GXO Logistics (GXO): Evaluating Valuation Following Q3 Earnings Growth and Guidance Reaffirmation

GXO Logistics (GXO) just posted its third-quarter results, revealing higher sales and net income compared to last year. The company also reconfirmed its full-year outlook for organic revenue growth. These latest moves are drawing fresh investor interest.

See our latest analysis for GXO Logistics.

Momentum has started to return for GXO Logistics as recent quarterly results and new leadership have boosted confidence, even after a tough period that saw rising costs and a valuation downgrade. The company’s year-to-date share price return sits at an impressive 20.8%, yet the one-year total shareholder return remains negative at -13.9%. This highlights the challenges long-term holders have faced as the market recalibrates growth expectations and risk perceptions.

If GXO’s evolving strategy has you thinking about what else might be gaining traction, broaden your perspective and discover fast growing stocks with high insider ownership

With shares still trading at a discount to analyst price targets after a volatile year, investors now face a critical question: Is GXO Logistics undervalued at these levels, or is all future growth already priced in?

Most Popular Narrative: 16% Undervalued

GXO Logistics’s most-followed narrative suggests the fair value is $62.12, while the last close was $52.01. That gap between price and expected value turns the focus toward where analysts see the company headed next.

Enhanced deployment of automation, AI, and proprietary software (with recent launches like GXO IQ) is rapidly improving warehouse productivity, reducing labor costs, and increasing operational efficiency. This is beginning to drive margin expansion and should positively impact net earnings and EBITDA margins.

Want to know what aggressive assumptions are powering this bullish outlook? Picture a company betting its future on smarter warehouses and cost discipline, with profit targets that outpace most in the sector. Wondering just how ambitious those projections get? The full narrative lays bare the numbers behind this premium valuation.

Result: Fair Value of $62.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks from the Wincanton integration and leadership changes could quickly challenge the bullish outlook if cost synergies or strategic focus decline.

Find out about the key risks to this GXO Logistics narrative.

Another View: What Do Multiples Say?

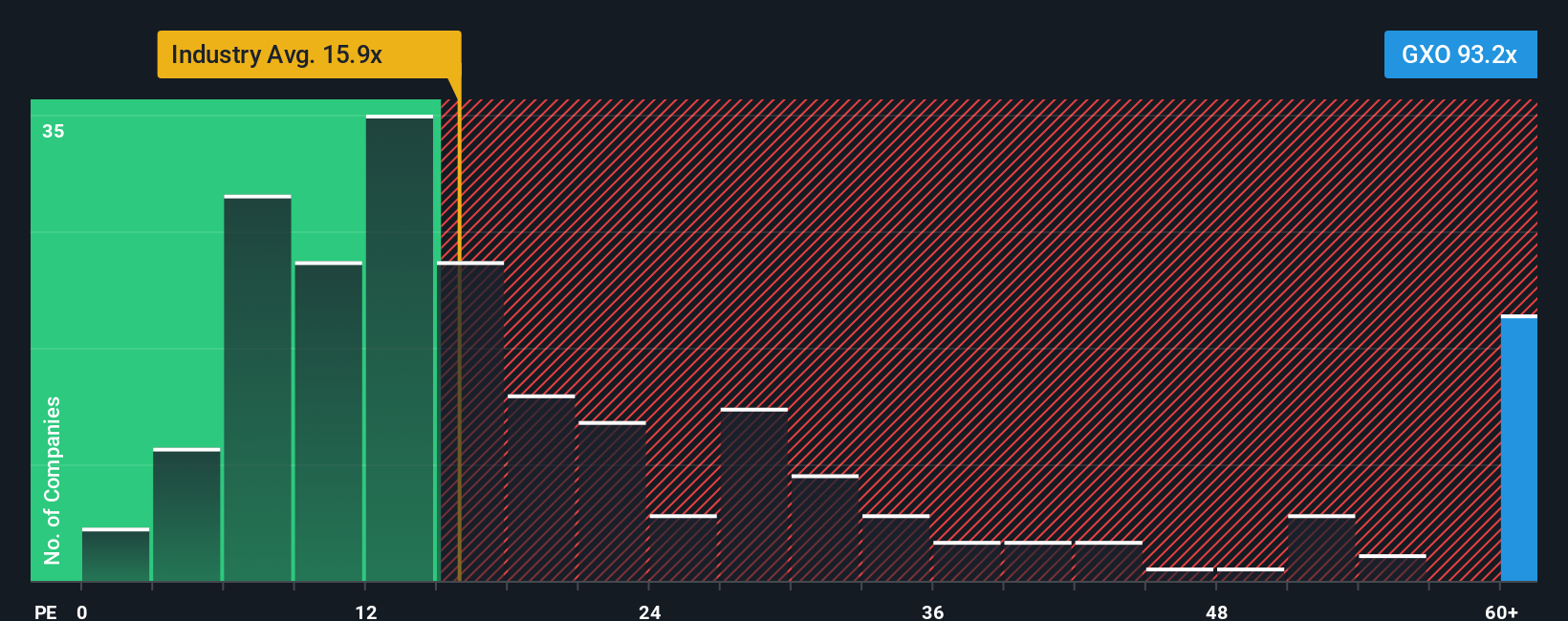

Looking at the price-to-earnings ratio paints a very different picture. GXO is valued at 66.9 times earnings, which is far higher than both its global industry average of 16.1x and its peer group at 21.5x. Even its fair ratio is just 41.7x. This lofty premium increases valuation risk, especially if growth expectations are missed. Does the market believe something others do not? Or are investors paying too much for possible future gains?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GXO Logistics Narrative

If you’re not convinced by the current narratives or want to see the numbers for yourself, you can craft your own view in just a few minutes with Do it your way

A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your potential gains to just one stock. Unlock fresh opportunities and make smarter moves by checking out these standout themes in today’s markets:

- Supercharge your portfolio’s growth prospects by capitalizing on emerging trends in artificial intelligence with these 25 AI penny stocks, which are shaping tomorrow’s breakthroughs.

- Start building a foundation of reliable income by targeting these 14 dividend stocks with yields > 3% that offer yields above 3 percent, perfect for strengthening your financial resilience.

- Harness outsized return potential in overlooked areas of the market by pursuing opportunities with these 3576 penny stocks with strong financials that boast solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal