Cargojet (TSX:CJT) Valuation: Weighing Global Expansion After Launching New Canada-Europe Cargo Route

Cargojet (TSX:CJT) just announced a new direct air cargo route connecting Canada with Liege Airport in Europe, starting November 1. This move adds critical international reach to their network and could shape investor conversations.

See our latest analysis for Cargojet.

Cargojet’s new European route is a bold move to regain momentum after a tough period. The share price has slipped 25% year-to-date, and the total shareholder return is down nearly 40% over the past year. This reflects ongoing challenges and shifting investor sentiment. While recent headline news is a step forward, performance has lagged in both the short and long term. Investors will be watching closely to see if this international push can help reverse the trend.

If you’re exploring new opportunities in transportation and logistics, it’s an ideal moment to broaden your horizons and discover fast growing stocks with high insider ownership.

With shares now trading at a steep discount to analyst targets, the question is clear: is Cargojet an undervalued turnaround story in waiting, or has the market already factored in its prospects for renewed growth?

Most Popular Narrative: 43.6% Undervalued

The most widely followed narrative sees Cargojet as sharply discounted compared to its fair value, with the current share price significantly below the valuation estimated by analysts. This creates the potential for a rebound, driven by key partnerships and new growth strategies.

Renewal and extension of long-term contracts with major partners Amazon (to potentially 2031) and DHL (to potentially 2037, with growth-oriented incentives) enhance future revenue visibility and position Cargojet to benefit further as these global customers expand. These agreements could support multi-year top line growth and greater earnings predictability.

What’s the hidden story behind this valuation gap? The answer lies in a unique blend of growth commitments, top-tier partners, and aggressive financial projections not typical for a struggling stock. Find out which ambitious factors drive analyst optimism and why this narrative takes a long-term view. Discover the full breakdown that could change how you see Cargojet’s future.

Result: Fair Value of $144.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Cargojet’s growth still relies on major contracts with Amazon and DHL. Any setback or renegotiation could quickly shift the outlook.

Find out about the key risks to this Cargojet narrative.

Another View: Are Multiples Telling a Different Story?

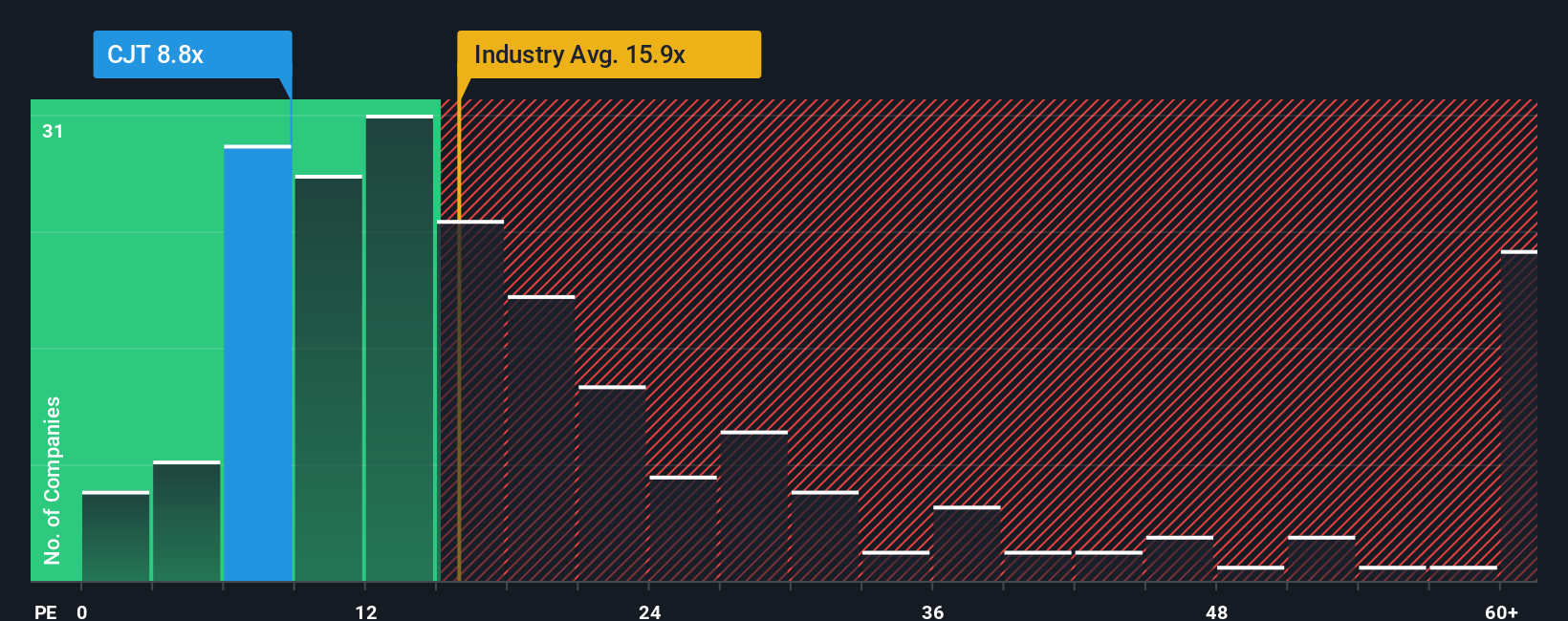

While the fair value estimate puts Cargojet as markedly undervalued, a closer look at its current price-to-earnings multiple offers a more nuanced picture. At 8.5x, Cargojet trades well below the global logistics industry average of 16x and its direct peer average of 16.4x. This suggests relative value. However, the fair ratio stands at just 6.9x, which hints that the market could still re-rate the stock lower if its fundamentals weaken. Is this a margin of safety or a sign of more downside risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cargojet Narrative

Prefer taking the data into your own hands? You can dig into the numbers and shape your own Cargojet story in just a few minutes: Do it your way.

A great starting point for your Cargojet research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Stay ahead of the curve by branching out into high-potential sectors that could reshape your portfolio. Don’t miss out on these standout opportunities:

- Start with these 840 undervalued stocks based on cash flows that offer strong fundamentals and potential for rapid price growth.

- Discover the future of healthcare innovation and see which companies are poised to benefit most by checking out these 33 healthcare AI stocks.

- Enhance your passive income stream with these 22 dividend stocks with yields > 3% that consistently deliver reliable and attractive yields above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal