Assessing Rio Tinto After a 19% Share Price Gain and Analyst Growth Projections for 2025

- Wondering if Rio Tinto Group is trading at a bargain or carrying hidden risks? You are not alone; many investors are looking for clarity on whether now is the right time to buy or hold.

- The stock has seen a 6.8% gain over the past month and is up 19.1% in the last year, catching the eye of both growth-minded and value-focused investors.

- Industry headlines highlight a renewed optimism for commodities and greater demand for critical metals, placing Rio Tinto squarely in the conversation about resource security. Global discussions around clean energy and infrastructure spending have also been fueling interest in mining giants and shaping investor sentiment.

- Our valuation checks place Rio Tinto Group at a score of 5 out of 6, indicating undervaluation in most areas. Next, we will break down how different valuation approaches measure up, and reveal a fresh perspective on finding true value by the end of this article.

Find out why Rio Tinto Group's 19.1% return over the last year is lagging behind its peers.

Approach 1: Rio Tinto Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors understand what the business might be worth now, based on its ability to generate cash in the coming years.

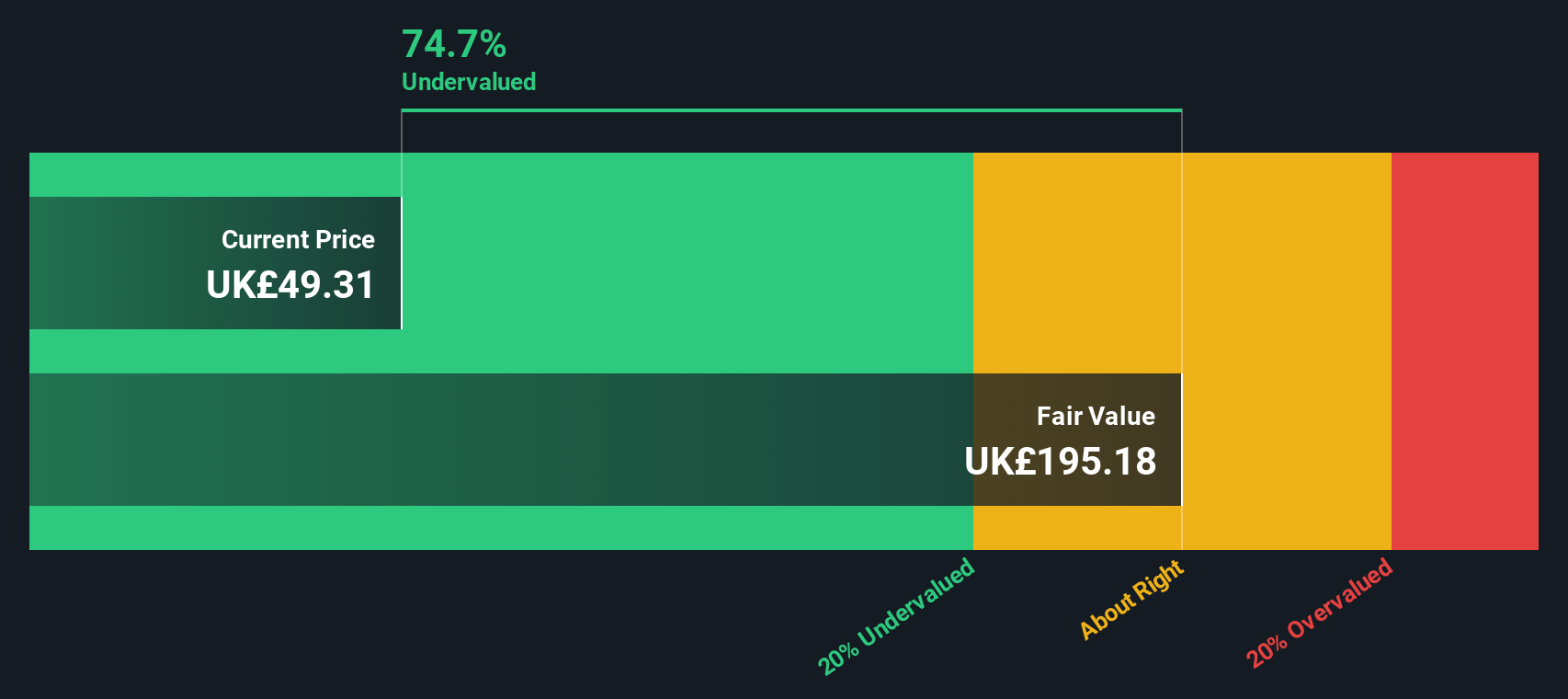

For Rio Tinto Group, the latest reported Free Cash Flow (FCF) is $7.08 billion. Analyst estimates cover the next five years, after which Simply Wall St extrapolates further figures. Projections suggest Rio Tinto's annual FCF could rise to $14.68 billion in 2028, and reach $31.59 billion by 2035. These substantial cash flows form the foundation of the company’s DCF valuation.

The DCF model applied here estimates an intrinsic value of $171.76 per share. Compared to the market price, this results in a striking 69% discount, which points to significant undervaluation based on cash flow potential alone.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rio Tinto Group is undervalued by 69.0%. Track this in your watchlist or portfolio, or discover 856 more undervalued stocks based on cash flows.

Approach 2: Rio Tinto Group Price vs Earnings

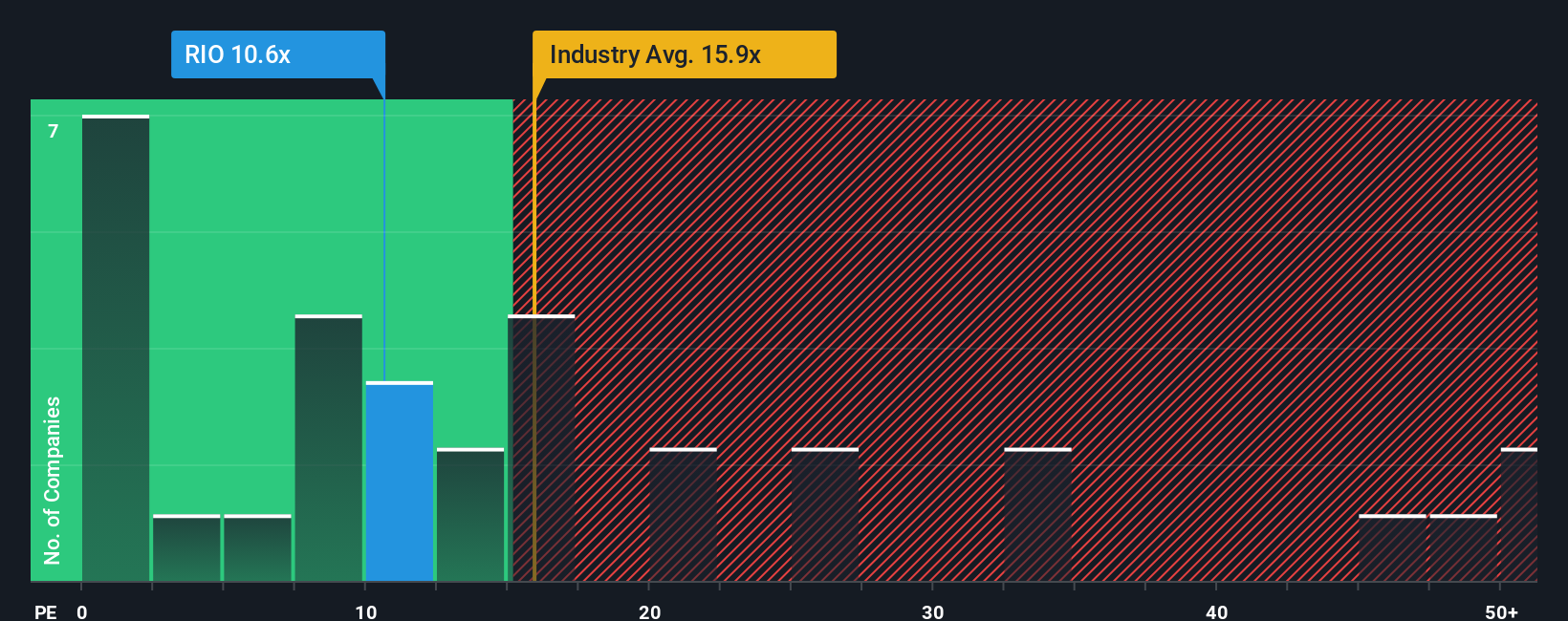

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Rio Tinto Group. It offers a straightforward way to see how much investors are willing to pay for each dollar of earnings, making it a practical benchmark for companies with consistent profitability.

Growth expectations and perceived risks naturally influence what a typical or “fair” PE ratio should be. Companies with faster earnings growth and fewer risks often command higher PE multiples. Those in more mature or riskier sectors tend to show lower ratios. This provides context for evaluating whether a stock is trading at a premium or discount.

Currently, Rio Tinto trades at a PE ratio of 11.1x. This is significantly below both the Metals and Mining industry average of 14.9x and its peer group average of 36.1x. This suggests investors are pricing in more caution or lower growth for Rio Tinto relative to competitors.

Simply Wall St’s proprietary “Fair Ratio” goes a step further than standard industry comparisons. The Fair Ratio for Rio Tinto stands at 23.6x, calculated by weighing factors unique to the company, including earnings growth prospects, profit margins, industry dynamics, and the company’s overall size and risk profile. This custom approach offers a more nuanced and realistic view of where the PE ratio should be, compared to market generalizations.

With Rio Tinto’s actual PE ratio of 11.1x sitting well below its Fair Ratio of 23.6x, this analysis points to the stock being undervalued on the basis of earnings multiples.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1372 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rio Tinto Group Narrative

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives.

A Narrative is your personal story about a company. It connects your expectations and research to a financial forecast, and then turns that into an estimated fair value. Instead of relying only on traditional ratios or analyst targets, Narratives let you clearly explain your outlook for Rio Tinto Group’s future revenue, profits, and margins, using your own assumptions and reasoning.

On Simply Wall St’s Community page, you can explore, create, and update Narratives with just a few clicks. This user-friendly feature, used by millions of investors, makes it easy to see how different viewpoints affect fair value. When news or earnings updates are released, Narratives adapt automatically, giving you the most relevant, real-time insights to compare your projected fair value with the current share price, helping you make smarter buy or sell decisions.

For example, some investors' Narratives for Rio Tinto Group forecast strong growth from new copper and lithium projects and see fair value as high as £66.68 per share, while others are more cautious due to commodity risks and set their fair value closer to £41.00. This highlights how your unique perspective shapes your investment case.

Do you think there's more to the story for Rio Tinto Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal