Assessing Colgate-Palmolive Shares After Sustainability Push and 13% Fall in 2025

- Thinking about whether Colgate-Palmolive is a bargain right now? You are not alone, especially as shoppers and investors alike take stock of this household name's position in the market.

- The stock has held steady this week, inching up 0.4%. However, it is down 13.0% year-to-date and 14.7% over the last year, despite notching gains over longer horizons.

- Recent headlines highlight Colgate-Palmolive stepping up its sustainability efforts and expanding its oral care brands globally. These developments have fueled both optimism and curiosity about the company's future trajectory. They have also caught the market's attention and could explain some of the recent volatility in the share price.

- On our core valuation checks, Colgate-Palmolive scores just 3 out of 6. This suggests a closer look is needed before calling it undervalued or overpriced. Let's walk through the main valuation techniques, and then, at the end, we will consider a better way to understand what the market is really pricing in.

Approach 1: Colgate-Palmolive Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its expected future cash flows and discounting them back to today. For Colgate-Palmolive, this method uses recent and forecast cash flows as the foundation for valuation.

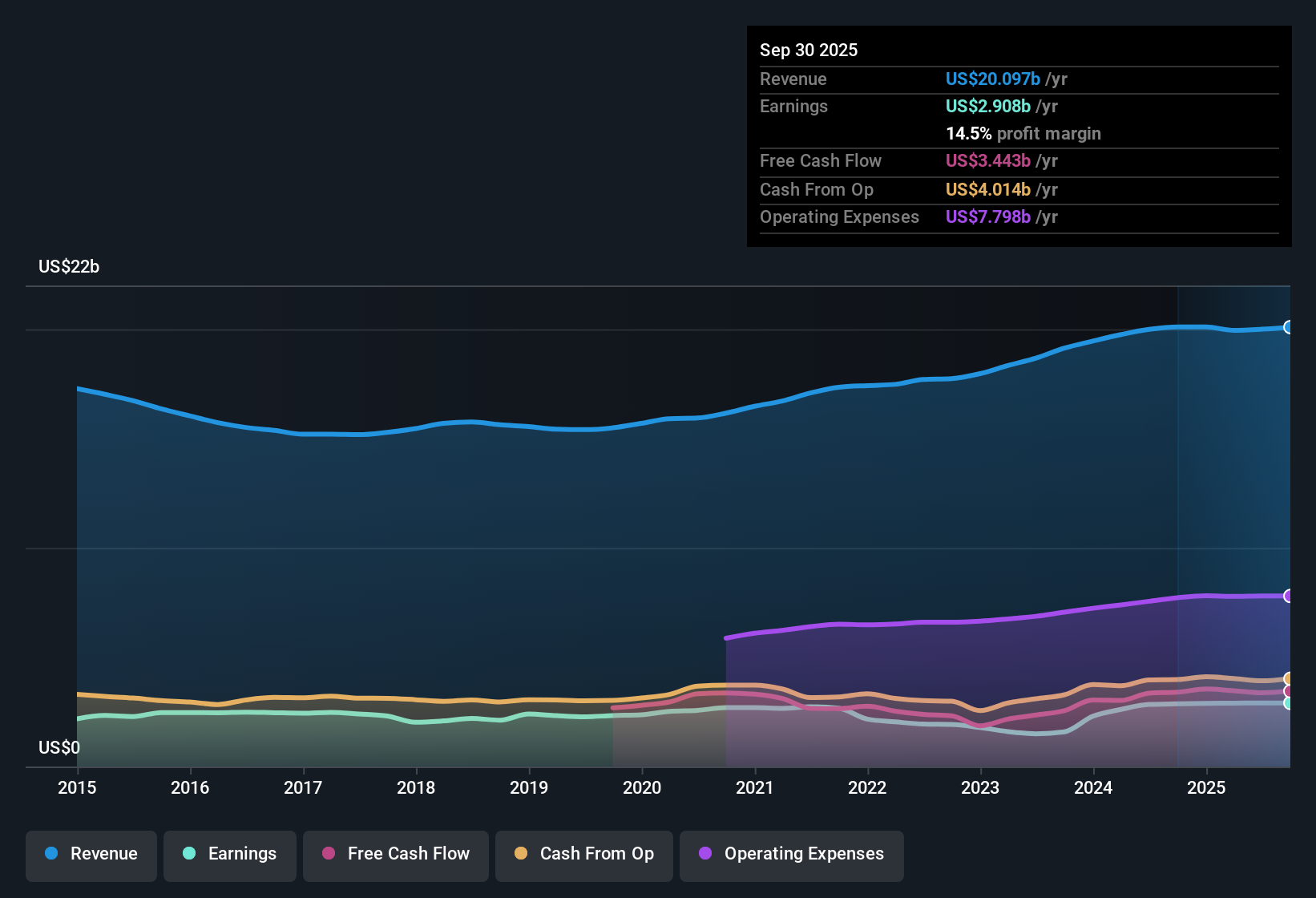

Currently, Colgate-Palmolive generates Free Cash Flow (FCF) of $3.38 billion. Analyst estimates extend for several years and forecast healthy growth. For example, cash flow is projected to reach $3.99 billion by 2029. Beyond this, projections continue through 2035 using a 2 Stage Free Cash Flow to Equity approach to model the likely trajectory, with annual FCF rising gradually above $4.9 billion.

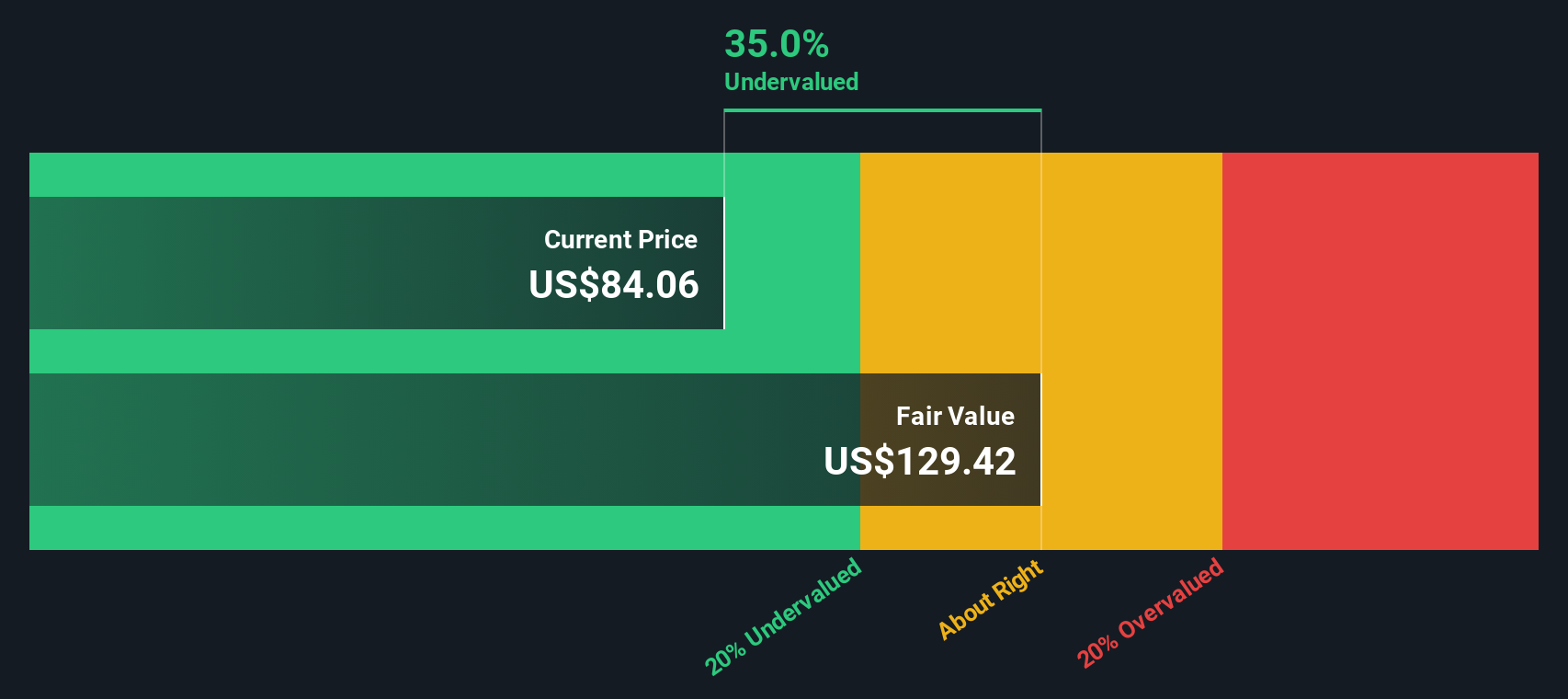

Discounting all these future cash flows to their present value yields an estimated intrinsic share price of $122.83. Compared to recent market pricing, the DCF model suggests the stock is trading at a 35.8% discount to its calculated fair value. This signals a significant margin of safety for investors, implying that Colgate-Palmolive may be undervalued on a cash flow basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Colgate-Palmolive is undervalued by 35.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks based on cash flows.

Approach 2: Colgate-Palmolive Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a popular and effective valuation tool for profitable companies like Colgate-Palmolive. Since it directly compares the price investors are willing to pay for each dollar of earnings, it provides an immediate sense of whether the stock is priced attractively relative to its profit-generating power.

Interpreting PE ratios involves more than a straightforward comparison, as higher growth prospects or lower risks often justify a higher PE ratio. Conversely, companies facing challenges or slower growth might see lower PEs as the market prices in uncertainty.

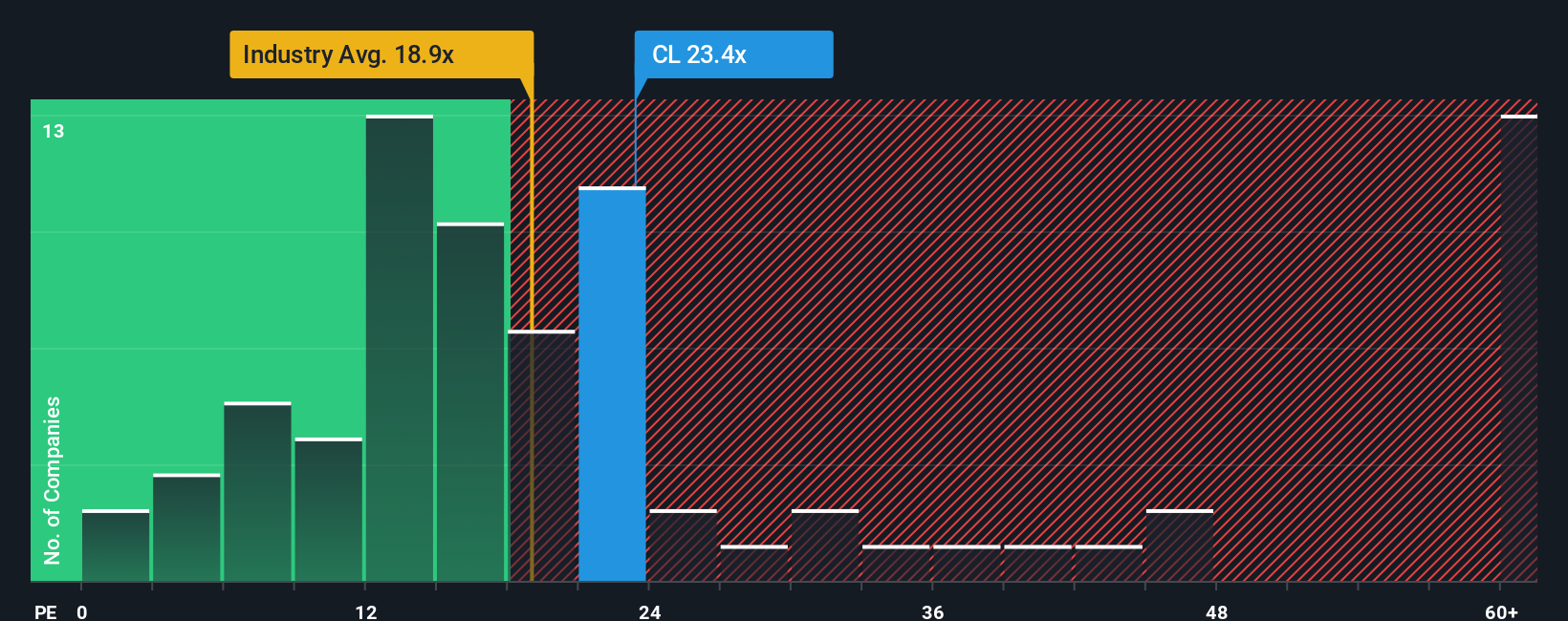

Currently, Colgate-Palmolive trades at a PE ratio of 21.8x. This is above the Household Products industry average of 17.5x and also higher than the average of its direct peers at 19.8x. While these comparisons highlight a premium, they do not capture the full picture.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio for Colgate-Palmolive stands at 22.5x. Unlike simple peer or industry comparisons, this metric incorporates the company's earnings growth, profit margins, size, risk profile, and more, offering a more balanced and forward-looking benchmark.

Comparing Colgate-Palmolive’s actual PE (21.8x) with its Fair Ratio (22.5x) shows that the current valuation is about right. The difference is small, suggesting the stock price fairly reflects its prospects and risks at present.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1417 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Colgate-Palmolive Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story or perspective about a company. It is how you connect what you believe about Colgate-Palmolive’s market position, strategy, or future prospects to expected financial outcomes like revenue, margins, and ultimately, fair value.

Narratives go beyond just looking at past data; they let you build a logical, numbers-backed story about what you think will happen next, which then drives your own fair value estimate for the stock. On Simply Wall St’s Community page, millions of investors can easily create, share, and follow Narratives, making it a smart and accessible way to invest alongside expert and peer perspectives alike.

The real advantage is that Narratives are live models. Each time new information comes in, like earnings news or big announcements, the fair value and forecasts update automatically, allowing you to react to changes quickly and confidently. By comparing your Narrative’s fair value to the current market price, you can decide for yourself whether it is time to buy, hold, or sell.

For example, some Colgate-Palmolive Narratives are optimistic, assuming organic sales will rebound and setting a fair value as high as $106.00 per share, while more cautious Narratives reflect ongoing headwinds and value the stock as low as $83.00.

Do you think there's more to the story for Colgate-Palmolive? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal