Saudi Sovereign Fund drastically divests in US stocks in Q3: nearly 12 stocks were liquidated, and the size of holdings fell to a new low during the year

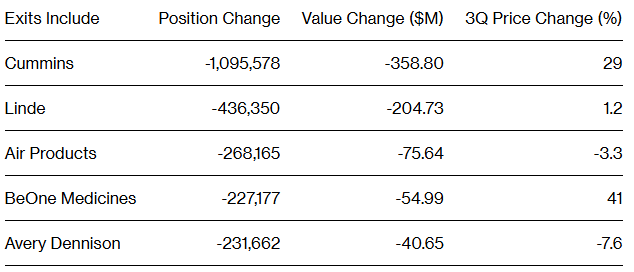

The Zhitong Finance App learned that in the third quarter, Saudi Arabia's sovereign wealth fund cleared the shares of nearly 12 companies listed in the US, including Pinterest (PINS.US) and industrial gas giant Linde Gas (LIN.US), reducing the value of US stock holdings to the lowest point in a year. According to the fund's latest 13F document, the $1 trillion public investment fund (PIF) also sold all of its shares in PLD.US (PLD.US) and Air Products & Chemicals (APD.US), which is cooperating with Saudi Arabia to develop a green hydrogen plant in Neom.

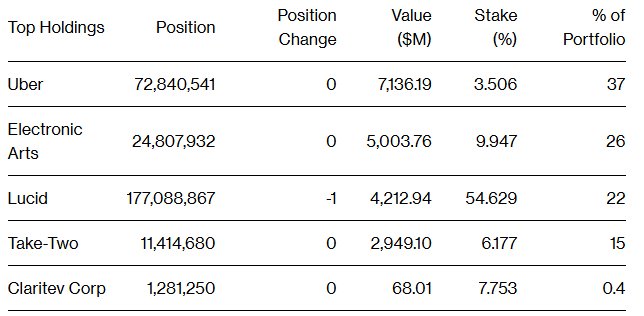

In addition, PIF also reduced its holdings in Cummins (CMI.US) and Avery Dennison (AVY.US). Although the fund continues to hold shares in Uber (UBER.US) and Electronic Arts (EA.US), it slightly reduced its holdings in electric vehicle manufacturer Lucid Group (LCID.US). Overall, the value of its US equity portfolio fell to $19.4 billion, down about 18% month-on-month, the lowest level since 2025.

This move continues the divestment trend of the previous quarter. The fund had already cleared positions such as Meta Platforms (META.US) and FedEx (FDX.US) in the previous quarter. This comes at a time when PIF is focusing more on local companies and prioritizing domestic investment to help Saudi Arabia's economic diversification plan.

Overall, according to the submitted documents, PIF's main holdings in the US are still Uber, Electronic Arts, Lucid, Take-Two Interactive Software (TTWO.US), and Claritev (CTEV.US).

It is worth mentioning that the latest 13F document revealed just a few days before Saudi Crown Prince Mohammed bin Salman went to the White House to meet with US President Trump. This will be the first official visit of the Saudi leader to the US since 2018. The agenda is expected to cover safety, semiconductor and nuclear technology agreements. Trump will also expect Saudi Arabia to fulfill its promise to invest hundreds of billions of dollars in the US after visiting Saudi Arabia in May.

According to information, the PIF, chaired by the Crown Prince himself, is the core entity leading Saudi Arabia's “Vision 2030” economic diversification plan, and is responsible for promoting dozens of large-scale projects such as Neom's new city and the historic heritage site of Diriyah. In recent years, as sluggish oil prices have worsened government budget deficits, PIF has been under increased pressure to drive local economic spending. Despite this, the fund plans to continue investing more capital in the future.

The PIF has indicated that it aims to invest 70 billion US dollars after 2025, the vast majority of which will be invested in Saudi Arabia. According to its annual report, the fund has deployed $57 billion in key sectors in 2024. According to reports, more details on its 2026-2030 investment strategy are expected to be announced early next year.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal