How Heavier Marketing Spend and Acquisition Costs at Hilton Grand Vacations (HGV) Have Shifted Its Investment Story

- Hilton Grand Vacations recently reported its third quarter 2025 results, with revenue of US$1.3 billion and net income of US$25 million, both slightly below prior-year figures, while also completing multiple share buyback tranches totaling nearly US$197 million between July and October 2025.

- The company attributed its earnings shortfall mainly to increased investment in customer acquisition and marketing, as well as higher integration costs from its Bluegreen acquisition, key factors impacting profitability despite continuing share repurchases.

- We’ll explore how Hilton Grand Vacations’ heavier marketing spend and acquisition integration costs could affect its outlook in light of recent analyst expectations.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Hilton Grand Vacations Investment Narrative Recap

To own Hilton Grand Vacations shares, you have to believe that higher spending on customer acquisition and successful integration of recent acquisitions like Bluegreen can drive contract sales and long-term member growth. The short-term outlook remains closely tied to whether this costly investment will convert package sales into tours and contracts quickly enough to offset current earnings pressure; however, the recent financial updates do not materially shift the near-term catalyst or largest risk, which continues to be persistent bad debt and delinquencies affecting receivables quality.

The company’s announcement of repurchasing 4,403,300 shares for approximately US$197 million across two buyback tranches between July and October 2025 is especially relevant, demonstrating an active effort to manage capital returns even as profitability faces short-term headwinds from integration expenses and rising marketing costs.

However, against continued share repurchases, investors should be acutely aware of rising bad debt risk and the impact it could have on future...

Read the full narrative on Hilton Grand Vacations (it's free!)

Hilton Grand Vacations' outlook anticipates $6.4 billion in revenue and $785.5 million in earnings by 2028. This is based on a 12.6% annual revenue growth rate and an increase in earnings of $728.5 million from current earnings of $57.0 million.

Uncover how Hilton Grand Vacations' forecasts yield a $53.44 fair value, a 34% upside to its current price.

Exploring Other Perspectives

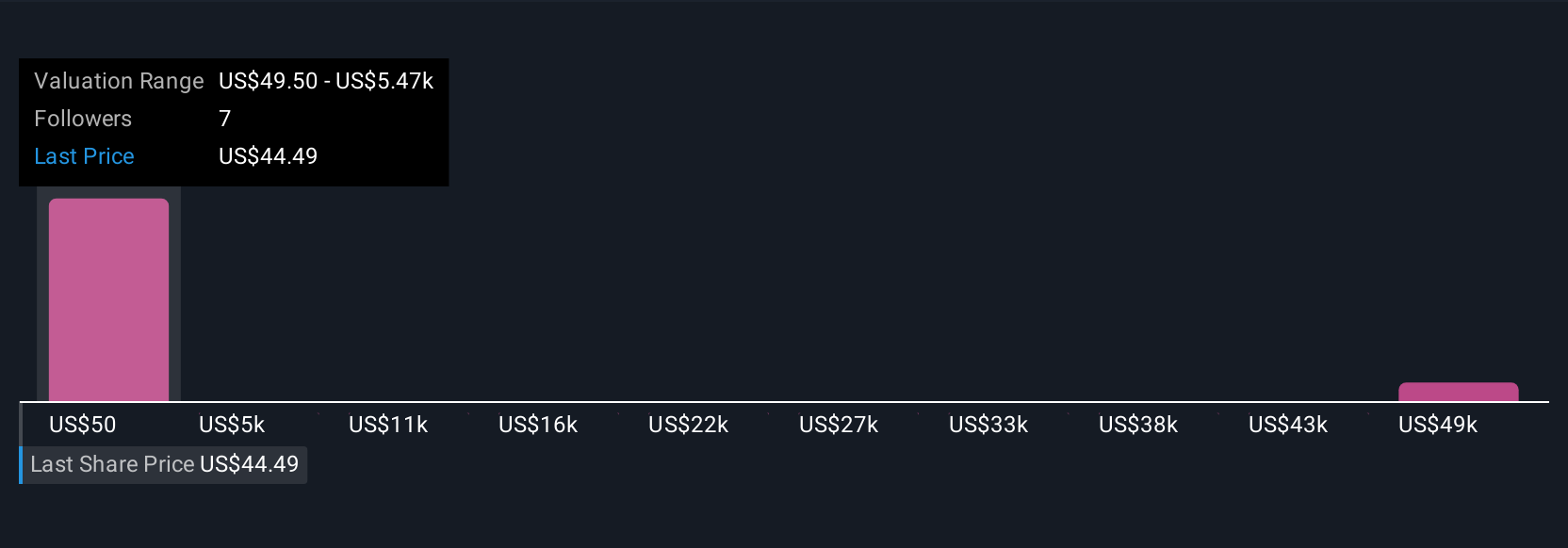

Four private investors in the Simply Wall St Community set fair values between US$53 and over US$54,000 per share, revealing broad differences in growth expectations. Many expect operational improvements from acquisition integration, but persistent delinquency risk may complicate the road ahead, so you may want to review a variety of perspectives before making your decision.

Explore 4 other fair value estimates on Hilton Grand Vacations - why the stock might be worth just $53.44!

Build Your Own Hilton Grand Vacations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hilton Grand Vacations research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hilton Grand Vacations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hilton Grand Vacations' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal