Top Asian Dividend Stocks For November 2025

As global markets grapple with AI-related concerns and fluctuating economic indicators, Asia's financial landscape is similarly experiencing volatility, particularly in technology sectors. Amidst this uncertainty, dividend stocks in Asia stand out as a potential source of stability and income for investors seeking reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.30% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.93% | ★★★★★★ |

| NCD (TSE:4783) | 4.51% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.23% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.71% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.82% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.82% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.43% | ★★★★★★ |

Click here to see the full list of 1056 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

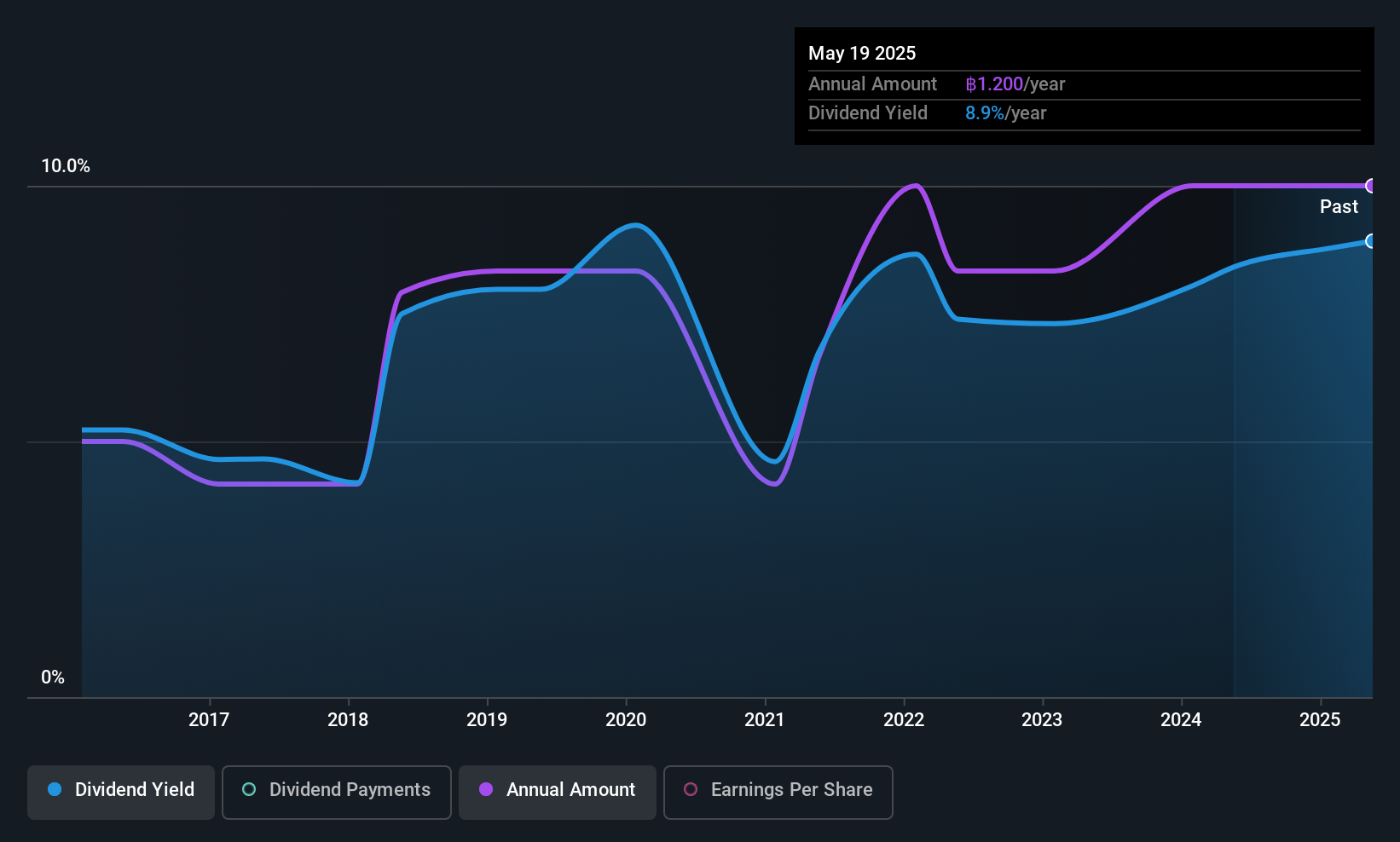

Thai Steel Cable (SET:TSC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Thai Steel Cable Public Company Limited manufactures and distributes automobile and motorcycle control cables, as well as automobile window regulators in Thailand, with a market cap of THB3.82 billion.

Operations: Thai Steel Cable generates revenue from the manufacturing and distribution of control cables for automobiles and motorcycles, as well as automobile window regulators in Thailand.

Dividend Yield: 8.2%

Thai Steel Cable's dividend payments have increased over the past decade, yet remain volatile and unreliable, with a high payout ratio of 102.5% indicating they are not well covered by earnings. Despite this, dividends are covered by cash flows at an 89.9% cash payout ratio. The company recently approved a THB 1.20 per share dividend for 2025, equating to THB 311.76 million or 90% of net profit, highlighting its commitment to returning value to shareholders amidst fluctuating earnings performance.

- Take a closer look at Thai Steel Cable's potential here in our dividend report.

- Upon reviewing our latest valuation report, Thai Steel Cable's share price might be too optimistic.

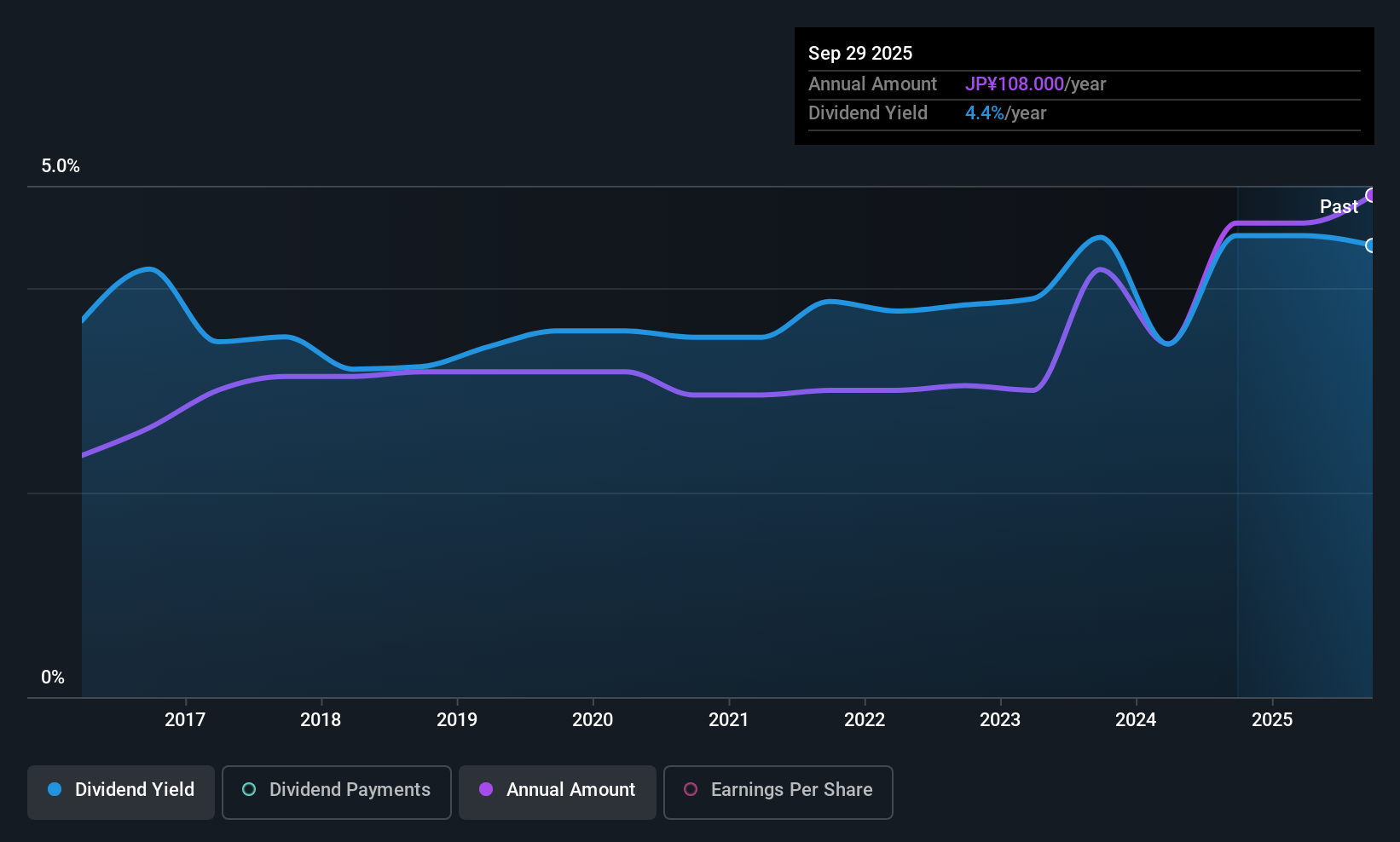

WELLNEO SUGAR (TSE:2117)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: WELLNEO SUGAR Co., Ltd. manufactures and sells sugar and other food products primarily in Japan, with a market cap of ¥93.19 billion.

Operations: WELLNEO SUGAR Co., Ltd. generates revenue through the production and distribution of sugar and various other food products within Japan.

Dividend Yield: 3.8%

WELLNEO SUGAR's dividends are well covered by earnings, with a payout ratio of 32.2%, and cash flows, with a cash payout ratio of 65.7%. Despite an unstable dividend track record over the past decade, recent increases reflect growth, as evidenced by the declared JPY 54 per share dividend for Q2 ending March 2026. The company's strategic share buyback program aims to enhance corporate value long-term, although it has seen minimal activity recently.

- Click here to discover the nuances of WELLNEO SUGAR with our detailed analytical dividend report.

- Our valuation report unveils the possibility WELLNEO SUGAR's shares may be trading at a premium.

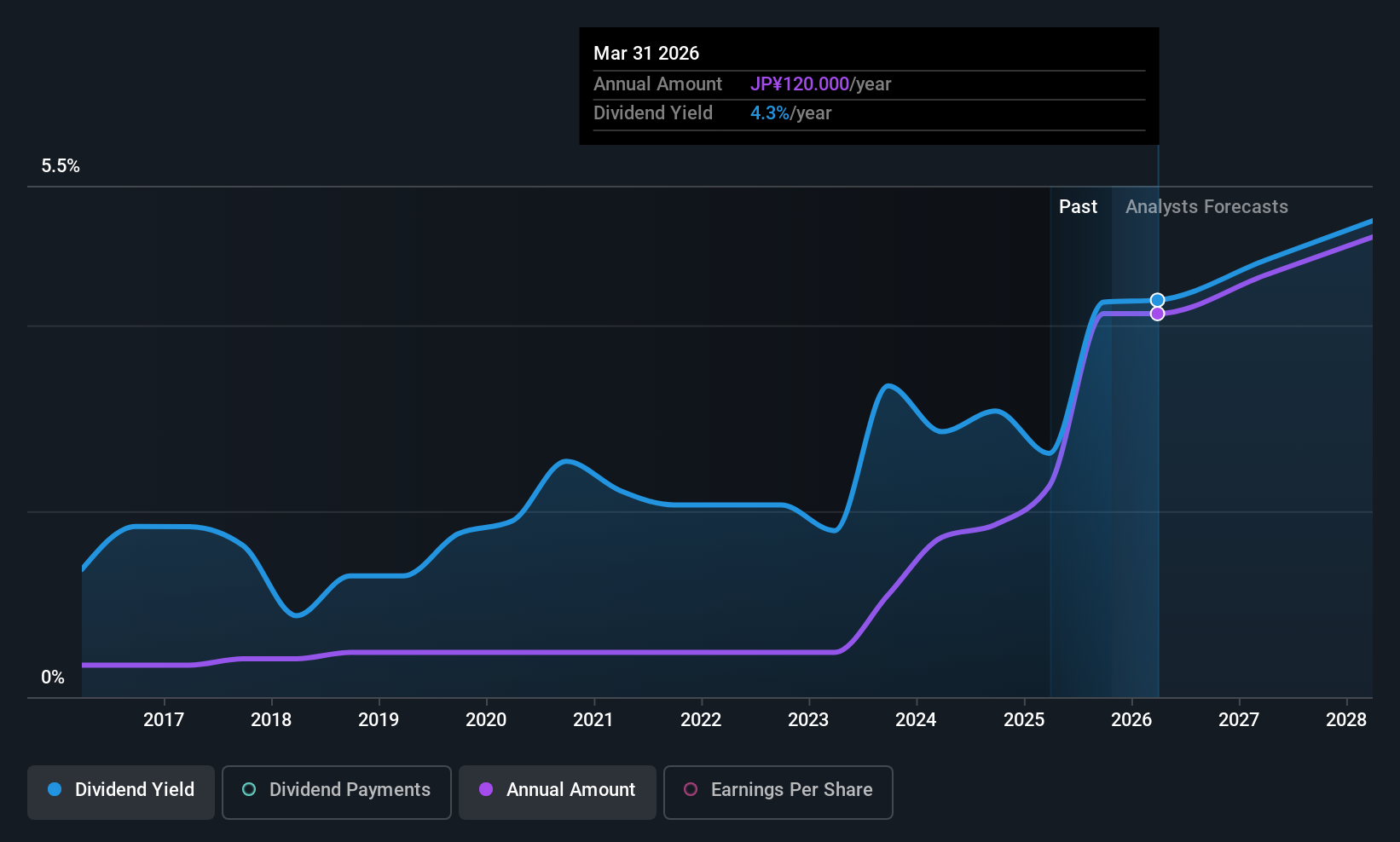

NCD (TSE:4783)

Simply Wall St Dividend Rating: ★★★★★★

Overview: NCD Co., Ltd. operates in Japan, focusing on system development, support and service, and parking system businesses, with a market cap of ¥21.74 billion.

Operations: NCD Co., Ltd.'s revenue is derived from its operations in system development, support and service, and parking systems within Japan.

Dividend Yield: 4.5%

NCD Co., Ltd. offers a reliable dividend yield of 4.51%, ranking in the top 25% of Japanese market payers, supported by a low payout ratio of 18.4%. Dividends have been stable and growing over the past decade, with recent increases to JPY 60 per share for Q2 ending September 2025. Despite lowering earnings forecasts due to project completions and strategic withdrawals, dividends remain well-covered by cash flows (53.2%), ensuring sustainability amidst financial adjustments.

- Unlock comprehensive insights into our analysis of NCD stock in this dividend report.

- According our valuation report, there's an indication that NCD's share price might be on the cheaper side.

Summing It All Up

- Navigate through the entire inventory of 1056 Top Asian Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal