Select Water Solutions Outlook After Recent Expansion Fuels 12% Price Jump

- Curious if Select Water Solutions could be a hidden gem or if the current price already factors in all the upside? You're not alone. Today we're taking a closer look at its value for investors like you.

- Stock price action has been a bit of a rollercoaster, with a 12% rise over the last month. However, the shares are still down 20% year-to-date.

- In recent weeks, coverage around the company's expansion into new service contracts and strategic partnerships has fueled fresh optimism. Some investors remain cautious given the industry's volatility. These developments add context to the swift changes in market sentiment around Select Water Solutions.

- When it comes to valuation, Select Water Solutions scores a 3 out of 6 on our value checks, suggesting there are both opportunities and risks. We'll dig into the usual valuation approaches in just a moment. Stay tuned to discover a smarter way to truly understand whether the stock is worth considering.

Find out why Select Water Solutions's -17.1% return over the last year is lagging behind its peers.

Approach 1: Select Water Solutions Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to the present. This approach helps assess whether a stock's price reflects its underlying value based on its ability to generate future free cash flows.

For Select Water Solutions, the current Free Cash Flow stands at $42.9 Million. Analysts provide forecasts for several years ahead, predicting steady cash flow growth. For example, Free Cash Flow is expected to reach $107 Million in 2028, with further extrapolations by Simply Wall St showing continued growth through 2035. These projections are all based in US dollars.

Using the two-stage Free Cash Flow to Equity model, the resulting estimated intrinsic value for Select Water Solutions comes out to $19.07 per share. This represents a 42.3% discount compared to the current market price, indicating the stock is significantly undervalued based on its long-term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Select Water Solutions is undervalued by 42.3%. Track this in your watchlist or portfolio, or discover 871 more undervalued stocks based on cash flows.

Approach 2: Select Water Solutions Price vs Earnings

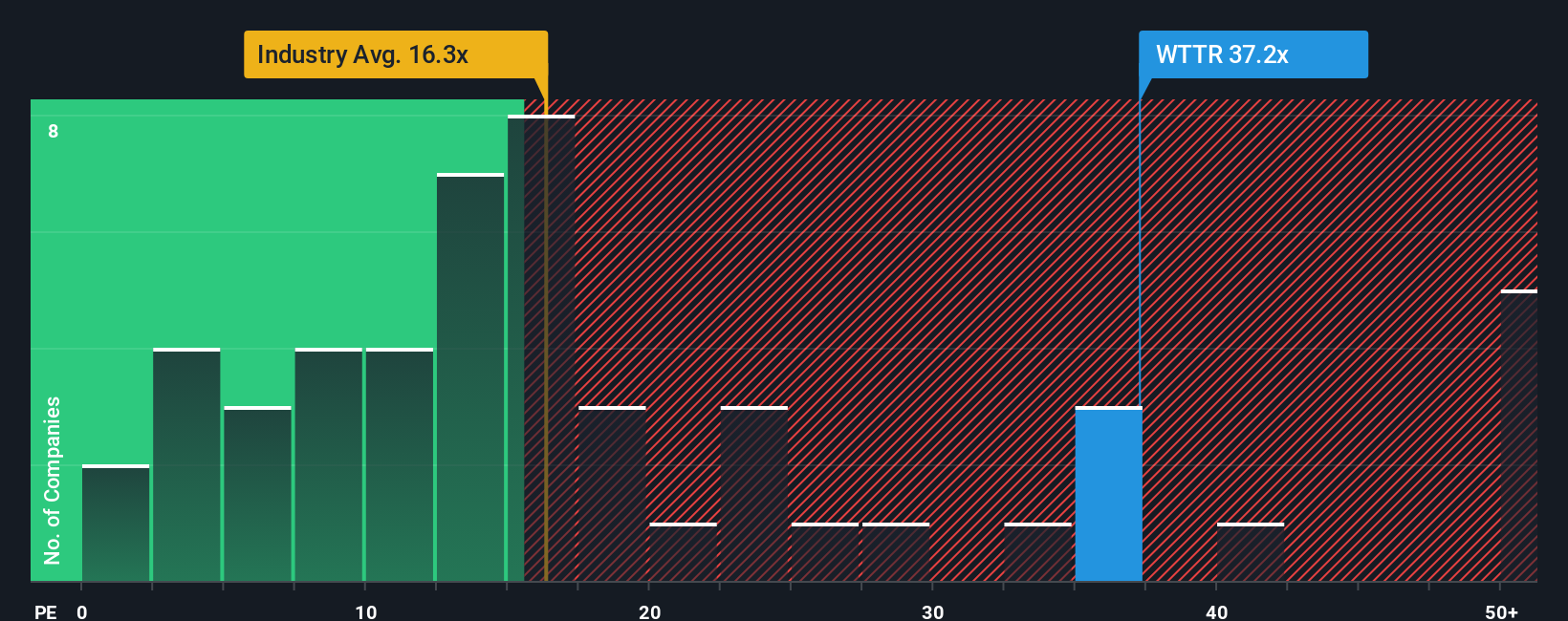

The price-to-earnings (PE) ratio is a widely used valuation metric for profitable companies like Select Water Solutions because it directly compares what investors are willing to pay for each dollar of earnings. This ratio offers a snapshot of market expectations for a business's future profitability.

Growth prospects and risk play important roles in determining a "normal" or "fair" PE ratio. Companies with higher, more reliable growth can justify a higher multiple, while those facing uncertain earnings or industry headwinds might deserve a lower one.

Currently, Select Water Solutions trades at a PE ratio of 57.9x. For context, this is much higher than the Energy Services industry average of 16.7x, as well as the peer average of 18.9x. This suggests that, at face value, the market is pricing in significant future growth or lower risk than its competitors.

Simply Wall St's Fair Ratio for Select Water Solutions is 22.0x. This proprietary benchmark adjusts for specific company factors such as projected earnings growth, risk profile, profit margins, its position within the industry, and market capitalization. Unlike a plain industry average, the Fair Ratio provides a more nuanced and tailored perspective on what the company’s PE multiple should be.

When comparing the Fair Ratio (22.0x) to the actual PE (57.9x), the current price appears elevated relative to what is justified by fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Select Water Solutions Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story or perspective about a company like Select Water Solutions, connecting your assumptions about its future, such as estimated revenue, earnings, and profit margins, to a specific fair value for the stock.

Narratives allow you to merge a company’s business outlook with numbers, showing exactly how your expectations about its future translate into a financial forecast and, ultimately, a fair value estimate. This approach goes beyond simple ratios and models and lets you create (and compare) your own reasoning with other investors' perspectives. You can do all of this easily on Simply Wall St’s Community page, where millions of investors share, update, and refine their views.

Narratives also help you decide when to buy, sell, or hold by making it clear how your version of fair value stacks up against the current market price. Whenever news breaks, earnings are released, or big announcements happen, Narratives refresh dynamically, allowing you to see instantly how the story and your conviction might change.

For example, some investors see Select Water Solutions’ lithium partnership and growing infrastructure contracts driving its fair value as high as $18.00 per share, while others focus on industry risks and forecast a much lower value, around $10.00. This proves that investing really is about how you view the future, not just the past.

Do you think there's more to the story for Select Water Solutions? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal