First Commonwealth Financial (FCF): Evaluating Value After Recent Share Price Decline

First Commonwealth Financial (FCF) shares have slipped over the past month, retreating about 9% during a mixed period for regional banks. Investors may be wondering how recent performance lines up with the company’s ongoing outlook and fundamentals.

See our latest analysis for First Commonwealth Financial.

This recent slide continues a pattern seen throughout the year, with First Commonwealth Financial’s share price return falling 9.3% over the past month and 7.6% year-to-date. Volatility has cooled some of the momentum built in previous years. The longer-term total shareholder return remains impressive, up 17% over three years and 114% over five.

If you’re keeping an eye on shifting trends in financials, now’s a great moment to branch out and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and healthy underlying growth, the question is whether First Commonwealth Financial is currently an overlooked value or if the market has already factored in the company’s potential upside.

Most Popular Narrative: 20.4% Undervalued

The most widely followed narrative points to a fair value price for First Commonwealth Financial that stands well above the recent closing price. This sets the stage for a debate on whether the company’s digital and diversification efforts can deliver the expected upside.

Robust organic loan growth across multiple business lines (equipment finance, small business, commercial, indirect and mortgage) and successful integration of recent acquisitions like CenterBank position the company to capitalize on population migration and economic expansion in secondary and tertiary markets, supporting sustainable future revenue and balance sheet growth.

Want a peek at the ambitious growth drivers behind this valuation? The most closely watched narrative hinges on surging business lines, strategic deals, and a digital push. Are these enough to drive future profits sky-high? The numbers that back up this assessment might surprise you. See which big assumptions support this intriguing target.

Result: Fair Value of $19.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow technology adoption or regional economic stagnation could quickly affect First Commonwealth’s growth ambitions and challenge the optimistic valuation narrative.

Find out about the key risks to this First Commonwealth Financial narrative.

Another View: Multiples Tell a Different Story

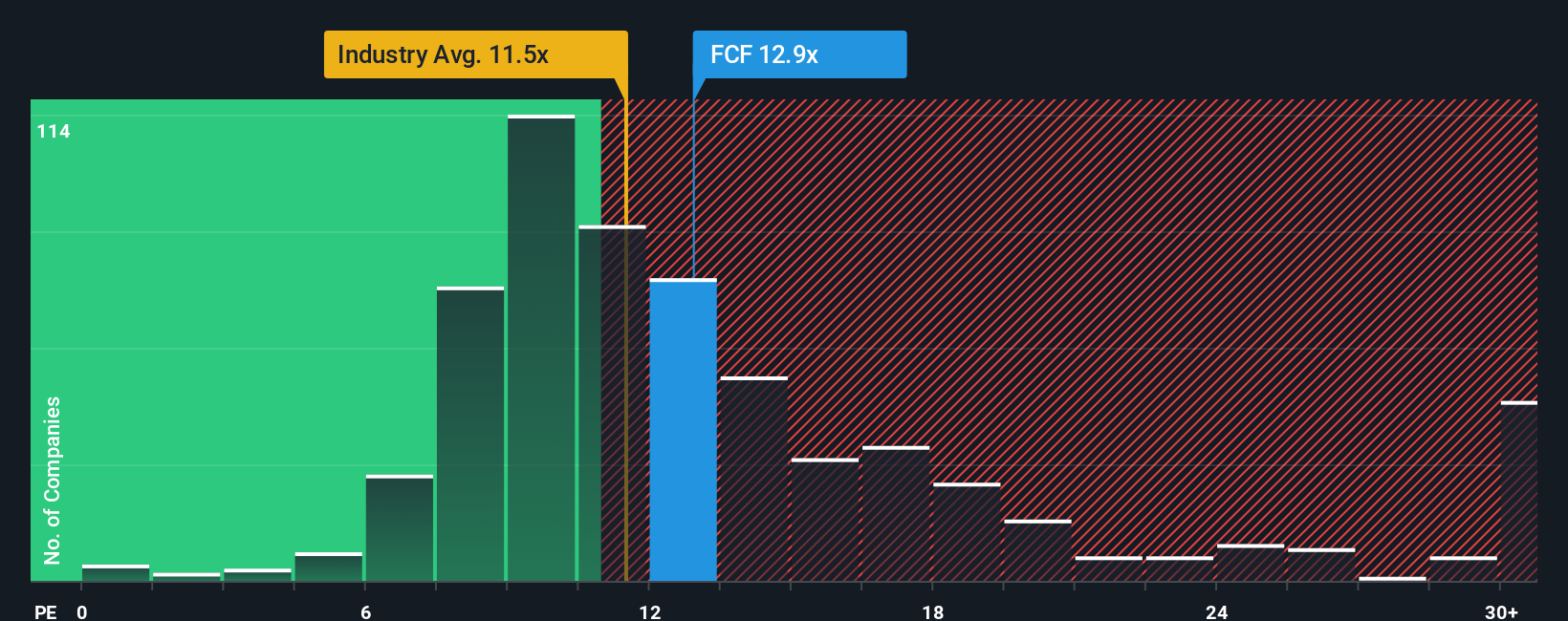

While fair value estimates suggest First Commonwealth Financial is undervalued, looking at traditional ratios complicates the picture. Its price-to-earnings ratio of 11.1 times profits is above the peer average (10.1x) and level with the US banks industry (11.2x), yet still below the fair ratio of 13.4x. This creates a tricky balance between perceived risk, opportunity, and where the market could trend next. Could the current premium signal optimism, or is it simply a risk factor investors should watch closely?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Commonwealth Financial Narrative

If you want to dig into the numbers and tell your own story, you can shape a custom narrative using the same data in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding First Commonwealth Financial.

Looking for More Investment Ideas?

Sharpen your investing game and stay ahead by using Simply Wall Street’s powerful Screener to spot strategies other investors may be missing. Here are three dynamic places to start:

- Uncover unmatched potential by targeting these 831 undervalued stocks based on cash flows that may be set for a comeback as market sentiment shifts in their favor.

- Supercharge your portfolio with these 26 AI penny stocks that are driving change through automation, machine learning, and real-world AI breakthroughs.

- Lock in steady cash flow by picking these 22 dividend stocks with yields > 3% designed to reward shareholders with reliable, above-average yields year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal