Is Palantir’s Wild 105% Stock Surge in 2025 Justified by Its Fundamentals?

- Ever wondered if Palantir Technologies stock is a hidden bargain or just living up to the hype? Let’s break down what’s been fueling the buzz and what might come next.

- Palantir’s share price has had a wild ride with a 105.9% jump year-to-date, 140.6% over the past year, but recently pulled back by 16.1% over the last 30 days.

- Much of this movement has come amid a surge of interest in AI and data analytics firms, with Palantir consistently making headlines for high-profile government contracts and growing commercial partnerships. Recent stories have explored how the company is positioning itself as an essential player in both national security and enterprise solutions, keeping investors on their toes.

- But does all this excitement mean Palantir is actually undervalued? According to our valuation framework, the company scores just 0 out of 6 on value checks, which raises the stakes for how we interpret its fair price. We’ll compare different approaches to assessing value, and at the end, I’ll share a smarter way to put it all in context.

Palantir Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

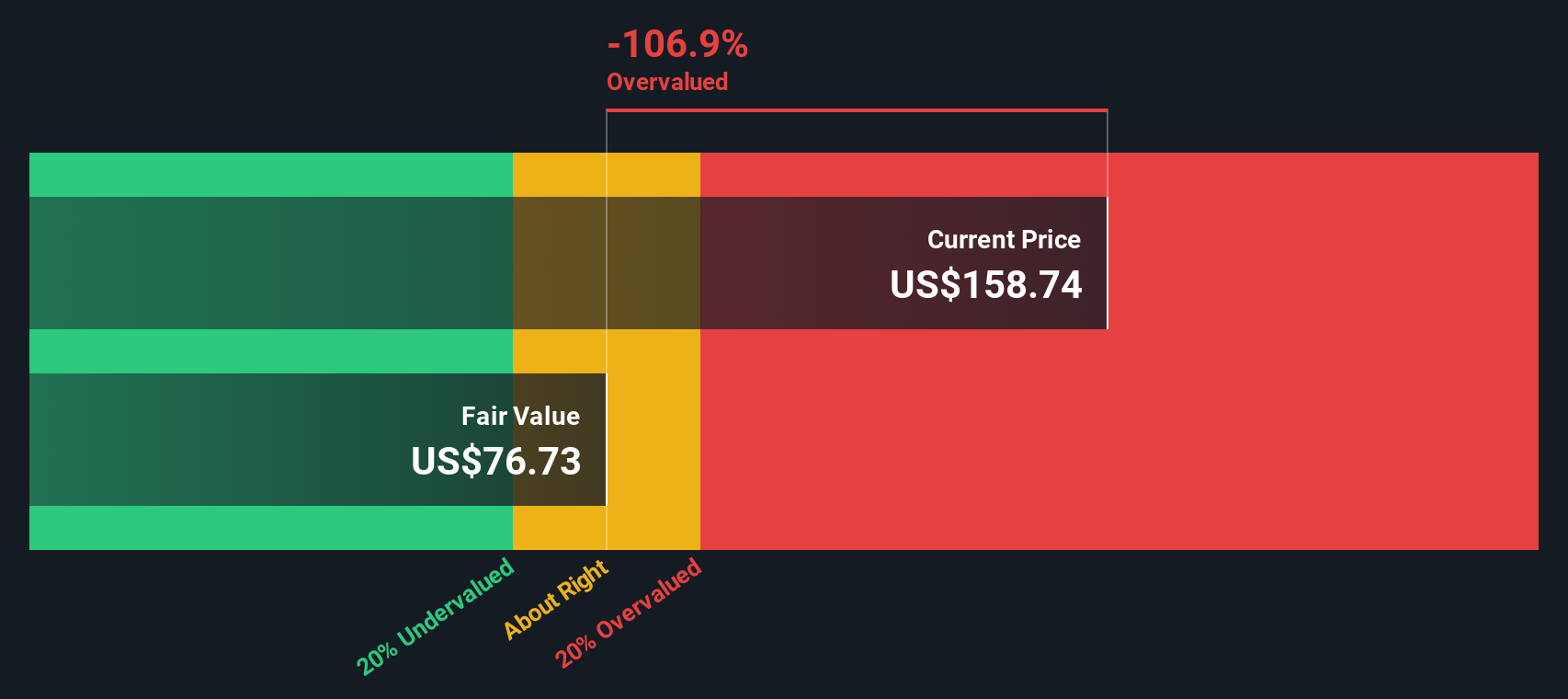

Approach 1: Palantir Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects a company's future cash flows and then discounts them back to their present value to estimate what the business is truly worth today. This approach provides a fundamental, forward-looking valuation based on how much actual cash the business is expected to generate.

For Palantir Technologies, the current Free Cash Flow sits at $1.79 Billion. Analysts forecast robust growth, with Free Cash Flow projected to reach nearly $7.0 Billion by the end of 2029. While estimates from analysts extend out five years, Simply Wall St’s model extrapolates these numbers further out, showing increasing Free Cash Flow over the next decade based on historical and expected growth rates.

After discounting these future cash flows to today's terms, the intrinsic value per share is calculated to be $73.55. However, when compared to Palantir’s current share price, this implies the stock is trading at a 110.5% premium to its fair value, meaning it is significantly overvalued by this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Palantir Technologies may be overvalued by 110.5%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

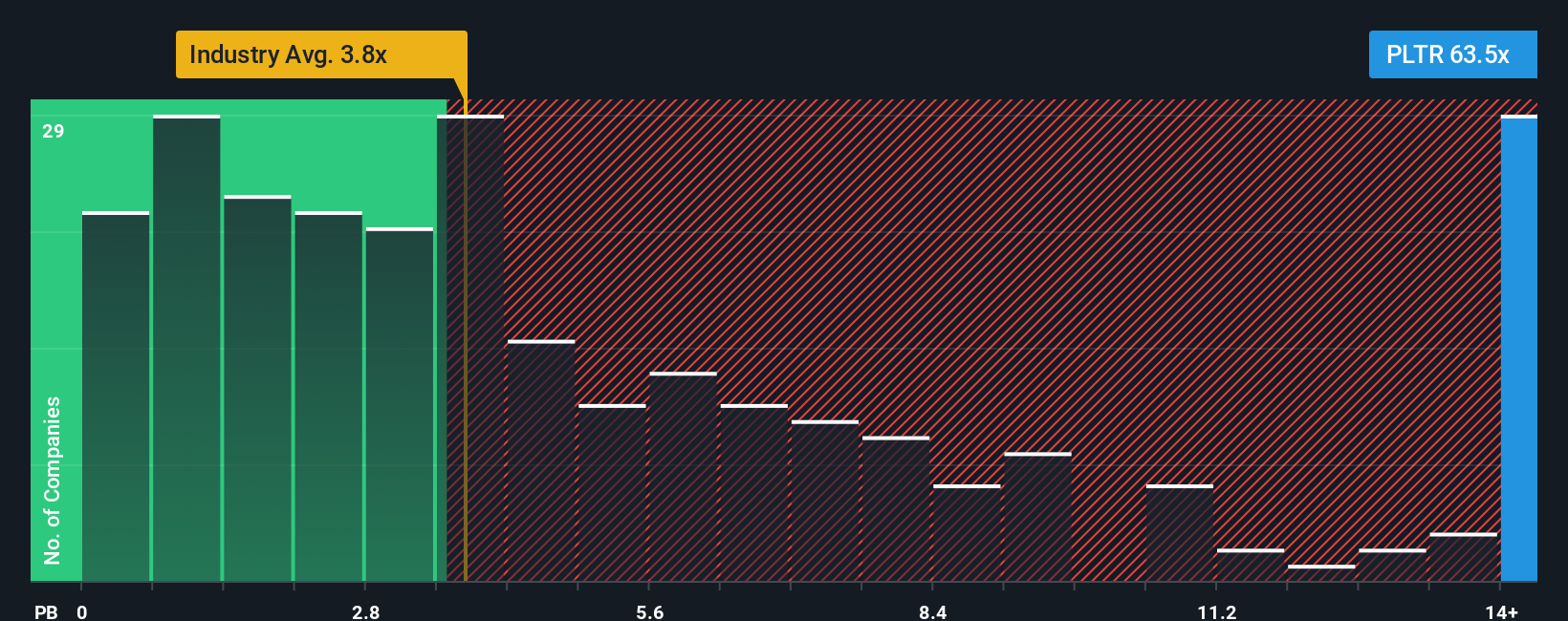

Approach 2: Palantir Technologies Price vs Book

The price-to-book (PB) ratio is a helpful valuation tool when assessing companies like Palantir Technologies, which have begun to generate meaningful profits and possess substantial intangible assets. PB can provide a clear baseline for how the market values a business relative to the book value of its assets, which is particularly relevant for software companies balancing intellectual property and tangible holdings.

Growth expectations and company-specific risks play a large role in shaping what investors consider a “fair” PB multiple. Companies with faster growth or lower risk profiles can often justify higher PB ratios, while those facing more uncertainty or slower prospects might trade closer to their asset value.

Currently, Palantir’s PB ratio sits at 56.0x, which is significantly higher than the peer average of 36.0x and well above the Software industry average of just 3.2x. This means the market is placing a premium on Palantir’s assets far beyond what is typical in its sector.

Simply Wall St's proprietary “Fair Ratio” offers a more holistic perspective than a simple industry or peer comparison. This metric factors in the company’s earnings growth, market cap, risk profile, profit margins, and industry dynamics to determine what a reasonable PB ratio should be for Palantir right now. It gives investors a contextual view unique to the business’s characteristics.

By comparing the actual PB ratio to the Fair Ratio, we gain a sharper sense of Palantir’s relative value. Since the absolute difference between Palantir’s current PB and its Fair Ratio is greater than 0.10, this suggests the stock is trading on the expensive side relative to its fundamentals.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1430 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Palantir Technologies Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives.

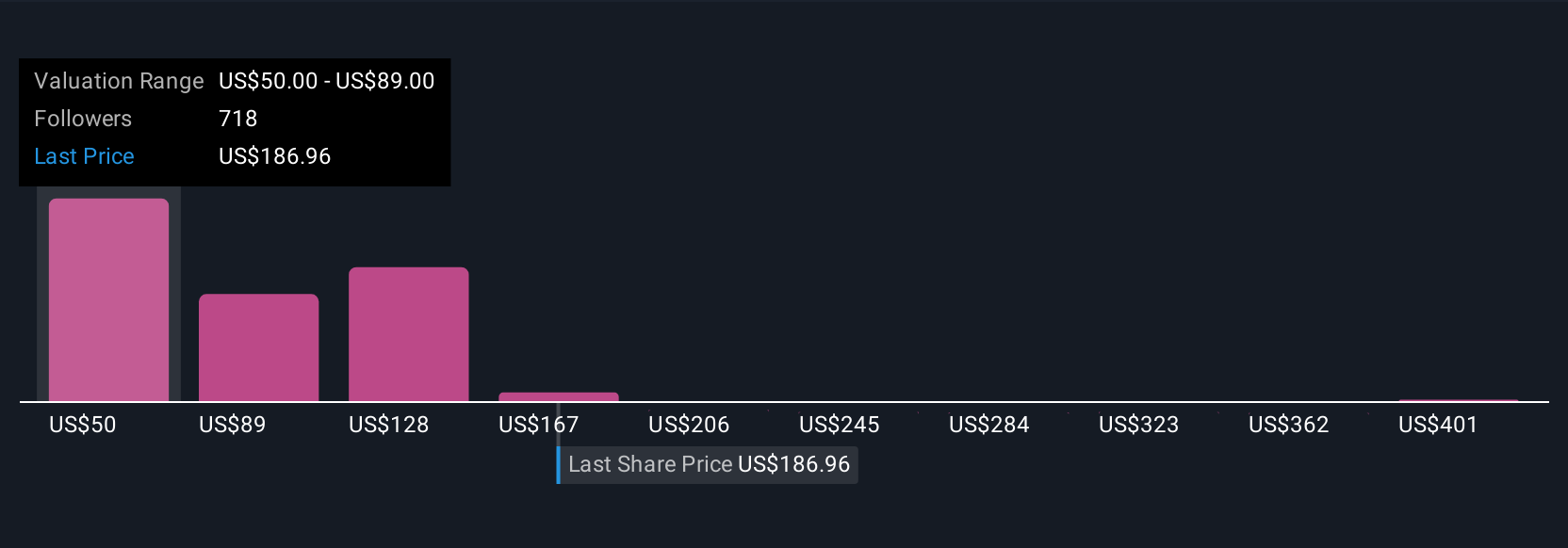

A Narrative is a dynamic, easy-to-use tool that lets investors define their perspective on a company’s future by linking a real-world story such as Palantir’s role in AI or government security to their own financial forecasts and assumptions about revenue, profit margins, and fair value.

Narratives bridge the gap between headline numbers and deeper insight by encouraging you to support your investment thesis with both context and calculations. Your story drives your forecast, which in turn generates an up-to-date, personalized fair value for the stock.

Used by millions of investors on Simply Wall St’s Community page, Narratives allow you to see exactly when your fair value signals a buy or sell opportunity as the market price fluctuates, turning complex valuation into a clear, actionable decision.

What makes Narratives especially powerful is their ability to stay current. When Palantir releases new earnings, secures a major contract, or the market shifts, your fair value and investment case update instantly to reflect the latest facts.

For Palantir Technologies, one Narrative sees explosive commercial adoption and durable government growth, supporting a fair value as high as $153.97, while another takes a more cautious outlook reflecting risks from competition and execution, and estimates fair value at just $66.00. This shows how the same data can support very different decisions.

Do you think there's more to the story for Palantir Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal