Itron (ITRI) Is Down 20.4% After Lowered 2025 Guidance and Delayed Project Deployments—What's Changed

- Itron reported third-quarter 2025 earnings showing year-over-year declines in both revenue and net income, attributed to portfolio streamlining, regulatory hurdles, and project deployment delays, and provided revenue guidance for the fourth quarter and full year 2025 that fell short of market expectations.

- Despite these headwinds, Itron highlighted record profit margins and free cash flow, pointing to ongoing cost optimization efforts and growth in its opportunity pipeline across various segments.

- We'll examine how Itron's lower-than-expected guidance and project delays may influence the company's longer-term growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Itron Investment Narrative Recap

To be an Itron shareholder, you need to believe in global utility digitalization, an expanding market for smart grid and analytics, and Itron’s ability to convert its technology and cost leadership into growing high-margin software revenue. The biggest near-term catalyst remains the acceleration of infrastructure deployments, but the latest quarterly results and reduced guidance highlight ongoing delays and regulatory pressures as the most important risks. At this stage, the guidance miss and project slippage are material, reinforcing the threat of prolonged revenue deferrals and increased near-term earnings volatility.

The recent partnership with Gordian Technologies to bring AI and machine learning to Itron’s Grid Edge Intelligence portfolio is particularly relevant. This move aims to deepen Itron’s software capabilities and recurring revenue potential, factors that can help offset headwinds from slower project deployments and regulatory hurdles if execution continues as planned.

Still, investors should be aware that, despite margin improvements, persistent utility budget constraints and regulatory scrutiny could further delay Itron’s return to...

Read the full narrative on Itron (it's free!)

Itron's outlook anticipates $2.8 billion in revenue and $388.8 million in earnings by 2028. This is based on a projected annual revenue growth rate of 5.2% and reflects a $118.9 million increase in earnings from the current $269.9 million.

Uncover how Itron's forecasts yield a $140.40 fair value, a 32% upside to its current price.

Exploring Other Perspectives

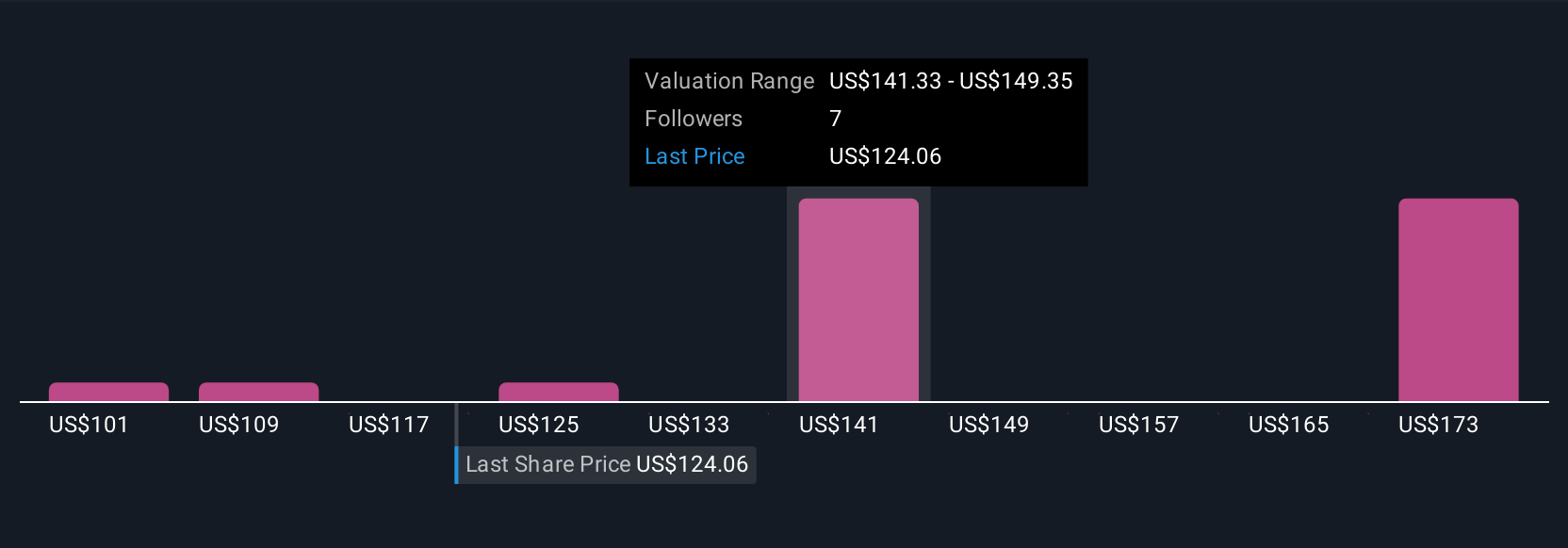

Fair value opinions from the Simply Wall St Community range from US$101 to US$189, with five estimates showing considerable spread. While many expect structural cost efforts to aid profitability, regulatory and project deployment delays continue to shape sentiment and could influence timing of any recovery in Itron’s results.

Explore 5 other fair value estimates on Itron - why the stock might be worth as much as 77% more than the current price!

Build Your Own Itron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Itron research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Itron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Itron's overall financial health at a glance.

No Opportunity In Itron?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal