Synopsys Shares Drop 17% in 2025 as Investors Debate Fair Value

- Thinking about whether Synopsys is a bargain or is getting too expensive? You are not alone. It pays to look beyond the surface when a stock like this is on your radar.

- Shares have seen quite a ride lately, sliding 3.7% over the past week, down 8.7% in the past month, and currently sitting 17.0% lower year-to-date. This comes despite an impressive 81.2% gain over the last 5 years.

- Part of this recent slide can be tied to shifting investor sentiment following key software industry headlines, as well as renewed conversations on competitive threats and the broader AI landscape. These stories have fueled some uncertainty but also highlight the fast-moving backdrop Synopsys operates in.

- If you are a numbers person, our valuation checks give Synopsys a score of 3 out of 6 for being undervalued, meaning it passes half our key tests. Next, let us break down the main approaches to valuing Synopsys. There is an even more insightful way to look at the numbers coming at the end.

Find out why Synopsys's -27.6% return over the last year is lagging behind its peers.

Approach 1: Synopsys Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today. This approach is widely used for growth companies like Synopsys, as it captures value over the long term by considering cash generation potential.

Currently, Synopsys generates approximately $1.26 billion in free cash flow. Analysts estimate the company’s annual free cash flow could reach around $5.26 billion by 2030. Projections beyond the first five years are extrapolated to reflect continued but moderating growth. For example, free cash flow forecasts for 2028 and 2029 are about $3.99 billion and $4.56 billion, respectively, before climbing higher in the next decade.

Based on these projections, the DCF model calculates an intrinsic value of $465.68 per share for Synopsys in US dollars. With the stock currently trading about 13.9% below this estimated value, the model suggests Synopsys is undervalued at its current price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Synopsys is undervalued by 13.9%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

Approach 2: Synopsys Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a commonly used valuation tool for profitable, established companies like Synopsys. It helps investors assess how much they are paying for each dollar of current earnings, making it a relevant metric for software businesses generating reliable profits.

A company's "normal" or "fair" PE ratio depends on factors such as future earnings growth and risk profile. Firms with strong earnings growth potential and lower risks tend to command higher PE multiples, as investors are willing to pay a premium for potential upside. Conversely, higher risk or lower expected growth may justify a lower PE.

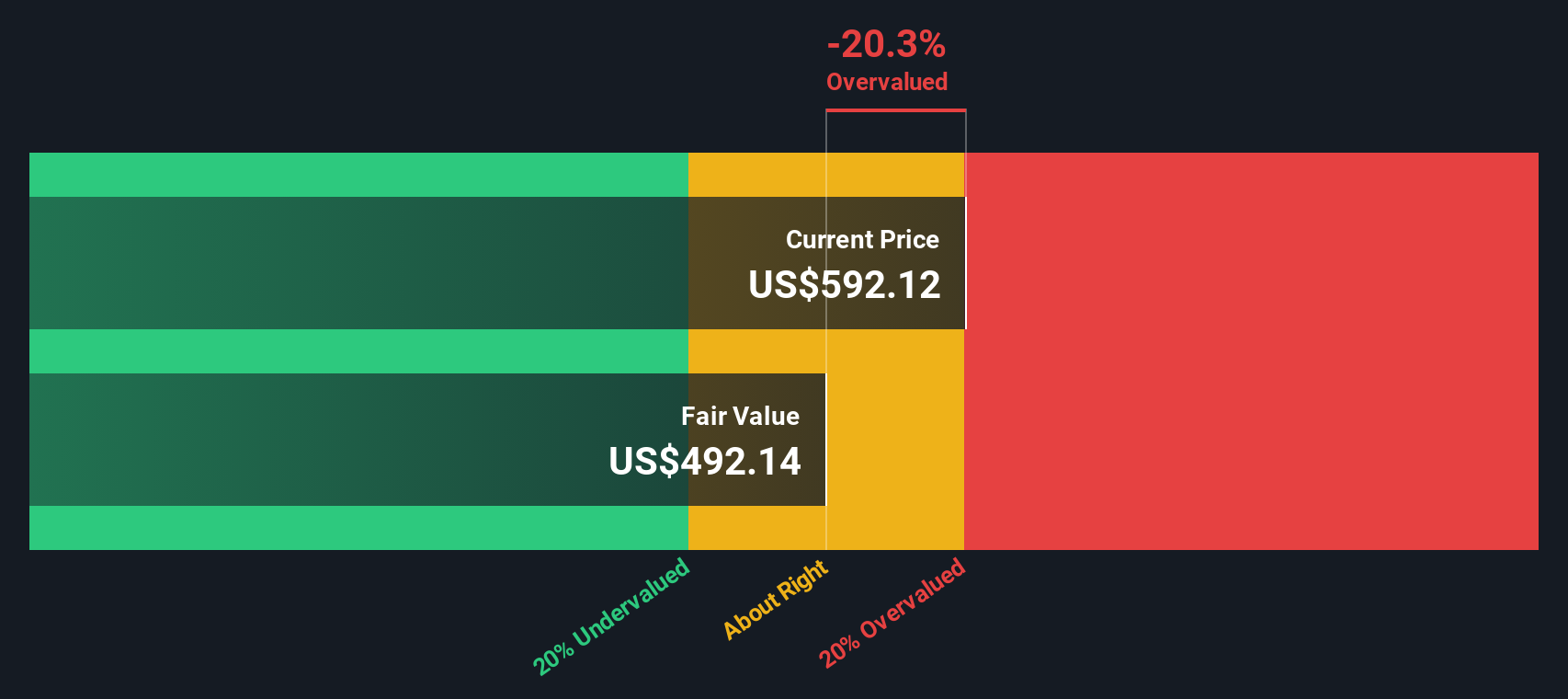

At present, Synopsys trades at a PE ratio of 63.8x. This is just below the peer average of 64.7x, but it remains significantly above the broader software industry average, which currently stands at 32.5x.

Simply Wall St introduces the concept of a “Fair Ratio,” a proprietary metric designed to estimate what Synopsys’ PE multiple should be, factoring in its unique growth outlook, profit margins, industry, and overall risk profile. Unlike the simple comparison to sector or peer averages, the Fair Ratio examines company-specific fundamentals and market characteristics, providing a more meaningful benchmark for valuation.

For Synopsys, the Fair Ratio has been calculated at 45.5x. Comparing this to the actual PE of 63.8x shows the stock is trading at a notable premium relative to what would be considered fair given its outlook and risk level.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Synopsys Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own story or perspective on Synopsys, tying together your views on its future revenue, profit margins, risks, and business catalysts into a personal financial forecast and “fair value” for the stock. Rather than relying only on static numbers, Narratives let you connect the evolving story of the company with its actual performance. This helps you decide whether the current price reflects what you believe about its future potential. Used by millions of investors in Simply Wall St’s Community page, Narratives give you a simple, hands-on way to compare your fair value with the market price so you can see if the stock is a buy, sell, or hold for you personally. They update dynamically with new earnings, news, or industry changes, ensuring your perspective stays relevant as events unfold. For Synopsys, one investor’s Narrative might highlight rapid SaaS adoption and accelerating AI opportunities (yielding a high fair value), while another remains cautious and factors in persistent IP headwinds or geopolitical risks (arriving at a much lower fair value).

Do you think there's more to the story for Synopsys? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal