NGL Energy Partners (NGL): Revisiting Valuation After Record Q2 Results and Upbeat Growth Guidance

NGL Energy Partners (NGL) delivered a standout set of results for the second quarter, surpassing earnings and revenue expectations. Higher water volumes and strong Grand Mesa segment growth were central to this performance, along with new long-term contracts and expanded commitments.

See our latest analysis for NGL Energy Partners.

Following its upbeat earnings release and an active share buyback program, NGL Energy Partners has captured investor attention in a big way. Momentum is building, with the share price rallying 56.8% over the past month and delivering an outstanding 129.1% total shareholder return over the past year. This performance has outpaced broader market trends and highlights growing optimism around the company’s turnaround and growth prospects.

If NGL’s surge has you thinking about what other stocks are showing renewed momentum, now’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

Yet with such rapid appreciation and management signaling confidence through buybacks, the big question now is whether NGL Energy Partners still offers value for new investors or if the recent rally means future growth is already priced in.

Price-to-Sales of 0.4x: Is it justified?

NGL Energy Partners is trading on a price-to-sales ratio of 0.4x, which appears notably cheaper than both its industry peers and broader market benchmarks. With the last close price of $9.83, this figure stands out in a sector where valuation discipline matters.

The price-to-sales ratio compares a company's market capitalization to its total revenue, offering a broad measure of how much investors are paying for each dollar of sales. This metric is especially relevant in the oil and gas sector, where earnings may fluctuate due to commodity cycles, but revenue remains a key anchor for valuation.

At 0.4x, NGL's price-to-sales ratio is far lower than the US Oil and Gas industry average of 1.5x and the peer average of 2.0x. This signals the market may be heavily discounting its sales. However, when compared to the estimated fair price-to-sales ratio of 0.2x, NGL actually appears somewhat expensive on a regression basis. This hints the market sees future earnings growth or profitability recovery justifying a premium over the statistical norm.

Explore the SWS fair ratio for NGL Energy Partners

Result: Price-to-Sales of 0.4x (UNDERVALUED versus industry average, ABOVE FAIR RATIO)

However, investors should note that declining annual revenues and persistent net losses remain meaningful risks that could challenge the bullish outlook for NGL Energy Partners.

Find out about the key risks to this NGL Energy Partners narrative.

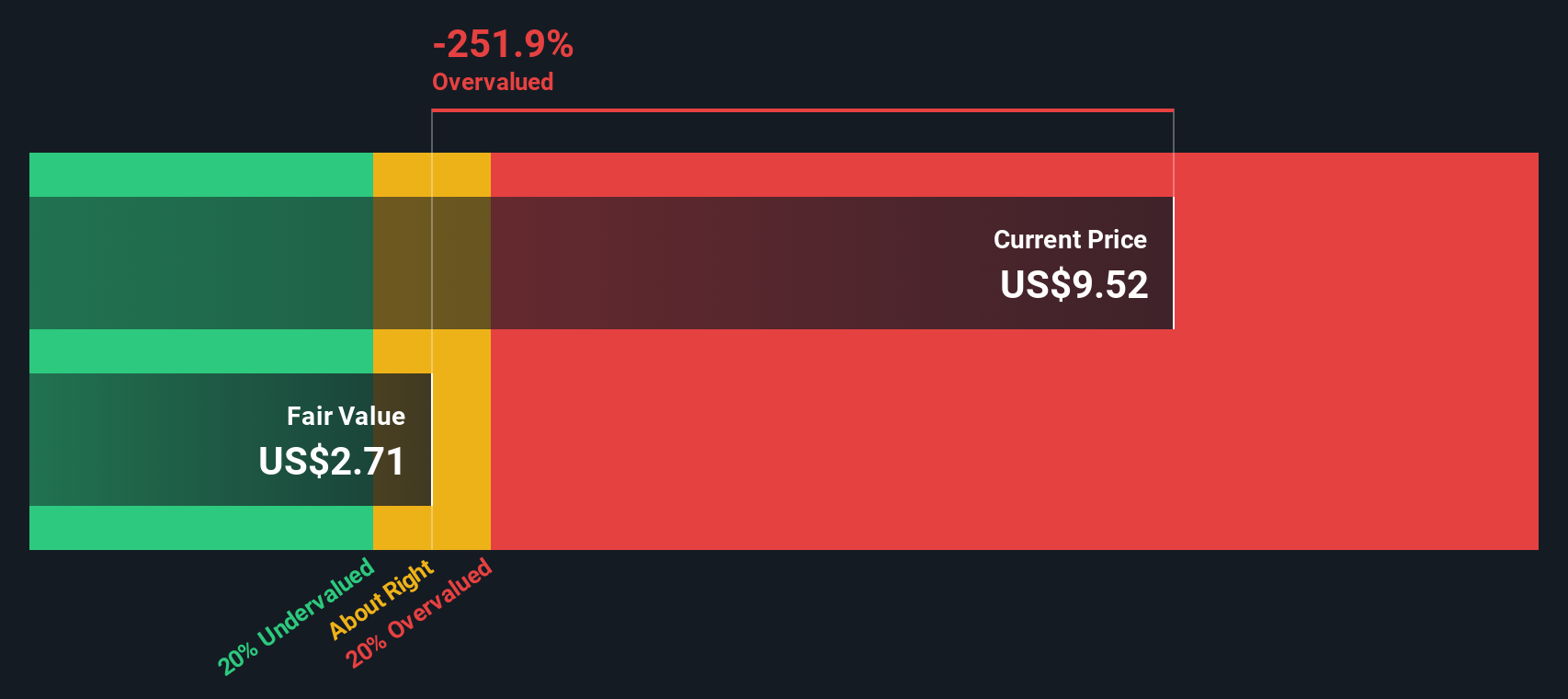

Another View: SWS DCF Model Points to Overvaluation

Looking from another angle, our DCF model arrives at a much lower estimate for NGL Energy Partners’ fair value. The model suggests $2.71 per share compared to the current market price of $9.83. This difference implies the shares may actually be overvalued on this basis. This raises the question: which view holds more weight for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NGL Energy Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NGL Energy Partners Narrative

If you have your own perspective or want to dig into the numbers yourself, it only takes a few minutes to craft a personalized view. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding NGL Energy Partners.

Looking for more investment ideas?

Smart investors are always on the lookout for hidden winners before the crowd spots them. If you want to keep an edge in the market, don’t miss out on these timely opportunities:

- Capture fresh growth by tapping into these 25 AI penny stocks, which are leading advancements in artificial intelligence and transforming industries from healthcare to finance.

- Enhance your portfolio’s income potential by reviewing these 16 dividend stocks with yields > 3%, which offer attractive yields and stable cash flows.

- Position yourself ahead of the curve as technology evolves by reviewing these 26 quantum computing stocks, which are driving breakthroughs in next-generation computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal