Turning Point Brands (TPB): Evaluating Valuation Following Strong Q3 Results and Modern Oral Growth Guidance

Turning Point Brands (TPB) just released its third quarter results, showing stronger sales and higher net income compared to last year. The company also raised its full-year sales guidance for the Modern Oral segment, highlighting ongoing momentum.

See our latest analysis for Turning Point Brands.

Turning Point Brands has been on a tear, with recent upbeat earnings and raised sales guidance helping to maintain strong investor sentiment. The company’s latest share price sits at $95.18, building on a year-to-date share price return of nearly 57%, while the one-year total shareholder return is an impressive 95%. Momentum has clearly been building, as consistent gains reflect renewed optimism in the business’s long-term growth story.

If you like seeing stocks with this kind of momentum, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With momentum surging and record results on the board, investors now face a crucial question: is Turning Point Brands still undervalued at these levels, or has the market already priced in its future growth?

Most Popular Narrative: 11.7% Undervalued

Turning Point Brands’ most widely referenced narrative sees fair value at $107.75, which is nearly 12% above the last close of $95.18. That sets expectations for continued share price upside. What underpins this optimistic view?

Strong growth in the Modern Oral nicotine pouch segment, with sales growing nearly 8x year-over-year and now accounting for 26% of total revenue, positions TPB to capture significant market share in a category projected to reach $10 billion by decade's end. This will drive long-term revenue and margin expansion as the modern oral segment scales and premiumizes.

Curious how such a premium is justified? The narrative alludes to market-shaking expansion in new categories, rising margins, and some bold forward-looking projections. Wonder which numbers drive this valuation and if they really add up? Find out what could fuel or limit this sharp upside.

Result: Fair Value of $107.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, even with these upbeat forecasts, heavier regulatory scrutiny or a slowdown in Modern Oral growth could quickly disrupt current momentum and analyst optimism.

Find out about the key risks to this Turning Point Brands narrative.

Another View: The Market’s Multiple Sends a Different Signal

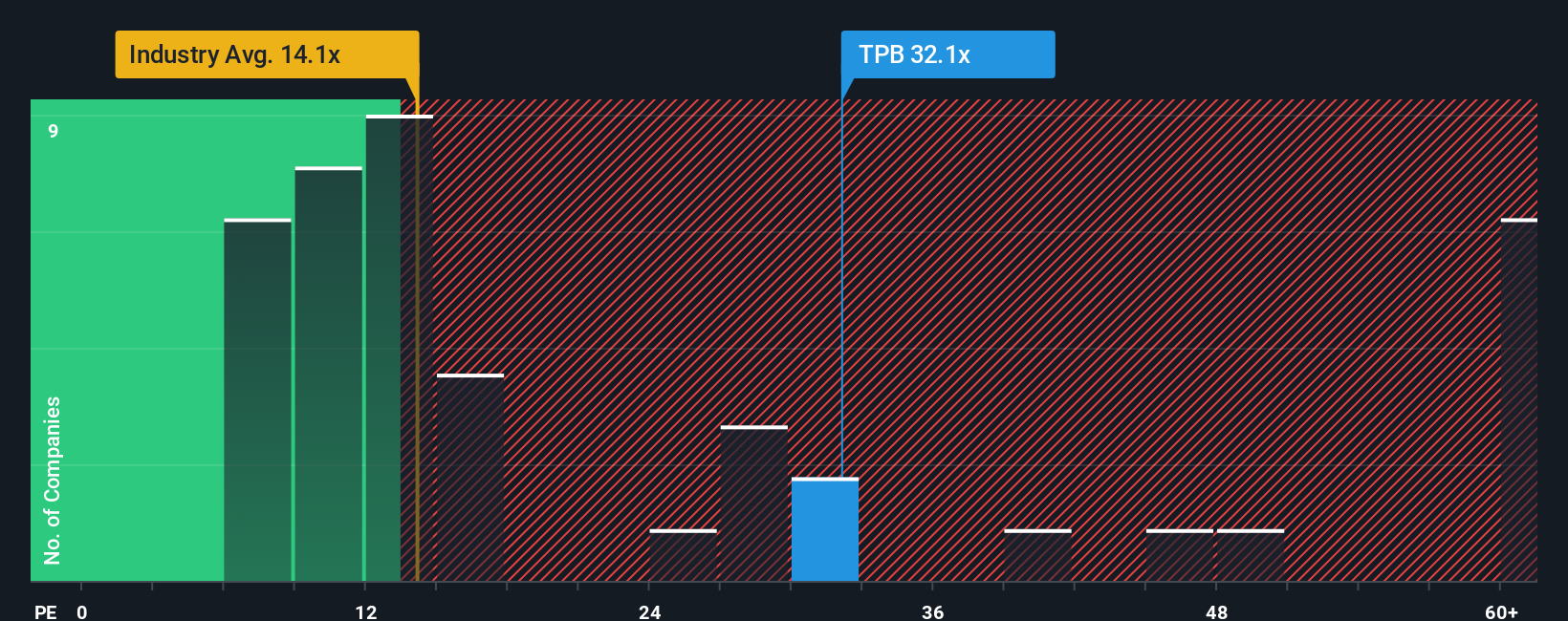

Not everyone is convinced by the upbeat analyst targets. Based on its price-to-earnings ratio of 33.5x, Turning Point Brands looks expensive compared to both the global tobacco industry average of 14.5x and its peers at 28.8x. The fair ratio the market could move towards is just 25.4x, suggesting the shares could be at risk of overvaluation if sentiment shifts. Is the premium truly warranted, or does it leave little room for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Turning Point Brands Narrative

If this perspective does not resonate with your own or you would rather dive into the numbers firsthand, crafting your own narrative takes just minutes. Do it your way

A great starting point for your Turning Point Brands research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give yourself a winning edge by checking out unique stocks you might have missed. The right idea now could make all the difference for your portfolio this year.

- Spot opportunities for regular income when you tap into these 20 dividend stocks with yields > 3% boasting yields above 3% and robust dividend histories.

- Capture tomorrow’s tech leaders by pursuing these 26 AI penny stocks, companies tapping into the explosive growth of artificial intelligence.

- Secure bargains before the crowd gets wise by evaluating these 841 undervalued stocks based on cash flows primed for strong upside based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal