Asian Dividend Stocks To Consider In November 2025

As global markets navigate the complexities of economic shifts, including the recent end of the longest U.S. government shutdown, investors are turning their attention to Asia where mixed performances in China and Japan highlight both challenges and opportunities for growth. In this environment, dividend stocks present a compelling option for those seeking steady income streams amidst market volatility, as they often provide a cushion against uncertain economic conditions while offering potential capital appreciation.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.27% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.76% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 4.06% | ★★★★★★ |

| NCD (TSE:4783) | 4.77% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.89% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.87% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.38% | ★★★★★★ |

Click here to see the full list of 1043 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Inpex (TSE:1605)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Inpex Corporation is involved in the research, exploration, development, production, and sale of oil, natural gas, and other mineral resources both in Japan and internationally with a market cap of ¥3.74 trillion.

Operations: Inpex Corporation's revenue segments include Oil & Gas Japan at ¥195.61 million, Oil & Gas Overseas - Other Project at ¥1.49 billion, and Oil & Gas Overseas - Ichthys Project at ¥355.19 million.

Dividend Yield: 3.1%

Inpex Corporation's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 13.7% and a cash payout ratio of 27.4%, ensuring sustainability from earnings and cash flows. Despite trading at 42.2% below estimated fair value, its dividend yield of 3.15% is lower than the top quartile in Japan's market. Recent guidance revisions indicate improved profitability prospects, while an enhanced buyback plan may further support shareholder returns.

- Navigate through the intricacies of Inpex with our comprehensive dividend report here.

- The analysis detailed in our Inpex valuation report hints at an deflated share price compared to its estimated value.

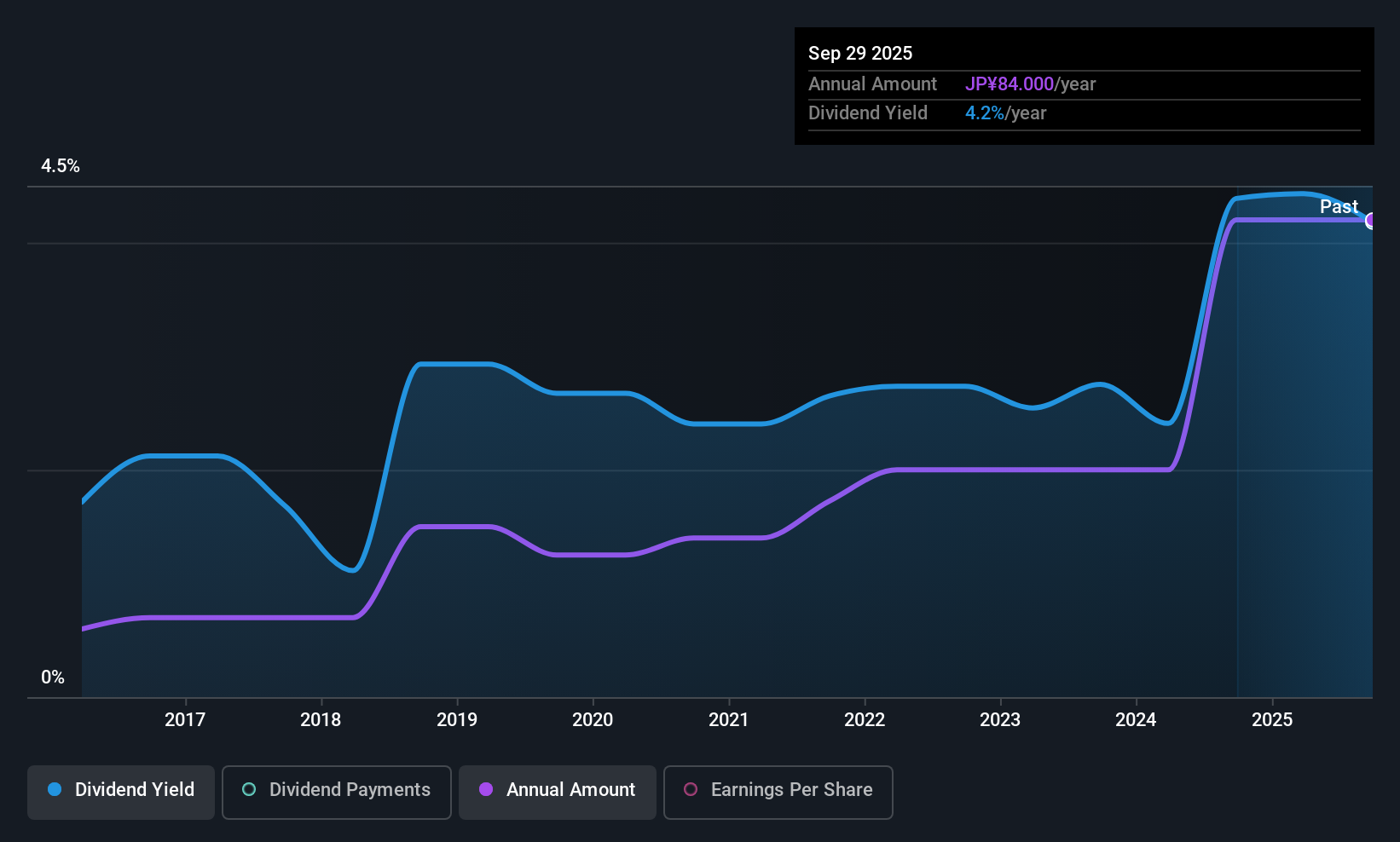

Seibu Electric & Machinery (TSE:6144)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Seibu Electric & Machinery Co., Ltd. is a Japanese company that manufactures and sells mechatronics, with a market capitalization of ¥34.75 billion.

Operations: Seibu Electric & Machinery Co., Ltd. generates revenue through its Precision Machinery Business at ¥15.99 billion, Conveyance Machinery Business at ¥10.68 billion, and Industrial Machinery Business at ¥6.65 billion.

Dividend Yield: 3.7%

Seibu Electric & Machinery has consistently increased dividends over the past decade, maintaining stability. However, its 3.65% yield is slightly below Japan's top quartile. While the payout ratio of 51.1% suggests earnings coverage, dividends are not supported by free cash flows, raising sustainability concerns. The company's price-to-earnings ratio of 14x is marginally below the market average, and recent earnings growth of 39.1% highlights potential for future profitability improvements despite current dividend challenges.

- Unlock comprehensive insights into our analysis of Seibu Electric & Machinery stock in this dividend report.

- Our valuation report here indicates Seibu Electric & Machinery may be overvalued.

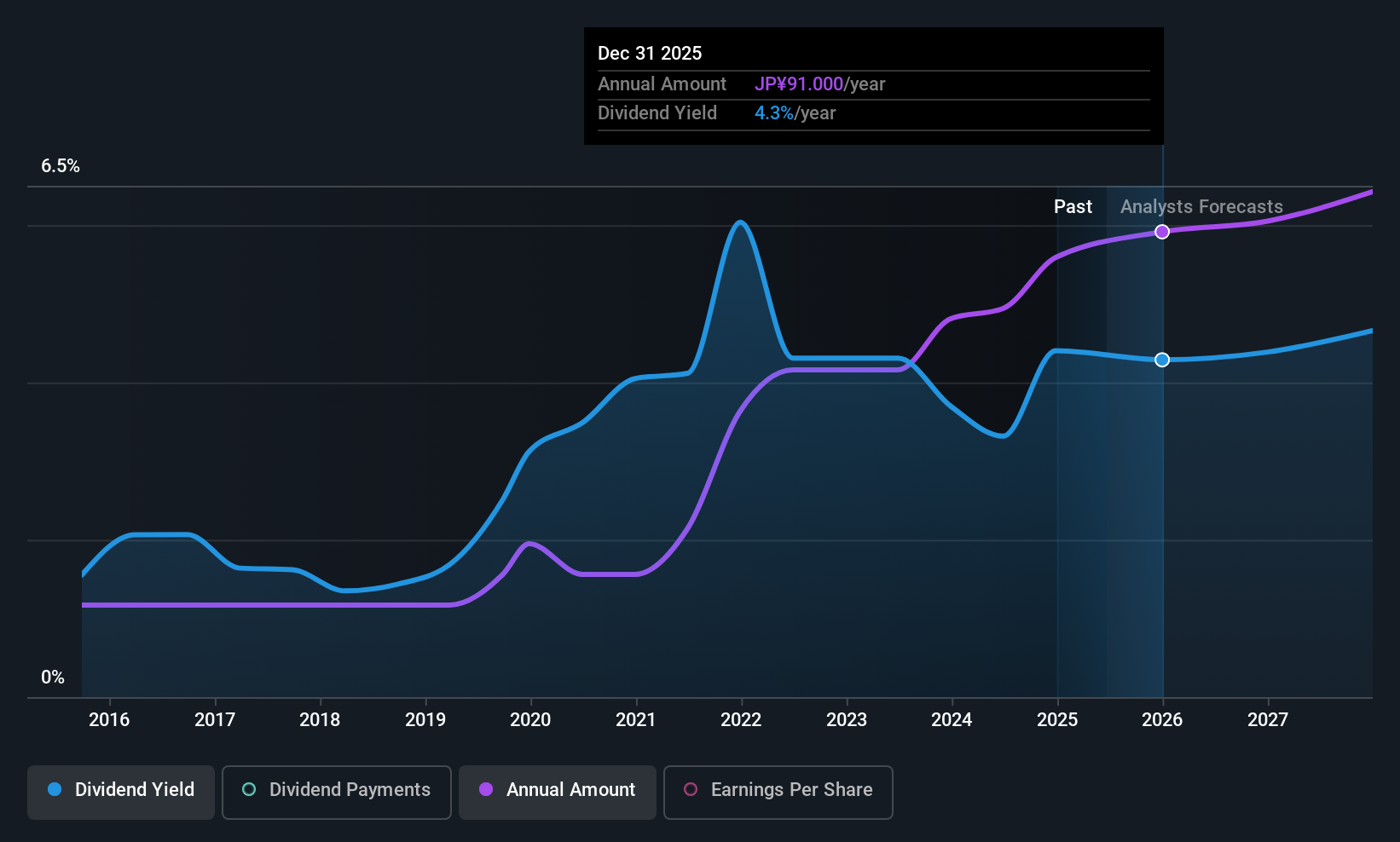

FinTech Global (TSE:8789)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FinTech Global Incorporated offers a range of financial services in Japan and has a market capitalization of ¥24.61 billion.

Operations: FinTech Global Incorporated generates revenue through its Investment Banking Business (¥11.60 billion), Entertainment Service Business (¥2.86 billion), and Public Management Consulting Business (¥502.38 million).

Dividend Yield: 3.9%

FinTech Global's dividend yield of 3.91% ranks in Japan's top quartile, yet sustainability is questionable due to lack of free cash flow coverage. Despite a low payout ratio of 27.5%, dividends have been volatile over the past decade. Recent earnings growth of 26.7% and a price-to-earnings ratio of 11.6x suggest value potential, but high non-cash earnings raise quality concerns. The company announced increased dividends for fiscal years ending September 2025 and September 2026 amidst share buybacks totaling ¥277.17 million.

- Click here to discover the nuances of FinTech Global with our detailed analytical dividend report.

- Our valuation report unveils the possibility FinTech Global's shares may be trading at a premium.

Make It Happen

- Gain an insight into the universe of 1043 Top Asian Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal