Bio-Techne (TECH): Assessing Valuation After ProximityScope Assay Unlocks New Spatial Biology Capabilities

Bio-Techne (TECH) has rolled out the ProximityScope assay, a game-changing solution designed to help scientists visualize protein interactions in tissue samples with remarkable spatial detail. By integrating with Leica Biosystems’ BOND RX platform, this launch brings a fresh perspective to spatial biology research.

See our latest analysis for Bio-Techne.

Bio-Techne’s rollout of the ProximityScope assay comes after a period of volatile trading, with the stock enjoying a 14.5% share price return over the last 90 days even as its year-to-date share price remains down 12.5%. Despite this recent spike, the company’s one-year total shareholder return sits at -17.1%, reflecting a broader trend of challenging sentiment, but with momentum beginning to build in the short term as product innovation takes center stage.

If you’re intrigued by breakthroughs in spatial biology, it’s a perfect moment to scan the landscape of leading healthcare stocks. See the full list for free.

With product headlines driving renewed attention, investors are left to weigh a key question: is the recent innovation and momentum pointing to an undervalued opportunity, or is the market already pricing in Bio-Techne’s next leg of growth?

Most Popular Narrative: 6.7% Undervalued

Bio-Techne’s most widely followed narrative places its fair value at $67.08, which is a premium to the last close price of $62.57. This difference sets the stage for a debate about the company’s forward momentum and whether current market pricing misses critical growth drivers on the horizon.

The growing prevalence of chronic and age-related diseases globally, alongside an aging population, is driving sustained demand for advanced diagnostics and therapeutics where Bio-Techne's reagents and tools are embedded. This trend supports recurring consumables revenue and long-term top-line growth even as short-term funding uncertainties persist.

Think you’ve grasped why analysts remain bullish? The real surprise hides in how future profit margins and a bold, tech-style valuation multiple anchor this story. What assumptions would you need to accept to agree with this price target? Click through and see how the numbers stack up.

Result: Fair Value of $67.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in biotech funding and new pharmaceutical tariffs may undercut Bio-Techne’s earnings outlook, putting pressure on the bullish narrative going forward.

Find out about the key risks to this Bio-Techne narrative.

Another View: Caution From the Market’s Ratios

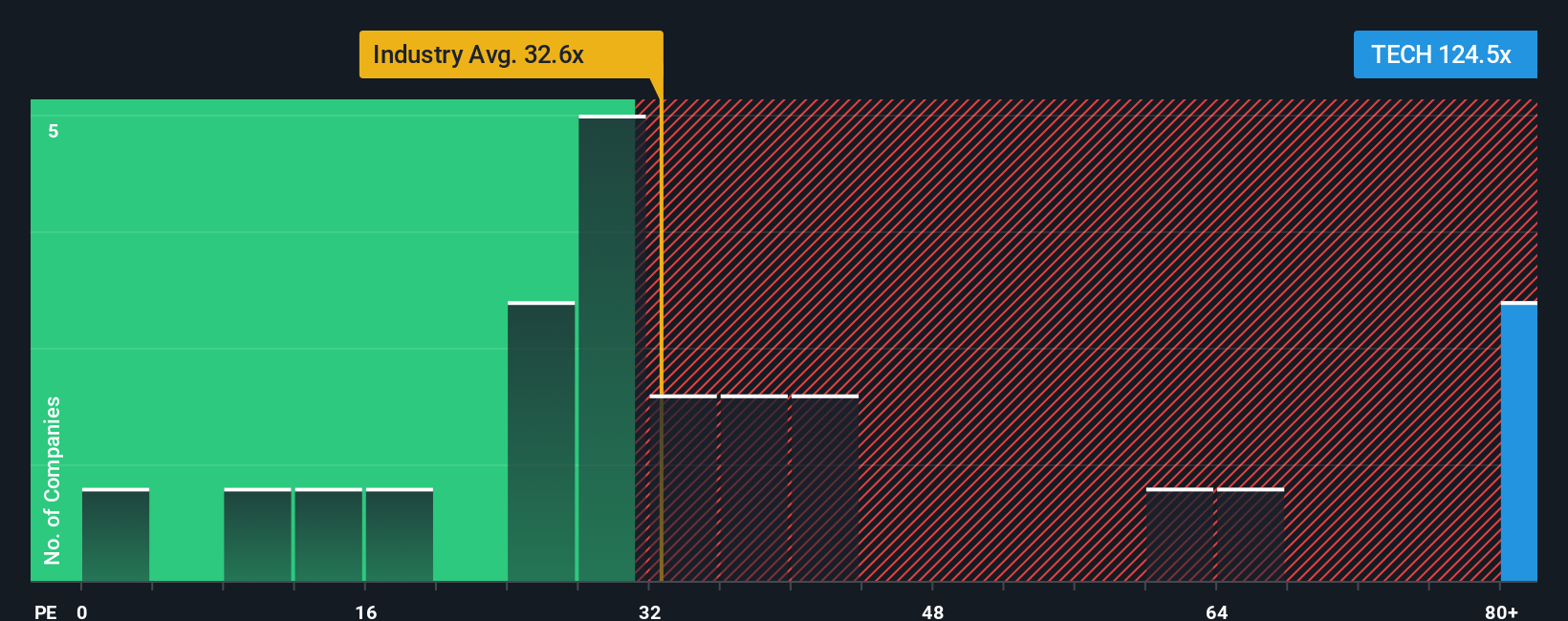

When we compare Bio-Techne’s price-to-earnings ratio to the sector, the picture looks much less optimistic. The company trades at 132.8 times earnings, dramatically above both the industry average of 36 and a fair ratio of 25.5. This big gap suggests potential overvaluation risk if the market shifts its expectations. Will Bio-Techne keep justifying such a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bio-Techne Narrative

If you see things differently or want to dig deeper, the tools are here to help you craft your own perspective in just a few minutes. Do it your way

A great starting point for your Bio-Techne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Momentum can be powerful, but the real advantage comes from finding unique stocks before they become widely recognized. Take action now with these screens that put fresh opportunities right at your fingertips.

- Focus on ultra-affordable picks with strong business models by scanning these 3588 penny stocks with strong financials before the rest of the market notices.

- Target companies unlocking new revenue streams from artificial intelligence by exploring these 27 AI penny stocks and identifying potential leaders.

- Tap into hidden value and enhance your portfolio potential through these 836 undervalued stocks based on cash flows, featuring companies trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal