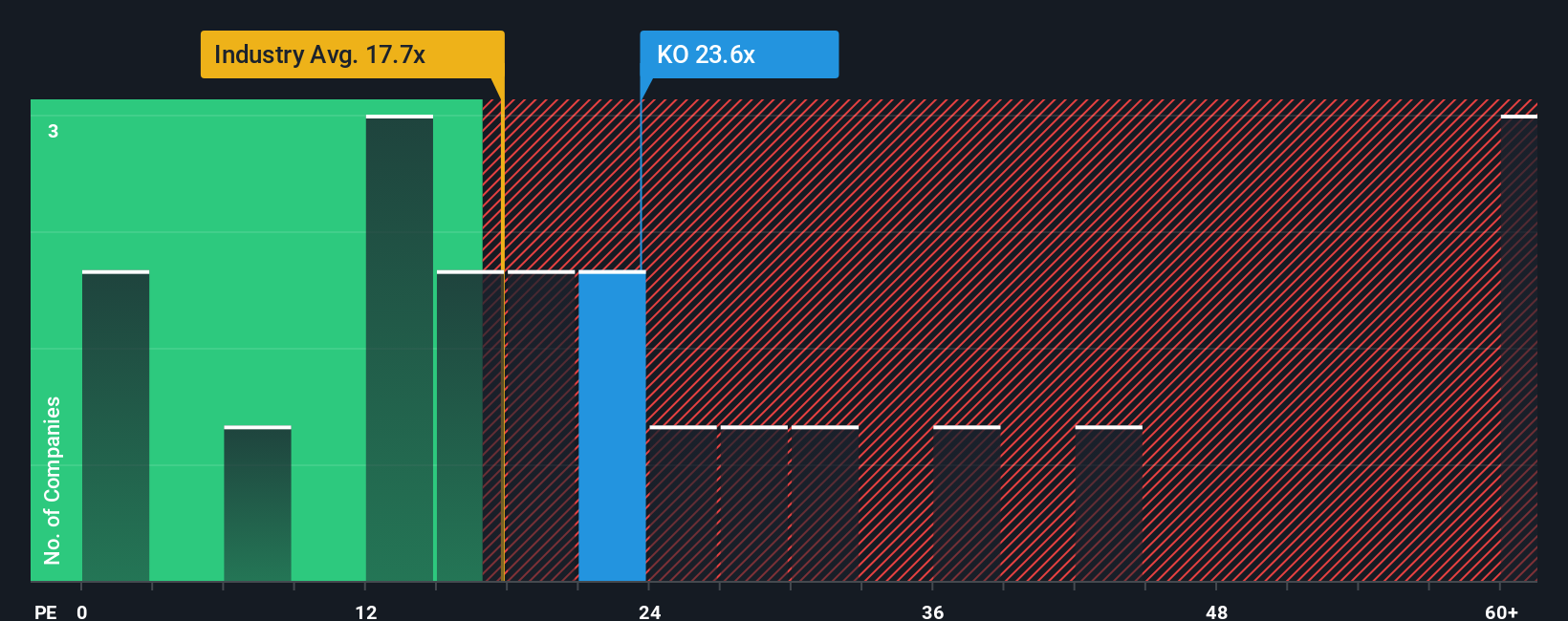

Coca-Cola currently trades at a PE ratio of 24x, which is below its main peer group average of 26.7x but noticeably higher than the overall beverage industry average of 17.7x. At first glance, this suggests the company is being valued more like its global peers than the wider industry.

Simply Wall St's "Fair Ratio" for Coca-Cola comes in at 22.8x. Unlike a simple comparison with competitors or sector averages, the Fair Ratio incorporates Coca-Cola's specific earnings growth outlook, profit margins, size, and risks unique to its business and industry. This proprietary metric gives a more tailored sense of whether the current valuation fits the company's fundamentals.

Comparing Coca-Cola's actual PE of 24x with its Fair Ratio of 22.8x signals that the shares are slightly above what fundamentals suggest, but the margin is not significant. This means the stock appears to be trading about where it should be, given its strengths and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coca-Cola Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives.

A Narrative is your unique story or thesis about a company. It is the set of reasons, assumptions, and forecasts you personally believe will shape its future, and ultimately what you think it's worth.

Unlike traditional metrics, Narratives go beyond the numbers by connecting your perspective on Coca-Cola’s strategy, risks, and opportunities directly to a numeric fair value, based on your own estimates for future revenue, margins, and growth.

On Simply Wall St's Community page, Narratives make advanced valuation accessible for everyone by guiding you to turn your insights into clear financial projections and a fair value, all in a few intuitive steps. No finance degree required.

By comparing your Narrative's Fair Value with the current price, you can make more confident buy or sell decisions and see where your view differs from the market or other investors.

Narratives are kept up-to-date automatically whenever new earnings, news, or industry developments are reported, so your analysis stays relevant as conditions change.

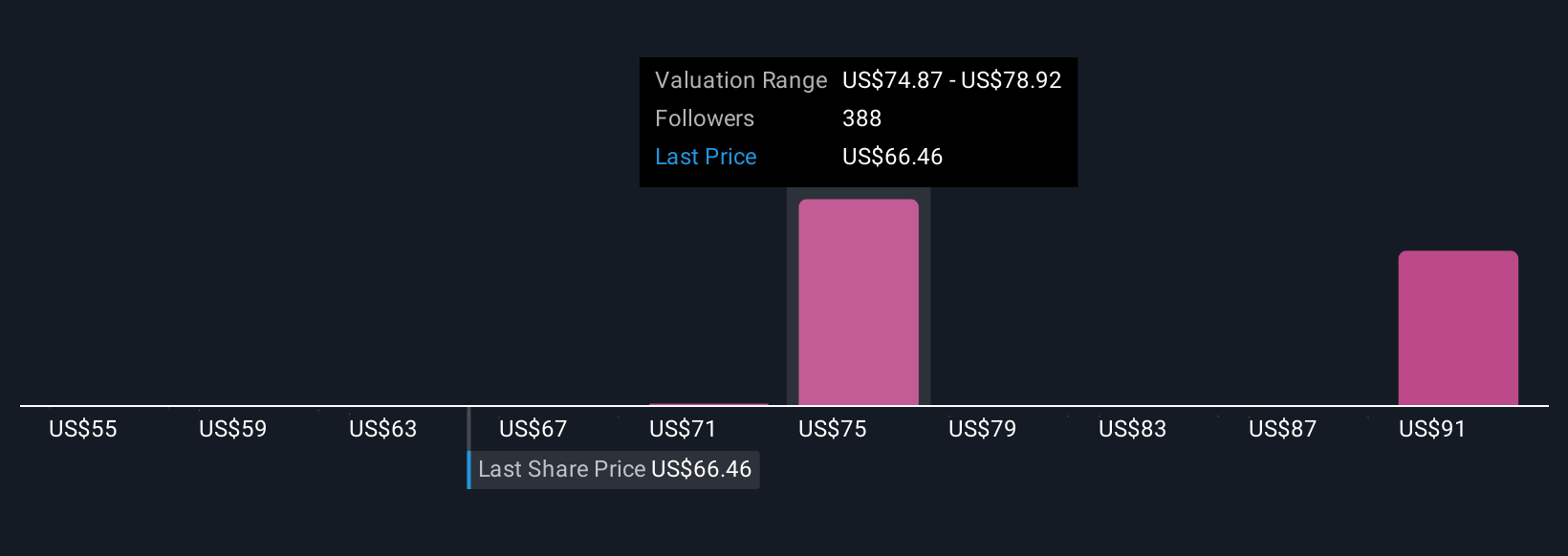

For Coca-Cola, some investors with an optimistic view of international growth and rising margins estimate a fair value as high as $85 per share, while more cautious analysts see fair value closer to $67. This illustrates how even with the same company, different stories can lead to different conclusions.

For Coca-Cola, we’ll make it really easy for you with previews of two leading Coca-Cola Narratives:

- 🐂 Coca-Cola Bull Case

Fair Value: $77.57

Undervalued by 6.4%

Revenue Growth Rate: 5.31%

- Focuses on growth in emerging markets, digital platforms, and high-margin dairy to drive revenue and margin expansion.

- Sustainability initiatives and asset-light strategies are expected to support brand equity, operational efficiency, and long-term earnings.

- Risks include health trends, regulatory uncertainty, competition, and input cost pressures. The overall view is that the stock is undervalued versus its fundamentals.

- 🐻 Coca-Cola Bear Case

Fair Value: $71.00

Overvalued by 2.2%

Revenue Growth Rate: 6.64%

- Coca-Cola's strong global brand and dividend record provide stability, but current valuation is rich and vulnerable to market changes.

- Shifting consumer trends toward health, currency volatility, and regulatory risks pose significant challenges, especially in emerging markets.

- Despite digital investments and resilience, current share price is seen as fair or slightly overvalued given execution risks and shifting industry dynamics.

Do you think there's more to the story for Coca-Cola? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal