Fujitsu (TSE:6702) Profit Growth and Margin Recovery Reinforce Bullish Narratives vs. Slower Outlook

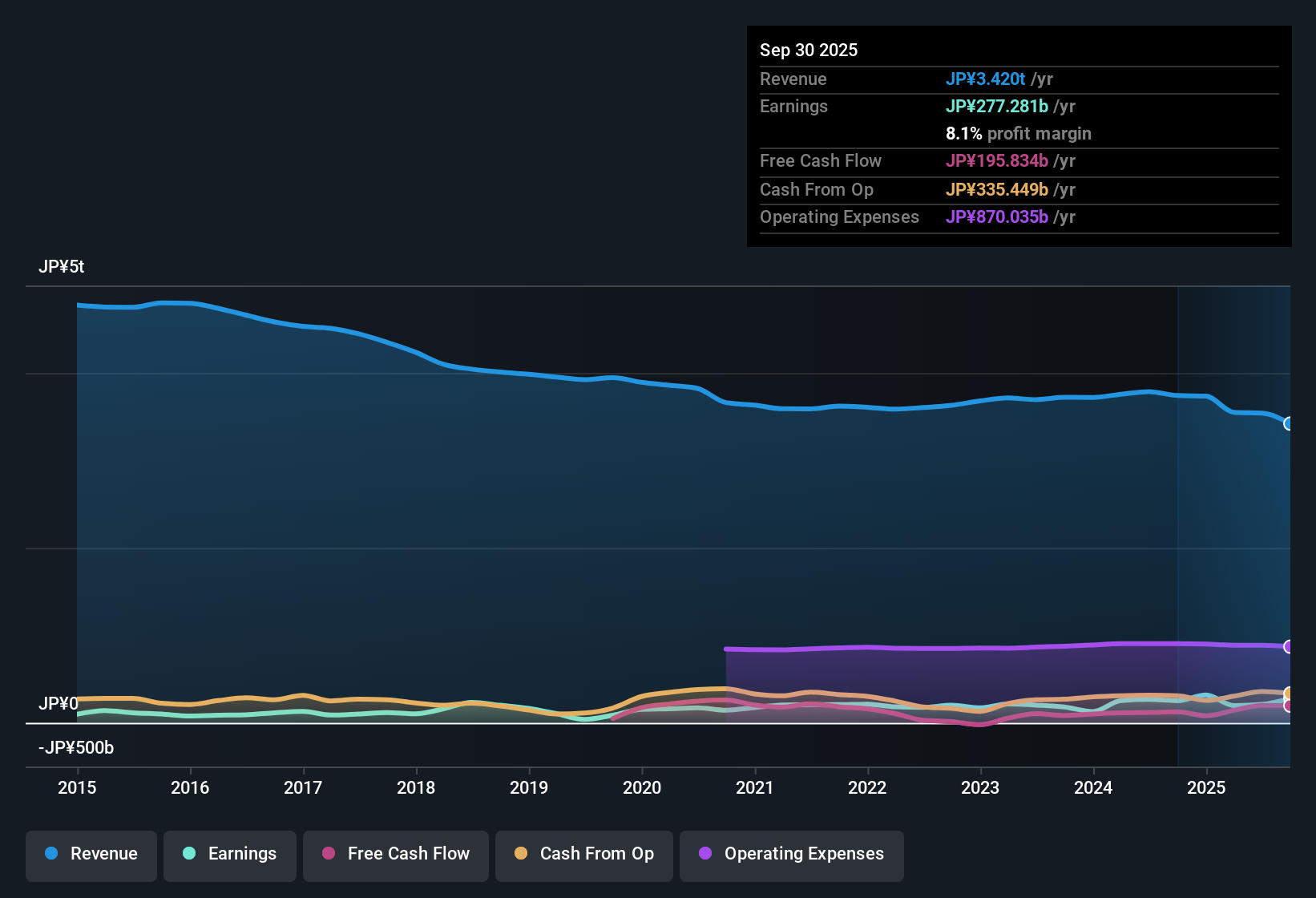

Fujitsu (TSE:6702) delivered earnings growth of 13.1% over the past year, outpacing its five-year annual average of 7.8%. Net profit margins rose to 8% compared to last year's 6.7%, while revenue is forecast to grow at 2.7% per year, which is notably slower than the broader Japanese market’s 4.5% forecast. Amidst these headline figures, investors are weighing the improved profitability and margin gains against a more muted outlook for revenue and earnings growth.

See our full analysis for Fujitsu.Next, we will break down how these earnings stack up against the current community narratives, exploring whether the numbers support or challenge expectations in the wider market.

See what the community is saying about Fujitsu

Recurring Services Boost Margins and Profit Mix

- Revenues from high-margin IT services like modernization and Uvance jumped 44% and 52% year-on-year, with Uvance now making up 29% of segment sales.

- The analysts' consensus view holds that this pivot toward scalable, recurring service businesses supports long-term growth and margin expansion.

- Net profit margin improved to 8%, while operational reforms and internal automation (including AI adoption for 30,000 engineers) drove a 1.5 percentage point rise in gross margin and added ¥7.6 billion in profit.

- Analysts anticipate these structural shifts will help earnings per share grow to ¥199.25 by 2028, up from ¥210.4 billion in net profits today, even though overall revenue growth is forecast at a more modest 2.7% annually.

Domestic Market Strength Masks Global Challenges

- Digital transformation demand pushed Japanese segment revenue up 6% and the order backlog by 13%, yet international markets continue facing revenue declines, threatened by exchange rate swings and lagging adoption of new technologies.

- The analysts' consensus view notes this local/global divide could narrow growth prospects.

- Despite strength at home, overreliance on Japan and weak international trends, particularly in Europe and APAC, risk limiting top-line expansion as the company’s global competitive position is challenged.

- Ongoing global business model reforms, such as carving out low-margin segments, are mitigating some regional headwinds, but sustainability of these gains depends on further international turnaround.

Valuation Running Above DCF Fair Value

- Fujitsu trades at a Price-To-Earnings ratio of 25, above the Japanese IT industry average but below direct peers; with shares at ¥4,031.00, the price is currently higher than the DCF fair value of ¥3,297.68 and below the sole analyst price target of ¥4,083.64.

- The analysts' consensus view points out that investors will need to believe in stronger future earnings and margin gains to justify this premium.

- Projected PE drops to 22.6x by 2028, still above the sector's 17.4x, so the stock’s upside from here relies on execution against ambitious margin and growth improvements.

- Bulls cite margin expansion and strong service mix as reasons for the premium, but valuation risk rises if growth projections disappoint or international weaknesses persist.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Fujitsu on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data with a unique angle? You can turn fresh insights into your personal investment narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Fujitsu.

See What Else Is Out There

Fujitsu’s international operations are struggling amid weak overseas revenue and global competitive headwinds. This situation is raising concerns about achieving consistent growth across all regions.

If you want to prioritize steadier performance regardless of geographic challenges, check out stable growth stocks screener (2099 results) to find companies that consistently deliver reliable earnings and revenue expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal