3 UK Stocks Estimated To Be Up To 50% Below Intrinsic Value

Amidst the recent downturn in the UK market, with the FTSE 100 and FTSE 250 indices reflecting concerns over China's economic slowdown, investors are increasingly seeking opportunities in undervalued stocks. Identifying stocks that are estimated to be significantly below their intrinsic value can offer potential for growth, especially when broader market conditions present challenges.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.338 | £12.64 | 49.9% |

| PageGroup (LSE:PAGE) | £2.348 | £4.34 | 45.9% |

| Likewise Group (AIM:LIKE) | £0.265 | £0.5 | 46.6% |

| Gooch & Housego (AIM:GHH) | £5.60 | £11.08 | 49.4% |

| Fevertree Drinks (AIM:FEVR) | £8.17 | £16.06 | 49.1% |

| Begbies Traynor Group (AIM:BEG) | £1.12 | £2.20 | 49.2% |

| Barratt Redrow (LSE:BTRW) | £3.767 | £7.45 | 49.4% |

| AstraZeneca (LSE:AZN) | £128.34 | £246.27 | 47.9% |

| Airtel Africa (LSE:AAF) | £2.934 | £5.87 | 50% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.135 | £4.16 | 48.7% |

We'll examine a selection from our screener results.

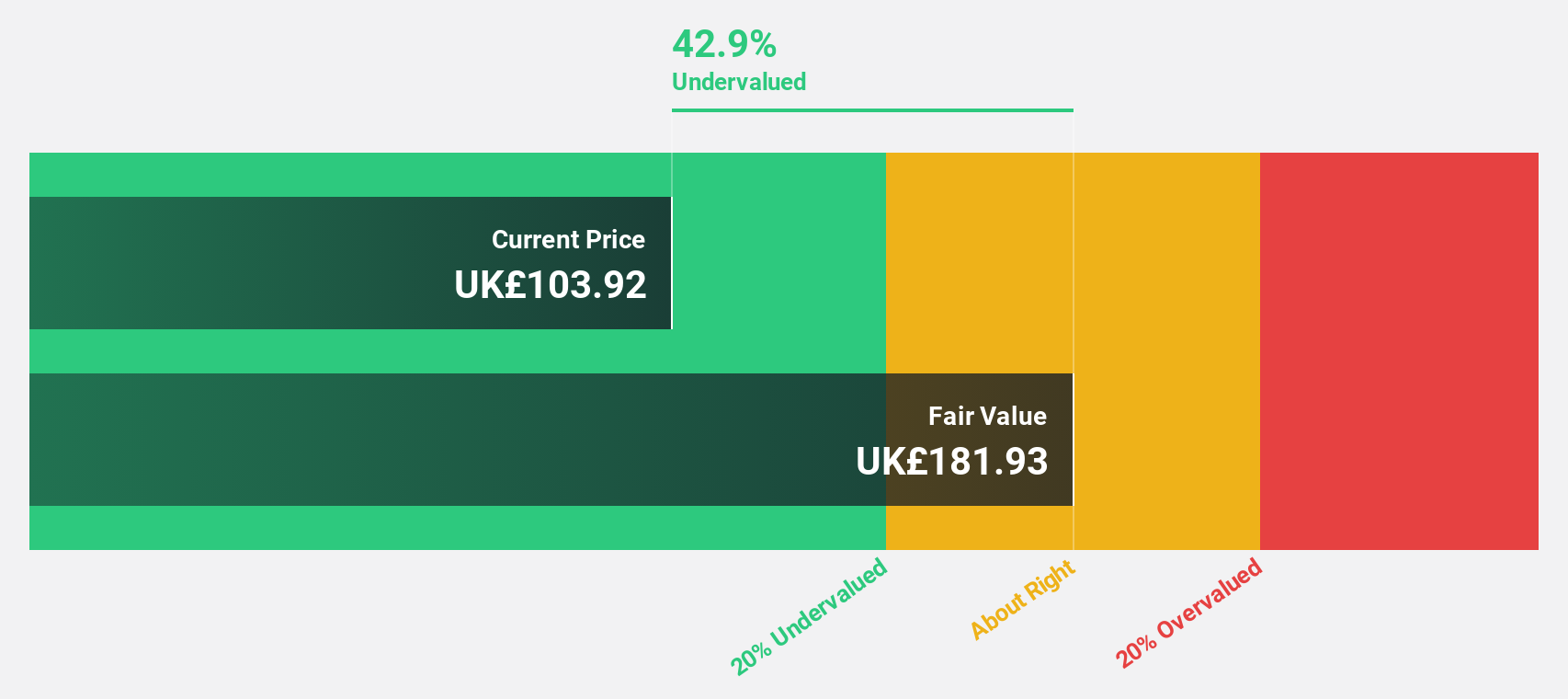

Serica Energy (AIM:SQZ)

Overview: Serica Energy plc, along with its subsidiaries, focuses on identifying, acquiring, and exploiting oil and gas reserves in the United Kingdom and has a market capitalization of £843.04 million.

Operations: Serica Energy generates revenue primarily from its oil and gas exploration, development, production, and related activities amounting to $570.52 million.

Estimated Discount To Fair Value: 42.7%

Serica Energy is trading significantly below its estimated fair value, presenting a potential opportunity based on cash flows. Despite recent operational disruptions at the Triton FPSO, production has resumed and is increasing. The company forecasts robust revenue growth of 10.7% annually, outpacing the UK market average. However, its high dividend yield isn't well covered by earnings or cash flows. Serica's strategic acquisitions in the North Sea could enhance future profitability as it leverages substantial tax losses for competitive advantage in M&A activities.

- According our earnings growth report, there's an indication that Serica Energy might be ready to expand.

- Click to explore a detailed breakdown of our findings in Serica Energy's balance sheet health report.

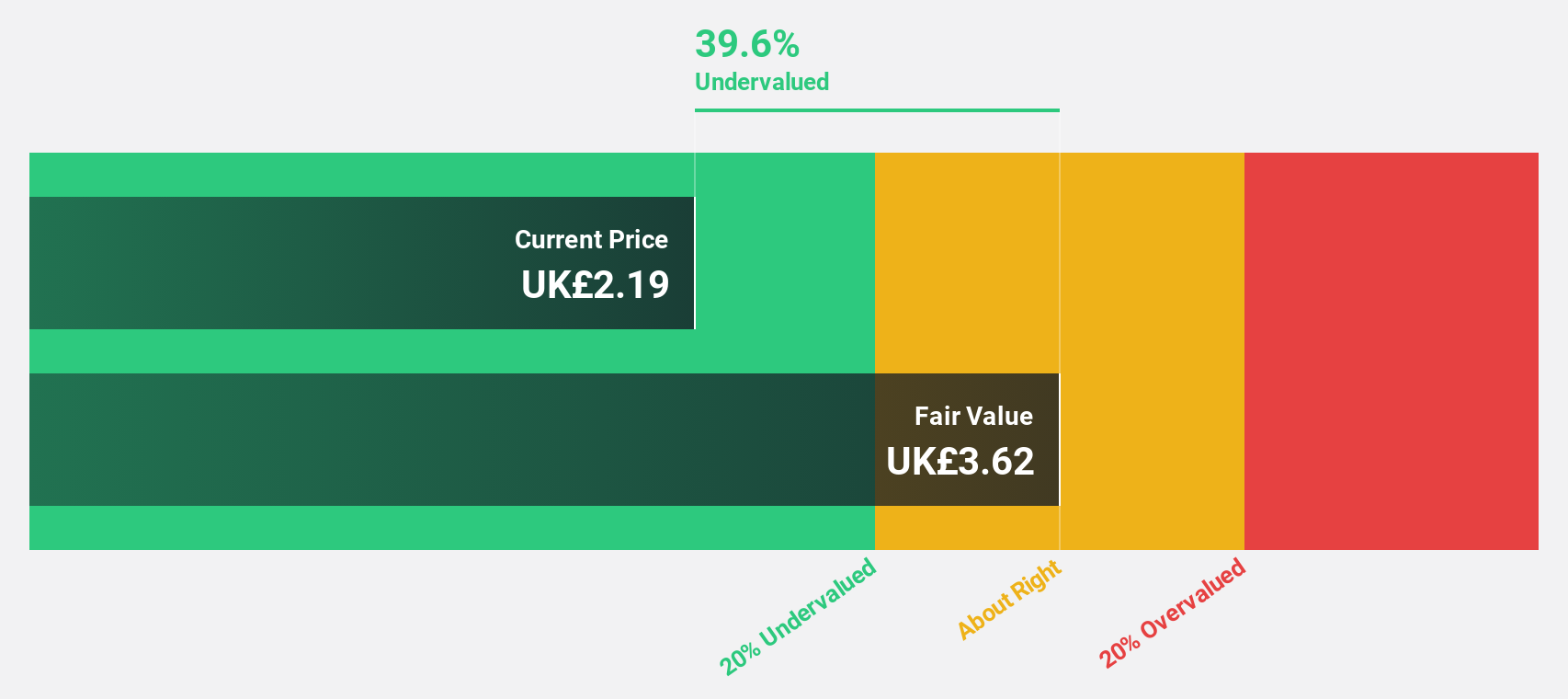

Airtel Africa (LSE:AAF)

Overview: Airtel Africa Plc, with a market cap of £10.70 billion, operates telecommunications and mobile money services across Nigeria, East Africa, and Francophone Africa.

Operations: The company's revenue is derived from three main segments: Mobile Money services generating $1.15 billion, Nigeria Mobile Services contributing $1.25 billion, and Mobile Services in East Africa and Francophone Africa bringing in $2.01 billion and $1.41 billion respectively.

Estimated Discount To Fair Value: 50%

Airtel Africa is trading at a substantial discount to its estimated fair value, offering potential based on cash flows. The company recently reported strong earnings growth, with net income rising significantly year-over-year. Revenue growth is expected to outpace the UK market, and earnings are forecasted to grow notably over the next three years. However, interest payments remain a concern as they aren't well covered by earnings. Airtel Africa also declared an interim dividend increase for shareholders.

- Insights from our recent growth report point to a promising forecast for Airtel Africa's business outlook.

- Click here to discover the nuances of Airtel Africa with our detailed financial health report.

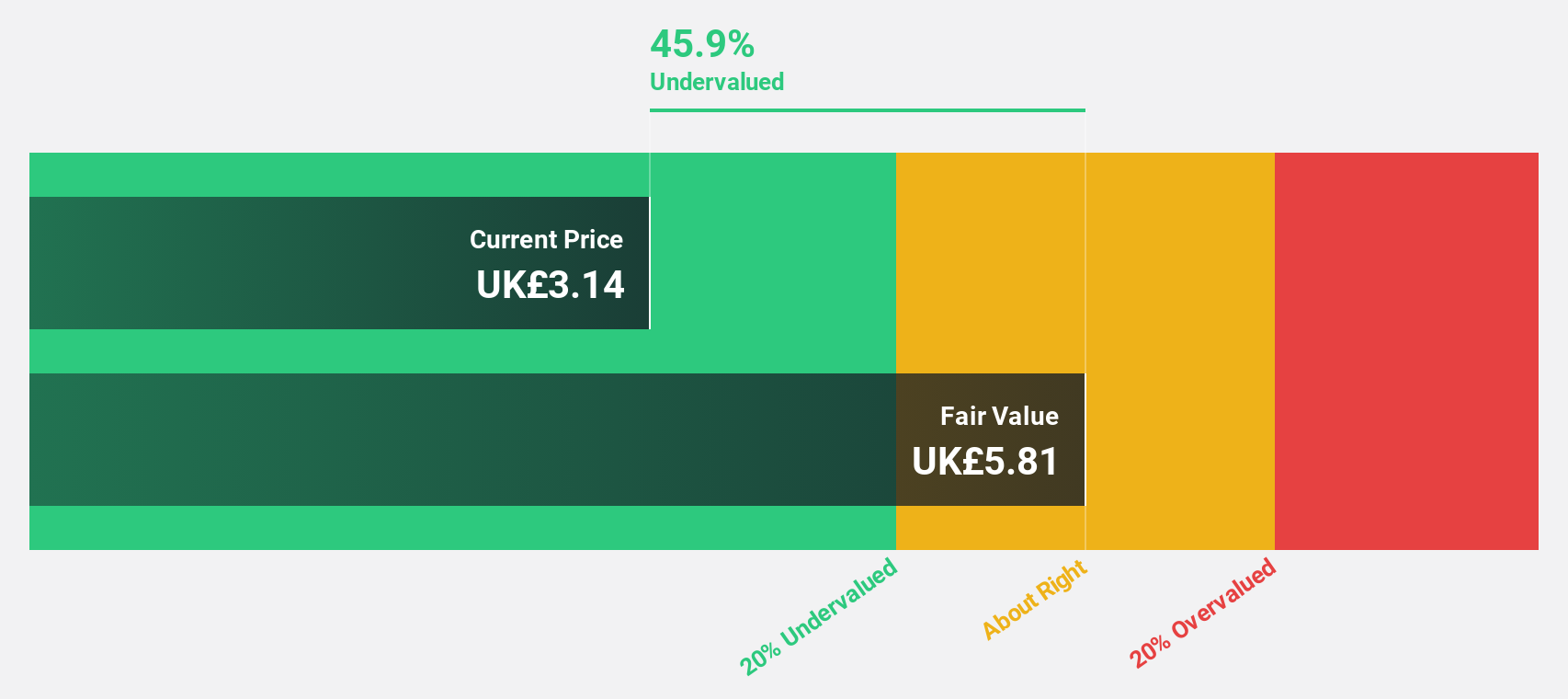

AstraZeneca (LSE:AZN)

Overview: AstraZeneca PLC is a biopharmaceutical company engaged in the discovery, development, manufacture, and commercialization of prescription medicines, with a market cap of approximately £199.02 billion.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, totaling $56.50 billion.

Estimated Discount To Fair Value: 47.9%

AstraZeneca's stock is trading significantly below its estimated fair value, suggesting potential undervaluation based on cash flows. The company reported robust earnings growth with net income increasing substantially year-over-year, and revenue forecasts indicate a faster growth rate than the UK market. Despite high debt levels and significant insider selling recently, AstraZeneca maintains a strong financial position with earnings projected to grow above market averages in the coming years.

- Our comprehensive growth report raises the possibility that AstraZeneca is poised for substantial financial growth.

- Get an in-depth perspective on AstraZeneca's balance sheet by reading our health report here.

Seize The Opportunity

- Click here to access our complete index of 54 Undervalued UK Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal