Could Webull's (BULL) AI Move Reveal the Next Phase of Its Competitive Positioning?

- Earlier this month, Webull launched Vega, an AI-powered decision partner that delivers real-time, personalized investment insights, options statistics, portfolio reviews, and natural-language order features to its U.S. users at no cost.

- This significant product release reflects Webull’s commitment to democratizing advanced market intelligence for both beginner and experienced investors by integrating actionable analytics and voice-enabled trading into its platform.

- Let's examine how Vega's personalized, AI-driven guidance could influence Webull's growth prospects and evolving investment thesis.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Webull Investment Narrative Recap

At the core of the Webull investment case is belief in the company’s ability to expand its user base and increase engagement through innovation, particularly by leveraging technology to offer advanced trading tools to a wider audience. The launch of Vega may support short-term growth catalysts by driving user activity and differentiating Webull in a crowded brokerage market, but the most immediate challenge remains exposure to fluctuating retail trading volumes and broader market conditions, which could directly affect revenue and earnings. At this stage, Vega’s impact is encouraging but not yet materially transformative for the company’s risk profile.

Among recent announcements, Webull’s relaunch of cryptocurrency trading in the U.S. stands out as highly relevant. Like the Vega rollout, it reflects a focus on providing deeper asset class access and more powerful tools for active investors, which could boost platform engagement and transaction-based revenues, key factors supporting top-line growth amid intense industry competition.

In contrast, investors should also be aware of how quickly trading volumes can shift with changing market cycles and what that means for...

Read the full narrative on Webull (it's free!)

Webull's narrative projects $920.2 million in revenue and $233.4 million in earnings by 2028. This requires 26.1% yearly revenue growth and a $158.5 million increase in earnings from $74.9 million today.

Uncover how Webull's forecasts yield a $18.50 fair value, a 127% upside to its current price.

Exploring Other Perspectives

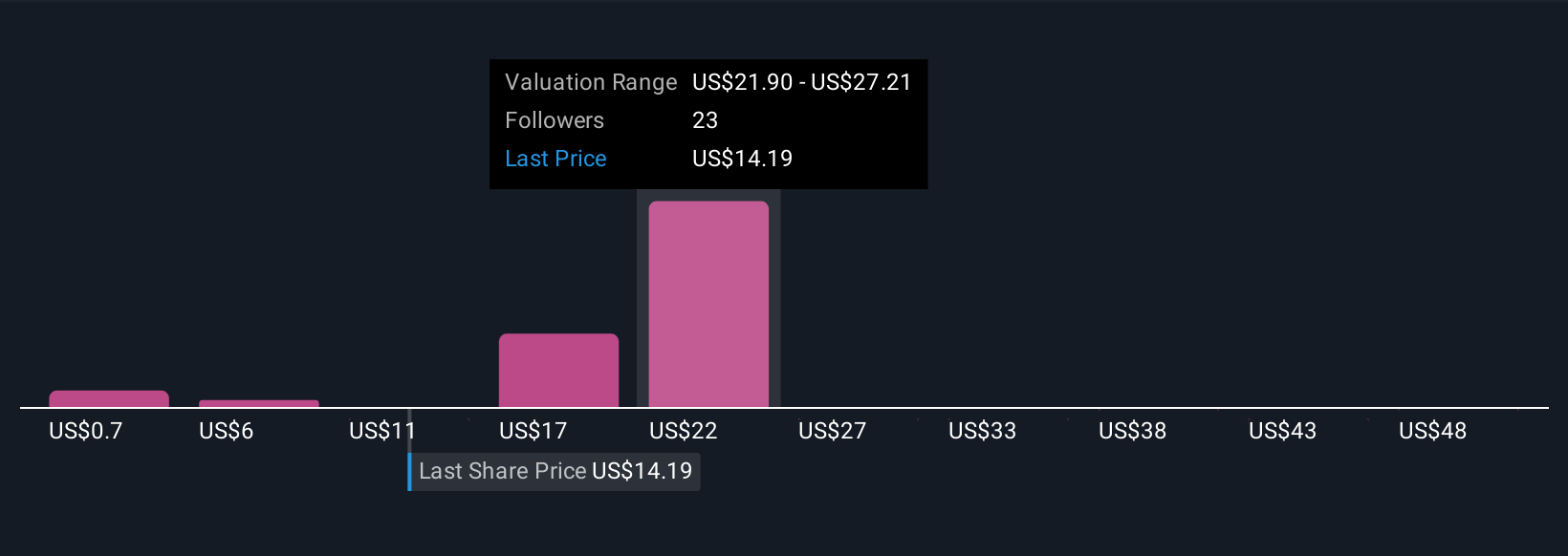

Seventeen Community members on Simply Wall St estimate Webull’s fair value anywhere from US$0.70 to US$53.71 per share. While some see strong upside, your expectations for trading activity and revenue swings could shape your own outlook just as widely, explore more member opinions for a fuller picture.

Explore 17 other fair value estimates on Webull - why the stock might be worth less than half the current price!

Build Your Own Webull Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Webull research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Webull research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Webull's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal