ExlService Holdings (EXLS): Exploring Valuation Following Q3 Beat and Upgraded Revenue Outlook on AI Insurance Growth

ExlService Holdings (EXLS) outperformed in fiscal Q3, with its Insurance segment driving revenue gains as more clients embraced AI-powered operations. The company responded by raising its full-year revenue outlook, which reflects continued confidence in sector growth.

See our latest analysis for ExlService Holdings.

Despite posting record Q3 results and raising its revenue outlook on the back of AI-driven Insurance growth, ExlService Holdings’ share price has drifted lower, down around 10% year-to-date and delivering a -11% total shareholder return over the past year. Still, long-term holders are well ahead, with a total return exceeding 145% over five years. This suggests that momentum may be cooling, but the bigger growth story remains intact for patient investors.

If you’re curious about what else the market is rewarding outside the headlines, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares down despite strong growth and the stock trading at a notable discount to analyst targets, investors must decide whether ExlService Holdings represents a compelling value or if the market has already priced in future gains.

Most Popular Narrative: 24% Undervalued

ExlService Holdings last closed at $39.71, a significant gap below the most popular narrative’s fair value estimate of $52.29. This creates a strong valuation spread for investors to assess, as expectations for revenue and earnings growth continue to rise in a fast-evolving market.

The accelerated global adoption of AI and digital transformation in regulated industries is expanding the addressable market for ExlService, driving strong double-digit pipeline and growing annuity-like revenues. This trend supports sustained revenue growth and improved earnings visibility.

The pricing model behind this undervaluation targets surging sector demand and expects faster, more predictable earnings. Which aggressive forecast is steering that fair value? The real surprise comes from the growth assumptions. Get the inside story that makes this narrative so compelling.

Result: Fair Value of $52.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent talent shortages and rising compliance costs could pressure ExlService’s margins. As a result, future earnings growth may be less predictable than the narrative suggests.

Find out about the key risks to this ExlService Holdings narrative.

Another View: Looking Beyond Fair Value

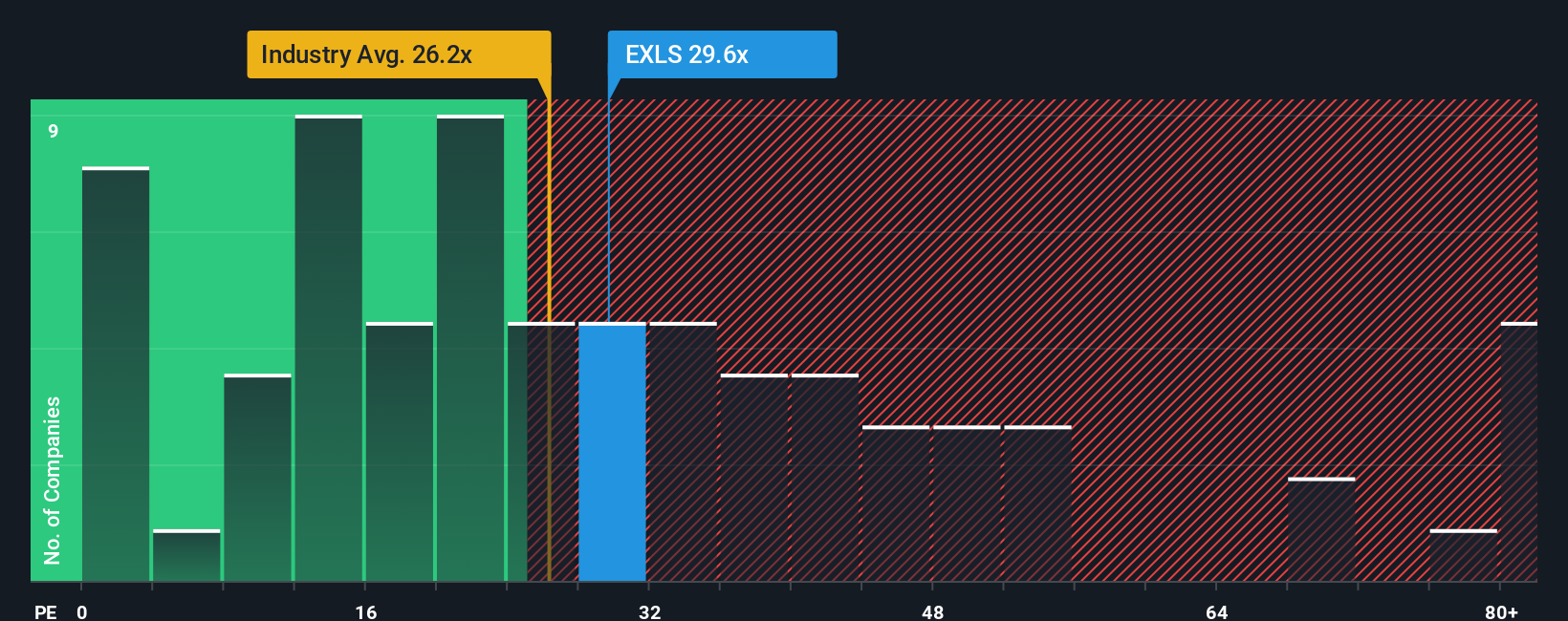

While the current valuation suggests ExlService Holdings is undervalued, the picture changes when you compare its price-to-earnings ratio. At 26.1x, this is higher than both the industry average of 24.4x and the fair ratio of 23.9x. This means the stock is priced at a premium relative to sector norms. This raises the question: is that extra cost justified, or could it signal limited upside if market expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ExlService Holdings Narrative

If you have a different view or want to dig deeper into the numbers yourself, you can shape your own take in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ExlService Holdings.

Looking for More Investment Ideas?

Seize your edge in today's market with tailored lists spotlighting companies at the intersection of innovation and value. Don’t let fresh opportunities pass you by.

- Maximize your portfolio’s potential by targeting stable returns with these 16 dividend stocks with yields > 3%. This list features yields above 3% from industry leaders.

- Tap into unstoppable technological trends by evaluating these 25 AI penny stocks, which are trusted for their breakthroughs in automation, data, and machine learning.

- Position yourself ahead of the curve by reviewing these 886 undervalued stocks based on cash flows, which includes companies flying under the radar but packed with value based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal