Assessing MGE Energy (MGEE) Valuation After 50th Consecutive Dividend Increase and New Senior Notes Issue

MGE Energy (MGEE) is in the spotlight after announcing a 5.6% increase in its quarterly dividend, marking its 50th consecutive annual rise. The company’s subsidiary will also issue $50 million in senior notes, which highlights active capital management.

See our latest analysis for MGE Energy.

Despite MGE Energy's move to boost its dividend streak and actively manage capital, the latest share price sits at $82.96, just above its recent 52-week low, underlining a cautious market mood. While momentum has faded this year, as reflected in a year-to-date share price return of -10.76%, the company’s long-term story stands out, with a 3-year total shareholder return of nearly 33% and a resilient five-year track record.

If today’s capital moves have you rethinking your strategy, now is the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares trading near their 52-week low despite steady dividend growth and resilient long-term returns, the question for investors is whether MGE Energy is undervalued, or if markets have already accounted for its next leg of growth.

Price-to-Earnings of 23.1x: Is it justified?

With MGE Energy’s shares closing at $82.96, the company’s price-to-earnings (P/E) ratio stands at 23.1x, noticeably higher than both the industry average and the SWS fair value benchmark. This premium valuation positions MGEE as relatively expensive among its electric utility peers.

The P/E ratio reflects how much investors are willing to pay today for a dollar of current earnings and serves as a measure of market optimism about the company’s future profit-generating ability. In utilities, where stable cash flows are expected but growth is typically mature, a higher P/E can indicate strong confidence in steady long-term returns or dividend policies.

However, MGEE’s current multiple puts it above both the US industry average (21.5x) and the calculated fair P/E of 17.6x. This signals that the market is pricing in more robust prospects or assigning a safety premium. Unless future growth accelerates meaningfully, the share price could gravitate toward these peer and fair value levels.

Explore the SWS fair ratio for MGE Energy

Result: Price-to-Earnings of 23.1x (OVERVALUED)

However, subdued revenue growth and a persistent discount to analyst price targets remain risks that could challenge the case for continued outperformance.

Find out about the key risks to this MGE Energy narrative.

Another View: SWS DCF Model Suggests MGEE Is Undervalued

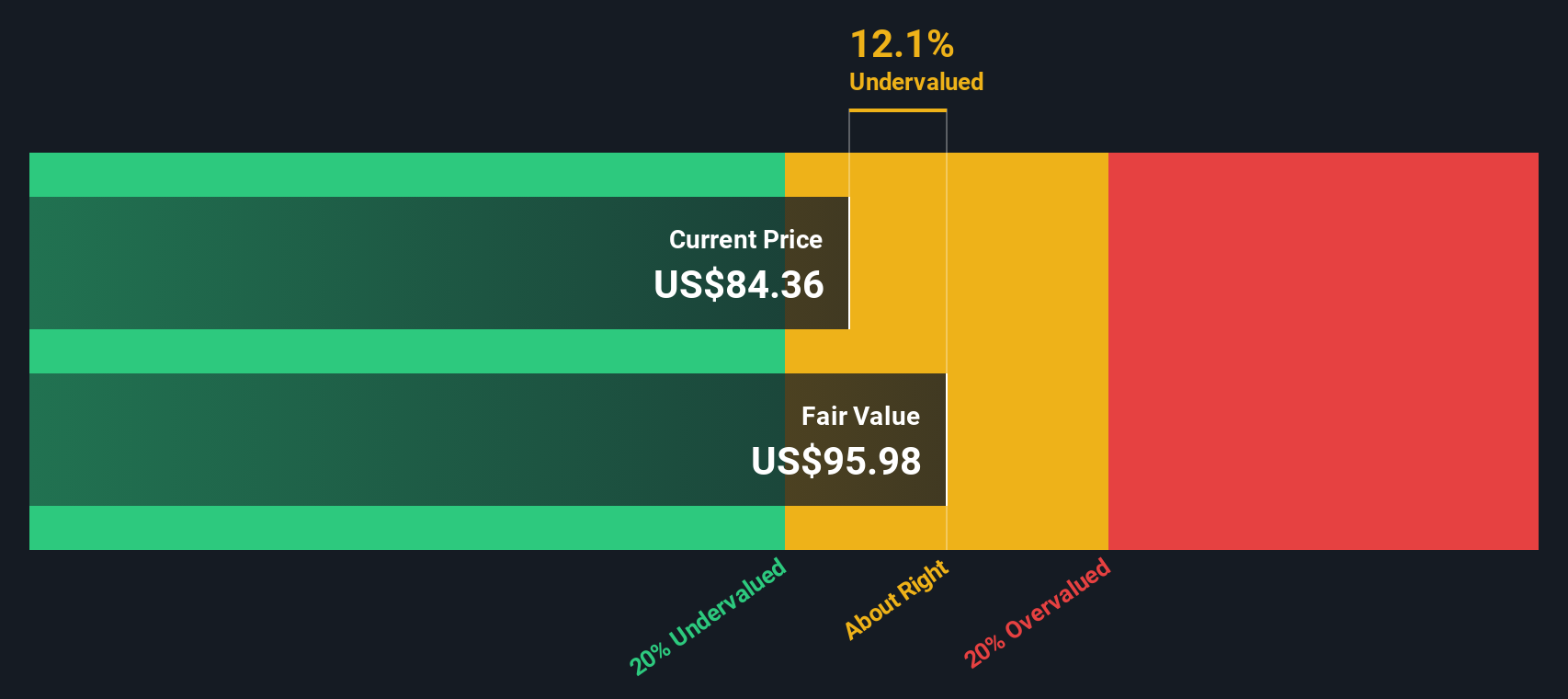

Looking beyond ratios, our SWS DCF model estimates MGE Energy’s fair value at $95.98. This figure is about 13.6% above the current share price. This difference contrasts with the elevated price-to-earnings figure and raises the question of whether the market is missing the long-term value on offer.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MGE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MGE Energy Narrative

If you’d rather dig into the numbers and shape your own take, making a personal narrative is quick, easy, and uniquely yours. Do it your way

A great starting point for your MGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your full investing potential by targeting uniquely positioned stocks. Do not let standout opportunities slip by. Every top-performing portfolio starts with the right search.

- Power up your returns by seeking out strong income opportunities through these 18 dividend stocks with yields > 3% that offer yields above 3% and robust financial health.

- Ride the next digital revolution and transform your strategy by tapping into these 26 AI penny stocks, which are driving innovation at the intersection of machine learning and industry.

- Beat the market to promising value opportunities with these 843 undervalued stocks based on cash flows identified by rigorous cash flow analysis and smart valuation metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal