Lam Research (LRCX): Assessing Valuation After Analyst Upgrades and Bullish Earnings Forecasts

Lam Research (LRCX) recently saw its stock gain attention after analysts revised earnings estimates higher, resulting in a consensus rating between Strong Buy and Buy. This wave of renewed optimism has highlighted its near-term prospects for investors.

See our latest analysis for Lam Research.

Lam Research’s momentum has been building, with analyst optimism and solid earnings sentiment helping drive a 30-day share price return of 17.1% and an eye-catching 122.8% year-to-date gain. Even as recent events like an affirmed dividend and bylaw changes made the headlines, it is the 120.9% total return for shareholders over the past year and robust gains over three and five years that really underscore how much the mood has shifted in the stock’s favor.

If the strength in Lam’s returns has you searching for more top performers, now is a prime moment to discover See the full list for free.

But with shares setting fresh highs and analysts already revising their targets upward, investors now face a critical question: Is Lam Research still undervalued, or has the market already priced in the company’s future growth?

Most Popular Narrative: 2.2% Overvalued

Analysts’ consensus fair value now stands at $158.02, which is modestly below Lam Research’s last close at $161.42. This flags a slight premium baked into the current market price. The narrative behind this estimate draws on upgraded analyst projections shaped by Lam’s expanding market leadership and high-margin outlook, fueling a spirited debate about just how much upside remains.

Lam's leadership in new process technologies, such as ALD Moly for metal deposition and advanced packaging solutions (SABRE 3D systems), positions the company to capture an increasing share of spend on next-generation chip manufacturing, leading to market share gains, higher average selling prices, and expanding gross margins over the long term.

Curious what key drivers are propelling Lam’s lofty price tag? There’s a pivotal metric in these analyst forecasts, one that hints at elevated future profits and valuation multiples rarely seen in this industry. Want to see what’s fueling the market’s confidence? Dive in to find the company’s most ambitious assumptions.

Result: Fair Value of $158.02 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing geopolitical tensions and customer concentration pose real threats that could quickly shift sentiment and challenge Lam Research’s positive outlook.

Find out about the key risks to this Lam Research narrative.

Another View: What Do the Ratios Say?

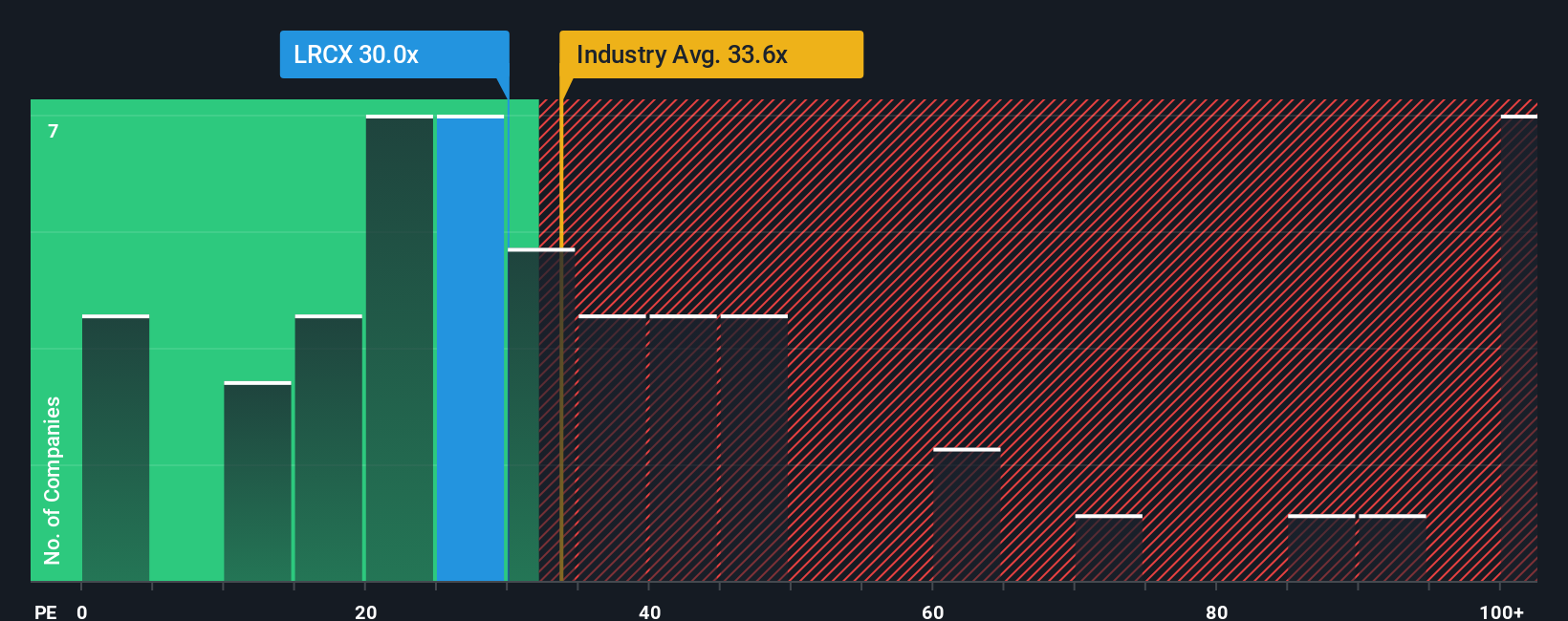

While analysts see Lam Research as slightly overvalued based on their fair value estimates, a look at its price-to-earnings ratio offers a different angle. At 34.9x, the company’s multiple is below both peer (37.9x) and industry (35.9x) averages. However, it is just above its own fair ratio of 34.2x. This close gap suggests Lam shares are reasonably valued compared to competitors, but not immune to a shift if the market realigns to that fair ratio. How much room is truly left for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lam Research Narrative

If you’d rather chart your own course or believe a different perspective tells the story, you can dive in and build a narrative in minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lam Research.

Looking for more investment ideas?

Don't limit yourself to just one opportunity. Expand your portfolio with expertly-screened stocks that showcase growth, value, and innovation. Miss out now and you could regret it later.

- Power up your strategy and add high cash flow picks by jumping straight into these 865 undervalued stocks based on cash flows to reveal outstanding value hidden in plain sight.

- Catch the wave and uncover the next breakout with these 25 AI penny stocks powering advancements in artificial intelligence across every industry.

- Boost your income stream by starting to track reliable yields above 3% via these 14 dividend stocks with yields > 3% and strengthen your portfolio for the long haul.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal