How Celsius Stock’s 31% Weekly Drop Impacts Its 2025 Valuation Outlook

- Ever wondered whether Celsius Holdings is a steal at today’s prices, or if its huge run-up has left little value on the table? You’re definitely not alone in asking that question.

- After a meteoric climb of 282.3% over five years and 43.7% over the past year, Celsius shares have cooled off recently. The stock has dropped 31.1% this week and 34.0% this month, even as it remains up 52.6% year-to-date.

- Behind these moves, the buzz has focused on Celsius’ fast-growing presence in the energy drink market and notable distribution partnerships, as well as shifting sentiment around valuations in high-growth consumer stocks. A series of headlines about market expansion and evolving competition has added fuel to the story, keeping investors guessing about what comes next.

- On Simply Wall St’s checks, Celsius Holdings scores 3 out of 6 on the undervalued scale, indicating a solid position but with some room for improvement. Let’s break down what that actually means, the methods behind valuation scores, and why a more nuanced approach to value might reveal the real story by the time we wrap up.

Approach 1: Celsius Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting those amounts back to their present value. This approach offers insight into the intrinsic worth of the business today. For Celsius Holdings, the analysis uses current and expected Free Cash Flow (FCF) as the key metric.

Celsius Holdings posted a last twelve months Free Cash Flow of $213.51 million. Looking ahead, analysts predict FCF to reach $582 million in 2029, with estimates extrapolated further by Simply Wall St. Annual projections suggest steady growth, with figures such as $532.14 million in 2027 and increasing into the $800 million range by 2035. These projections, all in US dollars, underline both strong performance and confident future expectations.

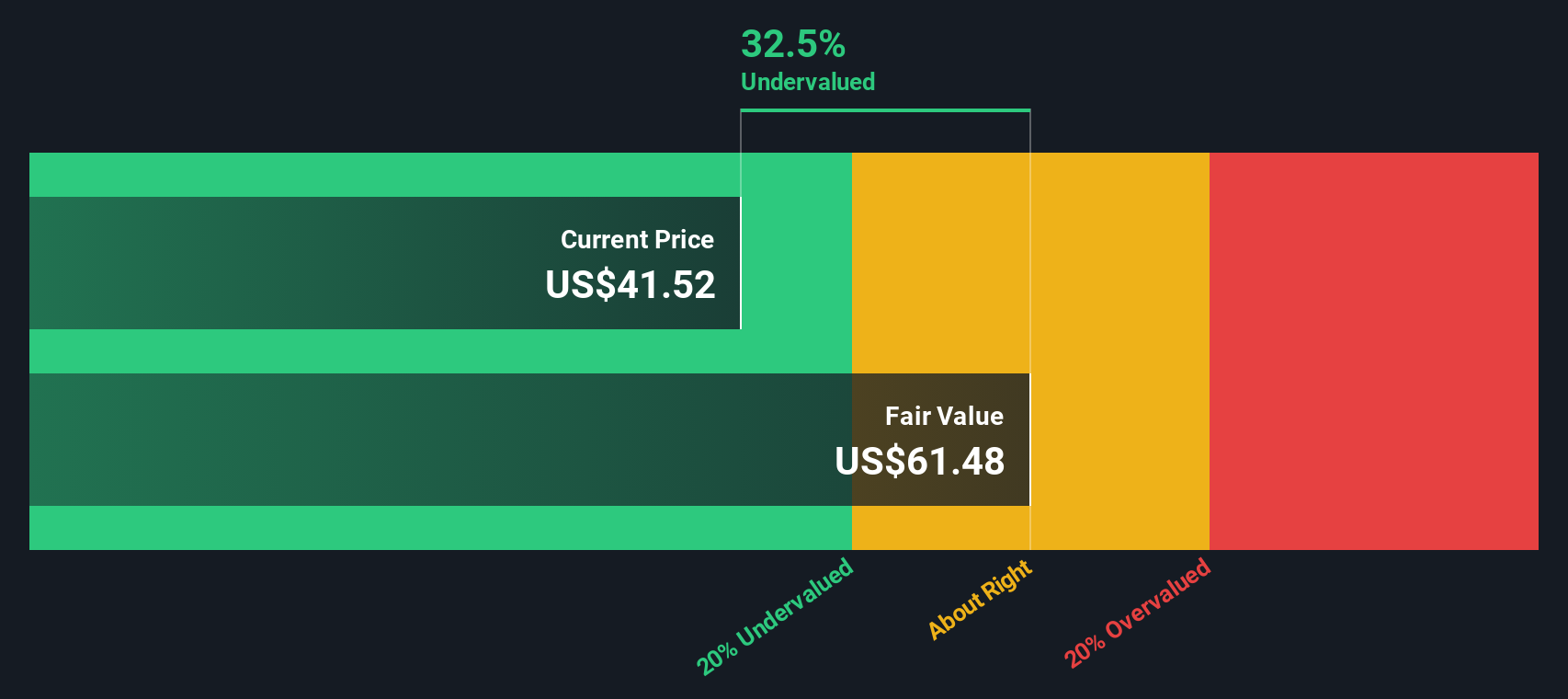

Based on these cash flows, the DCF model estimates Celsius Holdings’ fair value at $61.48 per share. The current share price is trading roughly 32.5% below this figure, which suggests the stock is meaningfully undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Celsius Holdings is undervalued by 32.5%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Celsius Holdings Price vs Sales

For companies like Celsius Holdings in the fast-growing beverage sector, the Price-to-Sales (P/S) ratio is a well-suited metric for valuation, especially when profits are still ramping up but revenue growth is robust. The P/S ratio helps investors understand how much they are paying for each dollar of revenue, which is key for high-growth businesses where traditional earnings metrics may fluctuate due to heavy reinvestment in expansion.

Generally, companies with faster expected revenue growth and stronger competitive positions can command a higher P/S ratio. At the same time, industry norms and peer comparisons help set expectations for what is considered "fair," while company-specific risks and profit margins also play crucial roles.

Celsius Holdings currently trades at a P/S ratio of 5.03x, noticeably higher than the beverage industry average of 2.12x and above its peer average of 1.47x. This would typically set off valuation alarm bells, but Simply Wall St’s proprietary Fair Ratio for Celsius sits at 3.58x. The Fair Ratio is more nuanced than simple market comparisons, weighing factors such as Celsius’s rapid revenue growth, unique risk profile, profit margin, industry dynamics, and market capitalization to provide a more holistic valuation benchmark.

Comparing the actual P/S of 5.03x to the Fair Ratio of 3.58x suggests the stock is valued above what would be justified by its underlying fundamentals and outlook.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Celsius Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple yet powerful tool that goes beyond the numbers to help investors put their unique perspective on a company like Celsius Holdings.

A Narrative is more than just a forecast; it is the story you believe about a company’s future, covering assumptions about sales growth, earnings power, margins, and what all of that could mean for its fair value. Narratives make investing more approachable by letting you connect your view of Celsius Holdings’ business, whether you see it dominating energy drinks through innovation or facing margin pressure from rising costs, to your own financial outlook.

Available on Simply Wall St’s Community page, Narratives are used by millions of investors to build, share, and update their outlooks with every new earnings report or company announcement. This means your Narrative, and the fair value you assign, stays as dynamic as the news.

With Narratives, you can clearly compare your calculated fair value to today’s share price, helping you decide when Celsius is worth buying or selling. For example, some investors think Celsius’ strong brand and global partnerships justify targets as high as $80 per share, while others, wary of competition and rising costs, see fair value closer to $33.50. Narratives empower you to invest with conviction based on your own informed reasoning.

Do you think there's more to the story for Celsius Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal