Will BellRing Brands' (BRBR) 2026 Sales Outlook Reshape Its Long-Term Growth Narrative?

- BellRing Brands recently announced its full-year results, reporting sales of US$2.32 billion for the year ended September 30, 2025, with net income and diluted earnings per share from continuing operations declining to US$216.2 million and US$1.68, respectively.

- Alongside these results, the company provided guidance for fiscal 2026, projecting net sales between US$2.41 billion and US$2.49 billion, representing expected sales growth of 4% to 8% year over year.

- We'll examine how BellRing Brands' sales growth outlook for 2026 may influence its investment narrative amid recent earnings results.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BellRing Brands Investment Narrative Recap

To own shares in BellRing Brands, an investor must be confident in continued demand growth for ready-to-drink protein shakes and the company’s ability to defend its Premier Protein brand despite margin pressures. The latest earnings showed sales growth but a notable decline in net income, while management expects mid-single-digit revenue expansion in fiscal 2026; however, these results do not fundamentally change the short-term focus on cost inflation risks, which remain the most critical challenge to earnings stability.

Among recent announcements, the appointment of David Finkelstein to the board stands out, adding a depth of experience in consumer product finance and mergers that may support oversight during a period of margin volatility and category competition. While board expansion can be relevant to long-term strategy, the near-term business catalysts and risks continue to center on operational performance and input cost management.

But with margin compression pressures persisting through at least fiscal 2026, investors should be aware that...

Read the full narrative on BellRing Brands (it's free!)

BellRing Brands' outlook anticipates $2.8 billion in revenue and $312.5 million in earnings by 2028. This is based on analysts' expectations for 8.1% annual revenue growth and a $84.2 million earnings increase from the current $228.3 million.

Uncover how BellRing Brands' forecasts yield a $50.00 fair value, a 90% upside to its current price.

Exploring Other Perspectives

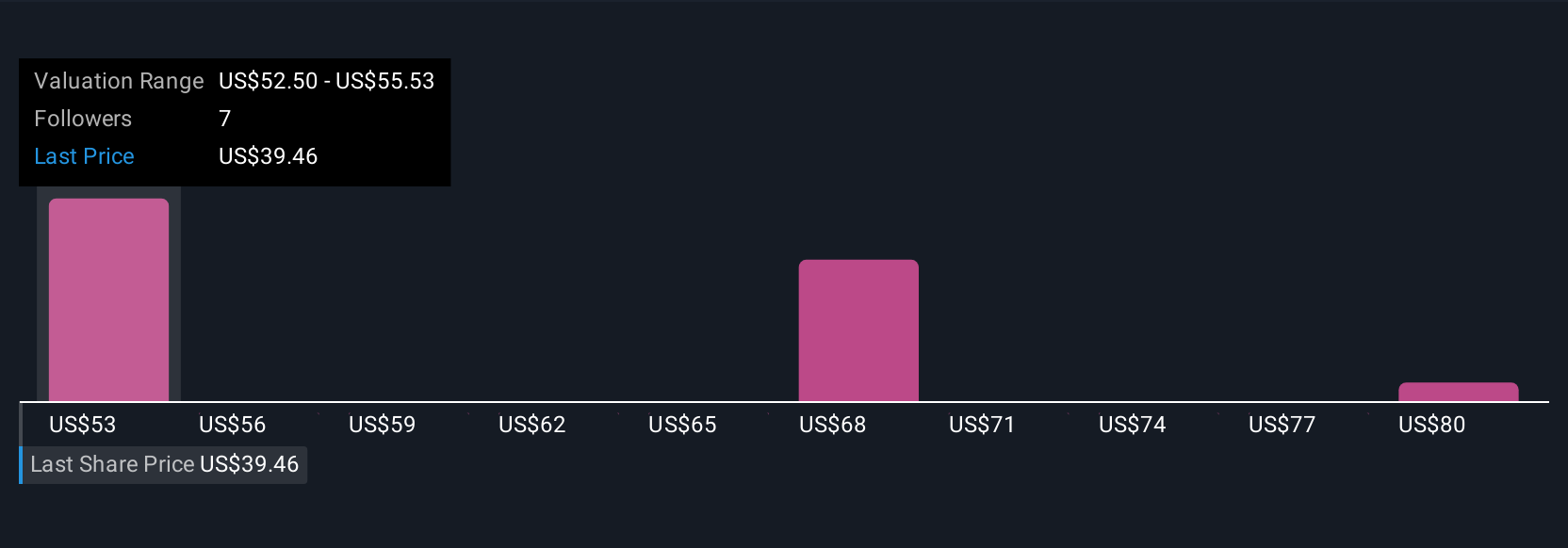

Five members of the Simply Wall St Community set fair value for BellRing Brands between US$40 and US$82.83 per share. With rising input costs threatening gross margins, these wide-ranging views reflect the varied outlooks on the company's future profitability and appeal to those seeking alternative viewpoints.

Explore 5 other fair value estimates on BellRing Brands - why the stock might be worth over 3x more than the current price!

Build Your Own BellRing Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BellRing Brands research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BellRing Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BellRing Brands' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal