How Record Revenue Guidance and Buybacks at QUALCOMM (QCOM) Has Changed Its Investment Story

- QUALCOMM recently reported results for the fourth quarter and full year ended September 28, 2025, with quarterly revenues rising to US$11.27 billion and issuing earnings guidance for the first quarter of 2026 projecting record revenues between US$11.8 billion and US$12.6 billion.

- The company also updated on its share buyback, having repurchased over 50 million shares since November 2024, totaling more than US$7.76 billion in capital returned to shareholders.

- We'll explore how QUALCOMM's record revenue guidance for 2026 may shift its investment outlook and diversification ambitions.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

QUALCOMM Investment Narrative Recap

QUALCOMM’s long-term investment story centers on capturing sustained growth from AI, connected devices, and diversification beyond smartphones, while confronting fierce competition from in-house chip efforts at major OEMs. The company’s record-setting first-quarter 2026 revenue guidance is certainly encouraging for near-term sentiment, but it does not materially alleviate the significant risk posed by its exposure to smartphone cycles and already-rising competition in its core chipset business.

Among several recent corporate actions, QUALCOMM’s ongoing share buyback, over 50 million shares repurchased since November 2024, stands out in this context. While this substantial return of capital may support shareholder value and bolster confidence around future cash flows, it is ultimately the company’s ability to secure large-scale design wins (especially outside smartphones) that remains the key short-term catalyst for the stock’s prospects.

However, the real risk investors should watch is that, despite record guidance, QUALCOMM’s heavy reliance on cyclical handset markets means that ...

Read the full narrative on QUALCOMM (it's free!)

QUALCOMM's narrative projects $46.9 billion revenue and $12.2 billion earnings by 2028. This requires 2.7% yearly revenue growth and a $0.6 billion earnings increase from $11.6 billion.

Uncover how QUALCOMM's forecasts yield a $187.71 fair value, a 8% upside to its current price.

Exploring Other Perspectives

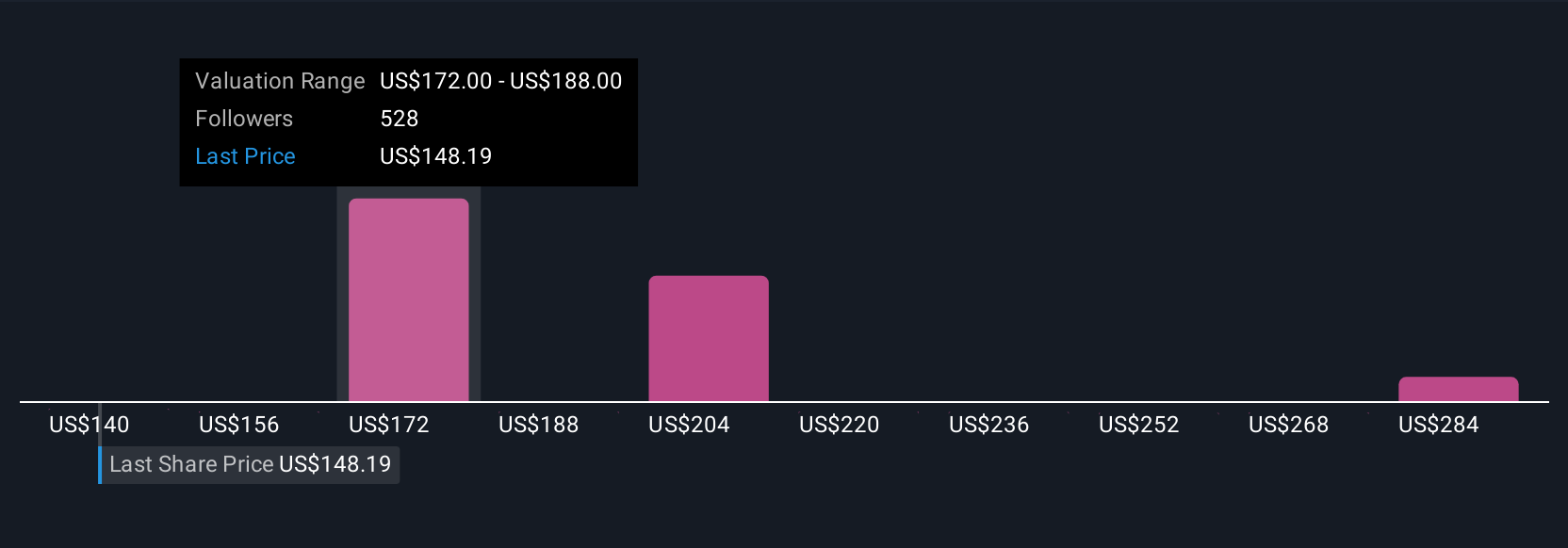

Fair value estimates from 31 members of the Simply Wall St Community span a wide US$140 to US$300 per share range. As you weigh these views, remember that QUALCOMM’s competitive challenges with leading OEMs could have far-reaching effects on its market opportunity and margin outlook.

Explore 31 other fair value estimates on QUALCOMM - why the stock might be worth 20% less than the current price!

Build Your Own QUALCOMM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QUALCOMM research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QUALCOMM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QUALCOMM's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal