Is Seagate’s Rally Justified After Data Storage Product Launches and Triple-Digit Gains for 2025?

- Ever wondered whether Seagate Technology Holdings is actually a bargain right now, or if the price has already run away from you? You're in good company, and digging in may just reveal more than you expect.

- The stock has been on a tear this year, rising 189.8% year-to-date and an incredible 152.3% over the last 12 months. However, with a dip of 1.0% in the past month, questions are swirling about where it's headed next.

- These moves are happening in the wake of headlines touting Seagate's innovations in data storage and positive analyst outlooks, which have helped support bullish sentiment and catch investor attention. Several prominent tech publications have highlighted the company's latest product launches, which has added fuel to recent buying activity.

- For those focused on numbers, Seagate currently scores a 3 out of 6 on basic undervaluation checks. The story of what that really means might surprise you as we dig into the different ways professionals value this tech giant, and why a more nuanced approach could matter even more by the end of this article.

Approach 1: Seagate Technology Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today. This allows investors to compare potential returns with other opportunities.

For Seagate Technology Holdings, analysts and market data providers first look at the company's current Free Cash Flow, which stands at $1.19 Billion over the last twelve months. Analysts then provide estimates for the next five years, with further projections extrapolated. By 2030, Seagate's Free Cash Flow is expected to reach $3.85 Billion, reflecting strong anticipated growth driven by industry demand and company innovation.

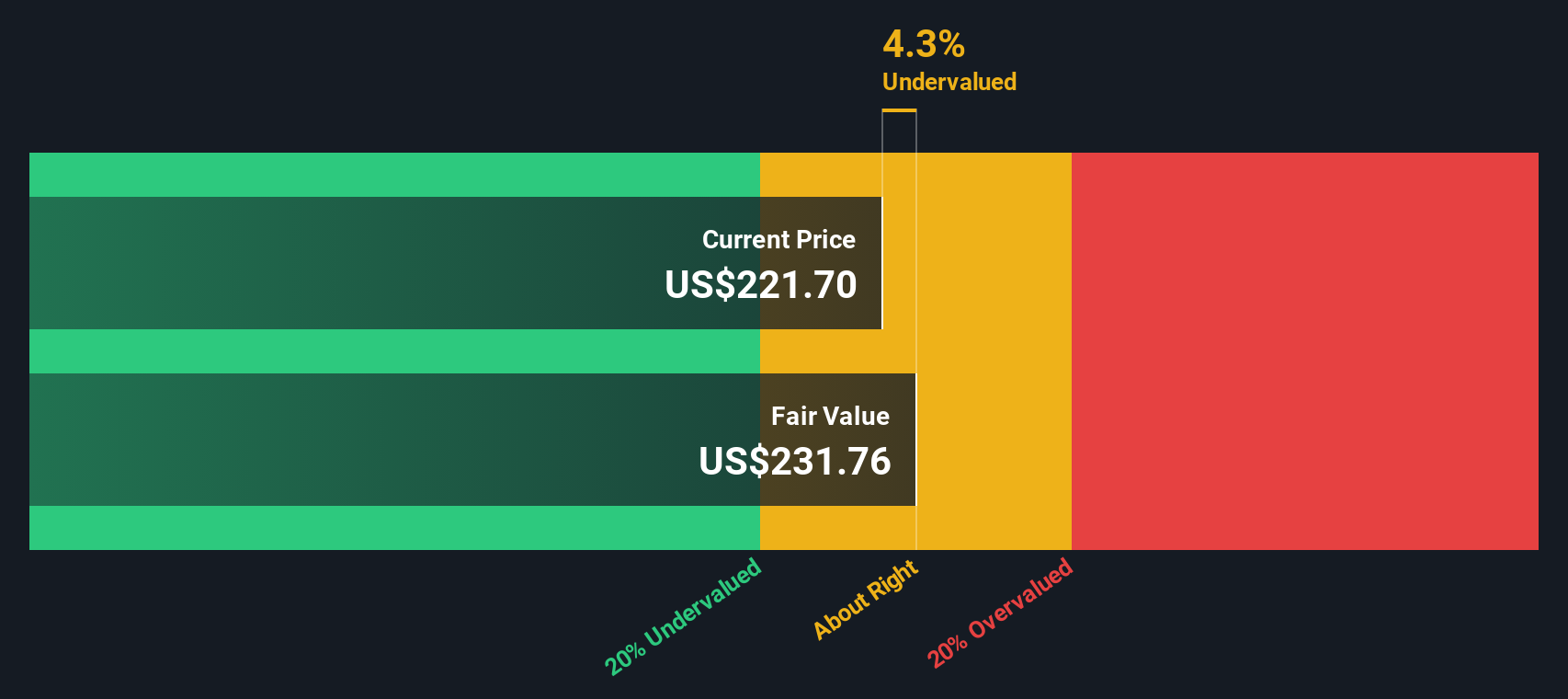

Using these projections, the DCF model calculates Seagate's intrinsic value at $367.59 per share. This figure suggests the stock is trading at a 31.9% discount compared to its estimated fair value and may indicate the market is undervaluing its future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Seagate Technology Holdings is undervalued by 31.9%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Seagate Technology Holdings Price vs Earnings (PE)

The price-to-earnings (PE) ratio is a widely adopted metric for valuing profitable companies like Seagate, as it helps investors gauge how much they are paying for each dollar of current earnings. Since earnings are the foundation for future dividends and growth, the PE ratio offers a useful lens for comparing similar businesses.

A "normal" or "fair" PE ratio will depend on factors such as a company’s expected earnings growth, risk profile, and overall industry conditions. Businesses with higher growth prospects or lower perceived risks often trade at a premium PE. Those facing challenges or increased risks may have discounted ratios.

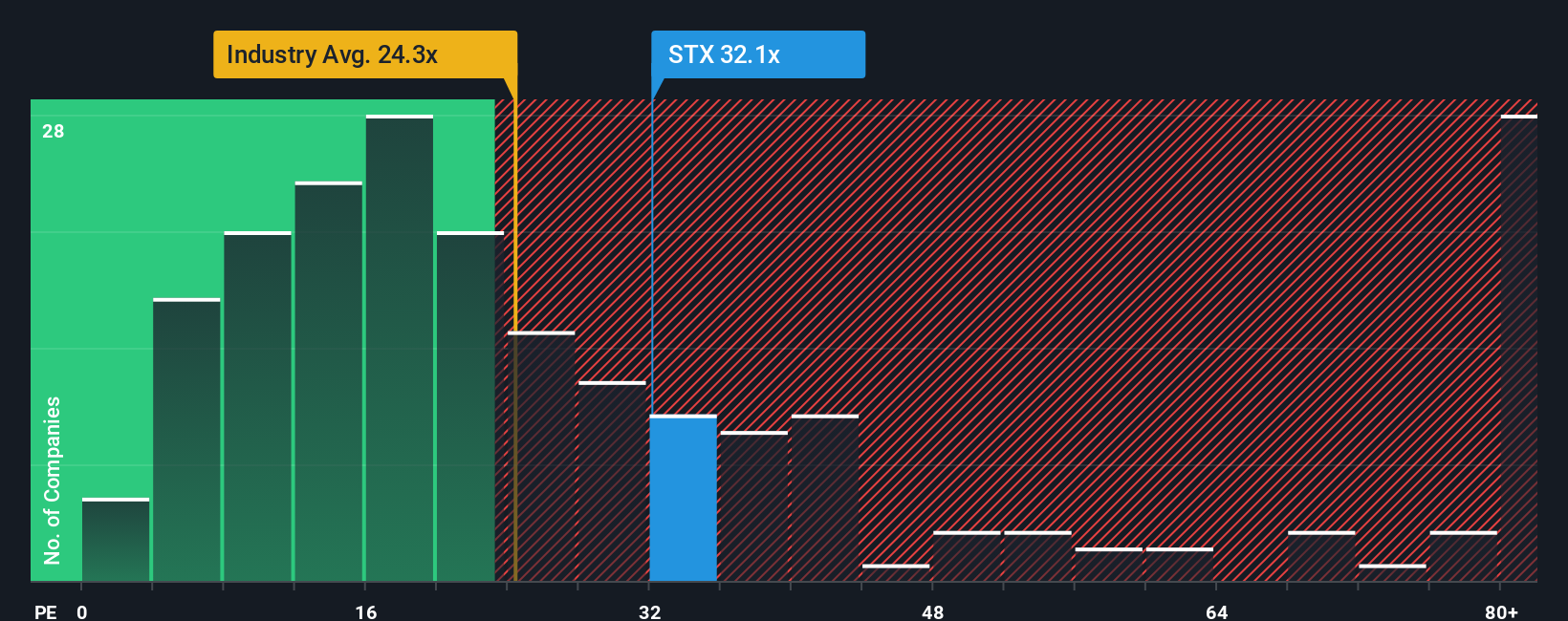

Seagate currently trades at a PE ratio of 31.21x, which is above both the tech industry average of 23.07x and the average for its peer group at 19.49x. At first glance, this may make the stock appear expensive compared to its closest competitors and the sector overall.

This is where Simply Wall St's proprietary "Fair Ratio" comes in. The Fair Ratio for Seagate is 39.77x, a figure that accounts for the company’s unique combination of earnings growth, profit margins, risk profile, industry characteristics, and market capitalization. Unlike generic comparisons, the Fair Ratio aims to reflect the specific valuation the company truly deserves based on its fundamentals and broader context.

When comparing Seagate's current PE of 31.21x to its Fair Ratio of 39.77x, the stock appears to be trading below its justified valuation. This may suggest an opportunity for investors looking for growth at a reasonable price.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Seagate Technology Holdings Narrative

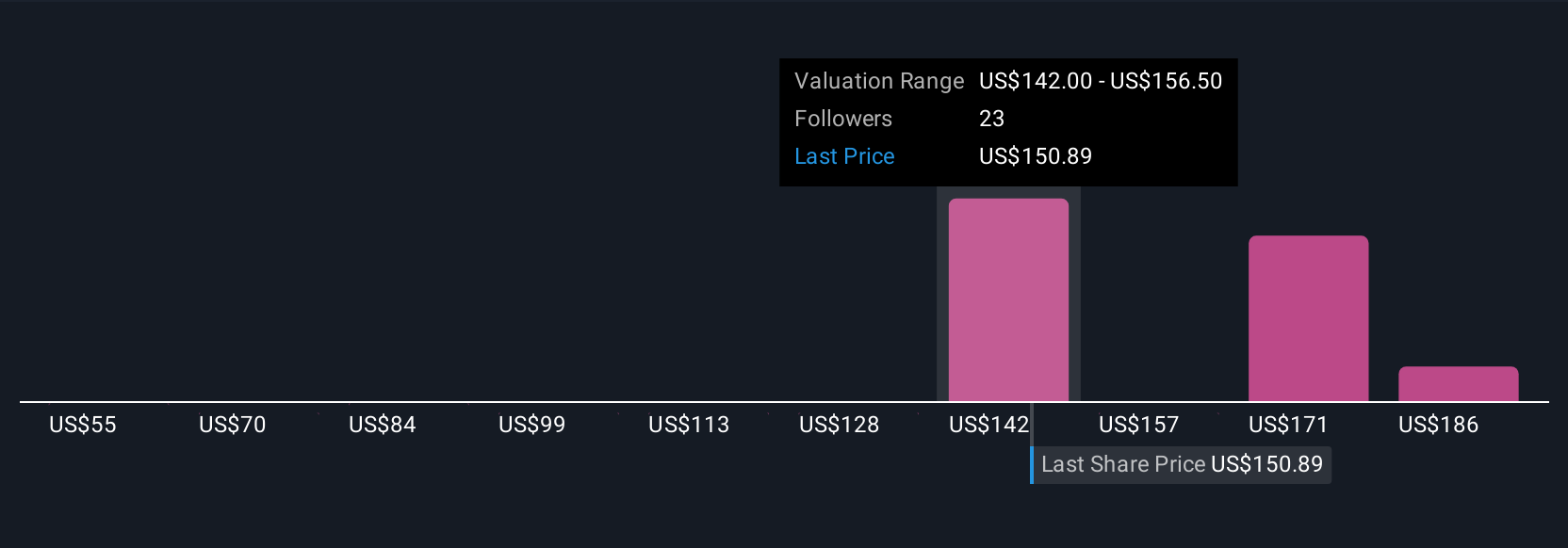

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative takes the company’s story, your perspective on its business model, future potential, and risks, and links that story with a tailored set of numbers, including fair value, revenue growth, and profit margins. Instead of relying solely on generic ratios or one-size-fits-all models, Narratives empower you to create a forecast and valuation that matches your personal thesis about the company.

Narratives are an easy-to-use tool built directly into Simply Wall St’s Community page, trusted by millions of investors. They help you quickly spot if Seagate’s share price is above, below, or near your own fair value estimate, guiding when to buy or sell. Narratives are dynamic, and when major news, earnings, or new data arrives, your scenario updates automatically, keeping your investment logic relevant and actionable.

For example, one investor’s Narrative for Seagate might project aggressive cloud storage growth, target a $200 fair value, and recommend holding at today’s price. Another, more cautious view might price in competitive threats and set a fair value at $80, suggesting the shares are overvalued. Narratives let you bring your personal insights and real-time data together so every investment decision is sharper and more informed.

Do you think there's more to the story for Seagate Technology Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal