Is Webull a Bargain After Its 6.4% Price Bounce?

- Wondering if Webull’s current share price is truly a bargain, or just buzz? You’re in the right place for a fresh take on what really drives its value.

- Webull’s stock price saw a 6.4% bounce in the past week, but it’s still down nearly 25% for both the past month and year. This hints at both growth potential and lingering market caution.

- Recent headlines about Webull’s platform expansions and new feature rollouts have kept investors talking. These developments have sparked debates about whether the company is building sustainable value or just fueling short-term excitement.

- On our valuation scorecard, Webull clocks in at 2 out of 6. Let’s break down what this means through different approaches, and explore an even smarter way to think about value before we’re done.

Webull scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Webull Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollar using a required rate of return. This gives investors a sense of what the business is worth based on its future earning power.

For Webull, the DCF analysis starts with its current Free Cash Flow of $386 million. Analysts forecast Free Cash Flow to grow each year, with growth of 6.70 percent in 2026 and moderating to around 3.4 percent annual growth by 2035. By 2035, projections see cash flow reaching roughly $592 million. Since detailed analyst estimates typically span only five years, later years' numbers are extrapolated by Simply Wall St based on trends.

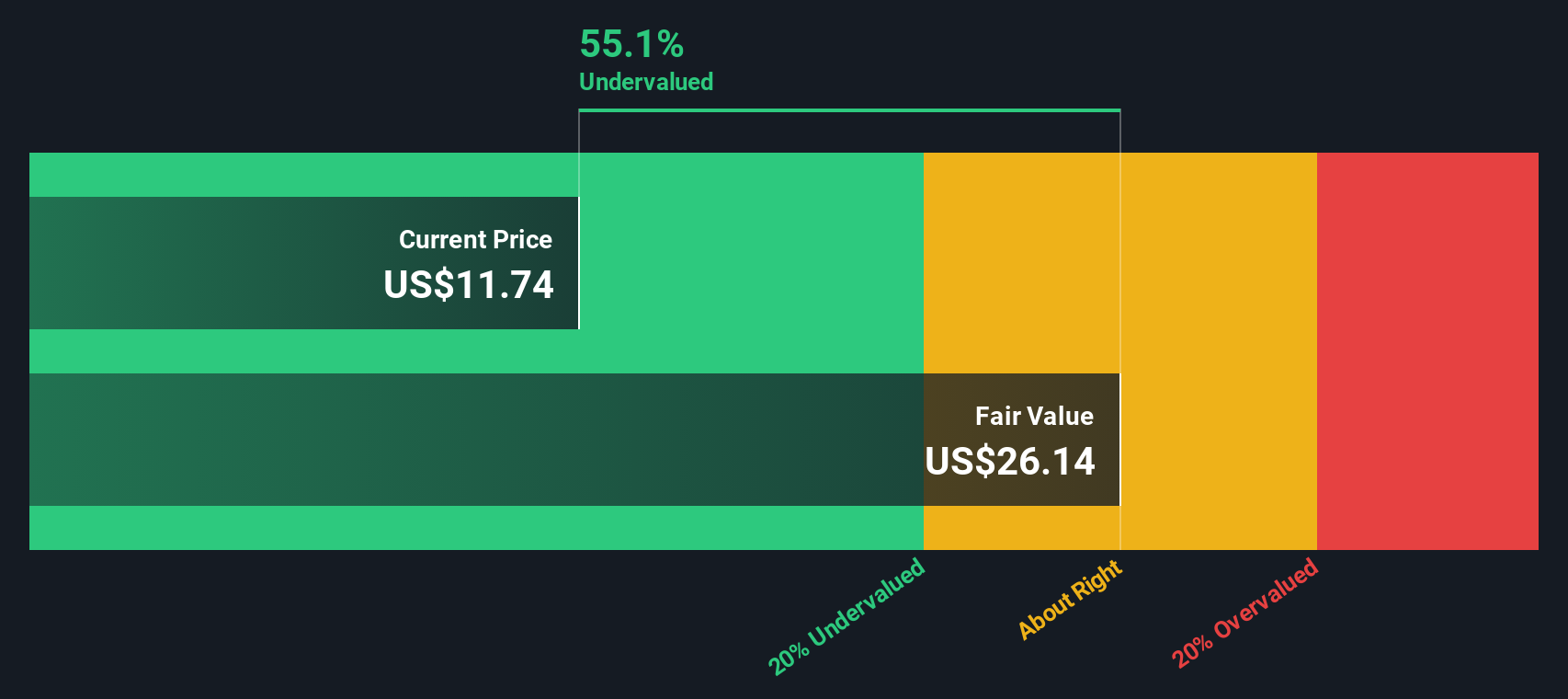

All cash flows are reported in US dollars. Using these growth assumptions, the DCF valuation model produces an estimated fair value for Webull shares of $18.10. This implies the stock is trading at a roughly 52.1 percent discount to its calculated intrinsic value, suggesting it is significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Webull is undervalued by 52.1%. Track this in your watchlist or portfolio, or discover 924 more undervalued stocks based on cash flows.

Approach 2: Webull Price vs Sales

For companies like Webull, which may not be consistently profitable or have volatile earnings, the Price-to-Sales (P/S) ratio is a popular and practical tool for valuation. The P/S ratio is especially useful when evaluating high-growth firms or those reinvesting heavily in their business. It focuses on revenue rather than earnings, which may be affected by short-term expenses or investments.

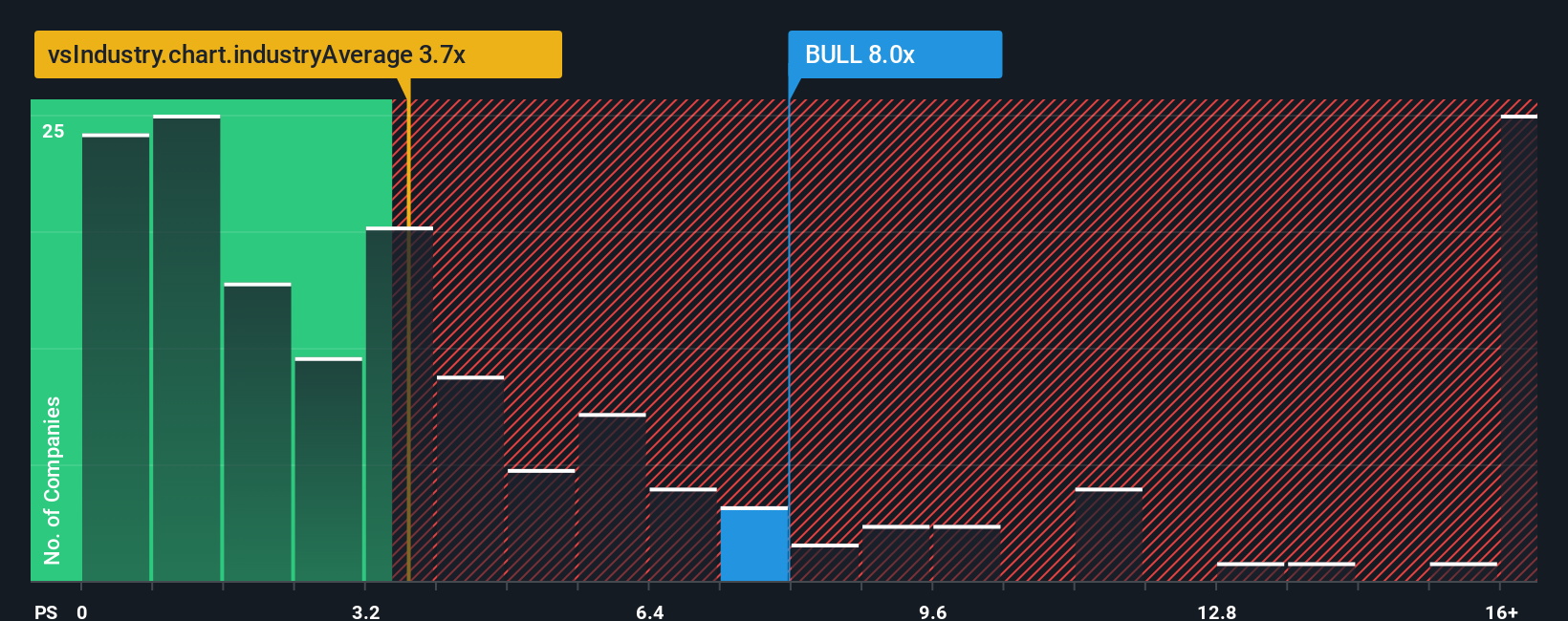

Typically, higher growth expectations and lower risk environments warrant a higher P/S ratio because investors are willing to pay more for future growth. However, if risks are elevated or growth prospects are fading, a lower multiple is justified. In Webull's case, its current P/S ratio is 8.45x, which is considerably above both the industry average of 3.66x and the peer group average of 1.51x.

Simply Wall St’s proprietary “Fair Ratio” goes a step further than just comparing with industry averages or peers. Webull’s Fair Ratio is calculated at 8.08x, tailored specifically for the company by factoring in elements such as its growth prospects, profit margins, risk profile, market cap, and industry dynamics. This approach provides a more holistic and personalized benchmark than generalized sector comparisons.

When comparing Webull’s current P/S ratio of 8.45x to its Fair Ratio of 8.08x, the two values are very close, with a difference less than 0.10. This suggests that the market price is quite reasonable given the company’s fundamentals and outlook.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Webull Narrative

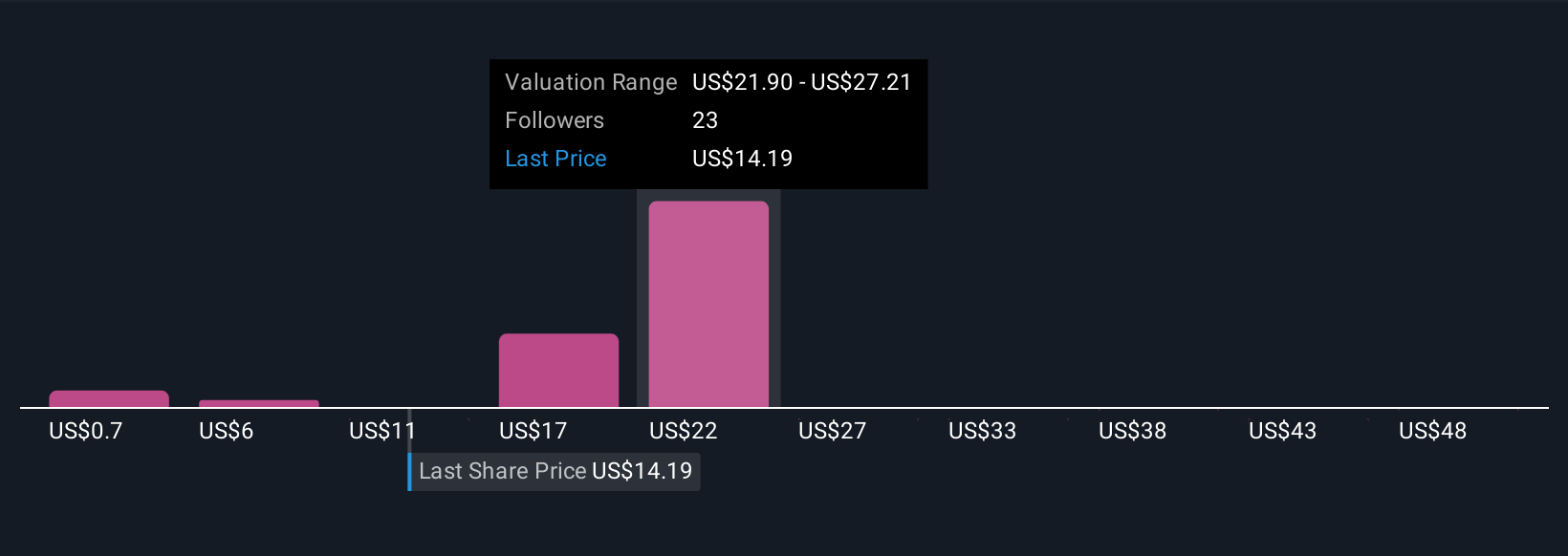

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique story about a company. It lets you connect business events, future prospects, and risks to your own forecasts for a stock’s revenue, earnings, and fair value.

With Narratives, investors go beyond the numbers to articulate why they believe a company will perform a certain way, linking their perspective to a financial forecast and ultimately a fair value estimate. This approach is simple and accessible, and you can try it yourself on Simply Wall St’s Community page, where millions of investors share and update their own Narratives.

Narratives help you decide when to buy or sell by showing you how your fair value compares with the current market price, and are updated dynamically in response to new news or earnings so your views stay relevant.

For example, some investors see Webull’s global expansion and subscription growth as strong catalysts and value the stock as high as $18.00, while others are cautious about margin pressure and see fair value closer to $12.93. Your own Narrative can reflect your best-informed view.

Do you think there's more to the story for Webull? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal