ASX Growth Stocks With Strong Insider Ownership

The Australian market has recently been navigating a challenging landscape, with the ASX200 experiencing some turbulence amid higher-than-expected inflation data that has dampened hopes for interest rate cuts. In this environment, growth companies with strong insider ownership can offer a compelling proposition, as insider confidence may signal resilience and potential for long-term success despite broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 12.6% | 90.7% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Polymetals Resources (ASX:POL) | 37.7% | 108% |

| Pointerra (ASX:3DP) | 19% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 21.6% | 144.4% |

| IperionX (ASX:IPX) | 16.9% | 96.3% |

| Emerald Resources (ASX:EMR) | 18.4% | 57.6% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| Adveritas (ASX:AV1) | 17.3% | 96.8% |

Let's dive into some prime choices out of the screener.

Duratec (ASX:DUR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Duratec Limited, with a market cap of A$546.64 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia.

Operations: The company's revenue segments include Energy (A$82.51 million), Defence (A$181.36 million), Buildings & Facades (A$111.87 million), and Mining & Industrial (A$136.65 million).

Insider Ownership: 29.3%

Earnings Growth Forecast: 13.8% p.a.

Duratec demonstrates promising growth potential with forecasted earnings growth of 13.8% per year, outpacing the Australian market's 11.7%. Despite no substantial insider buying recently, the company benefits from high insider ownership and limited selling activity over the past quarter. Trading at 13% below estimated fair value, it offers good investment value. Recent financials show steady revenue and profit increases, while strategic board appointments enhance governance and oversight capabilities.

- Navigate through the intricacies of Duratec with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Duratec implies its share price may be too high.

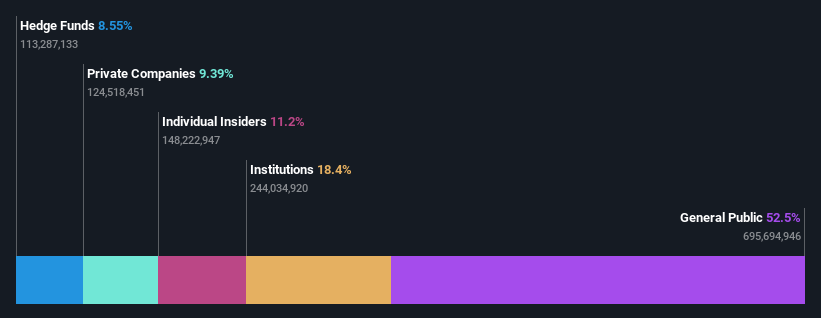

Titomic (ASX:TTT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Titomic Limited provides manufacturing and technology solutions for high-performance metal additive manufacturing across Australia, the United States, and Europe, with a market cap of A$384.30 million.

Operations: The company generates revenue from the development and sale of additive manufacturing technology, totaling A$9.43 million.

Insider Ownership: 11.2%

Earnings Growth Forecast: 74.9% p.a.

Titomic is expanding its European operations with a new facility in the Netherlands, enhancing its capabilities in cold spray manufacturing. Recent executive changes include appointing Aude Vignelles as President of APAC, strengthening leadership amid regional growth. Despite reporting a net loss of A$19.89 million for the fiscal year ending June 2025, Titomic's revenue is forecast to grow significantly at 46.1% annually, outpacing the market and indicating robust future potential despite past shareholder dilution.

- Get an in-depth perspective on Titomic's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Titomic's share price might be on the expensive side.

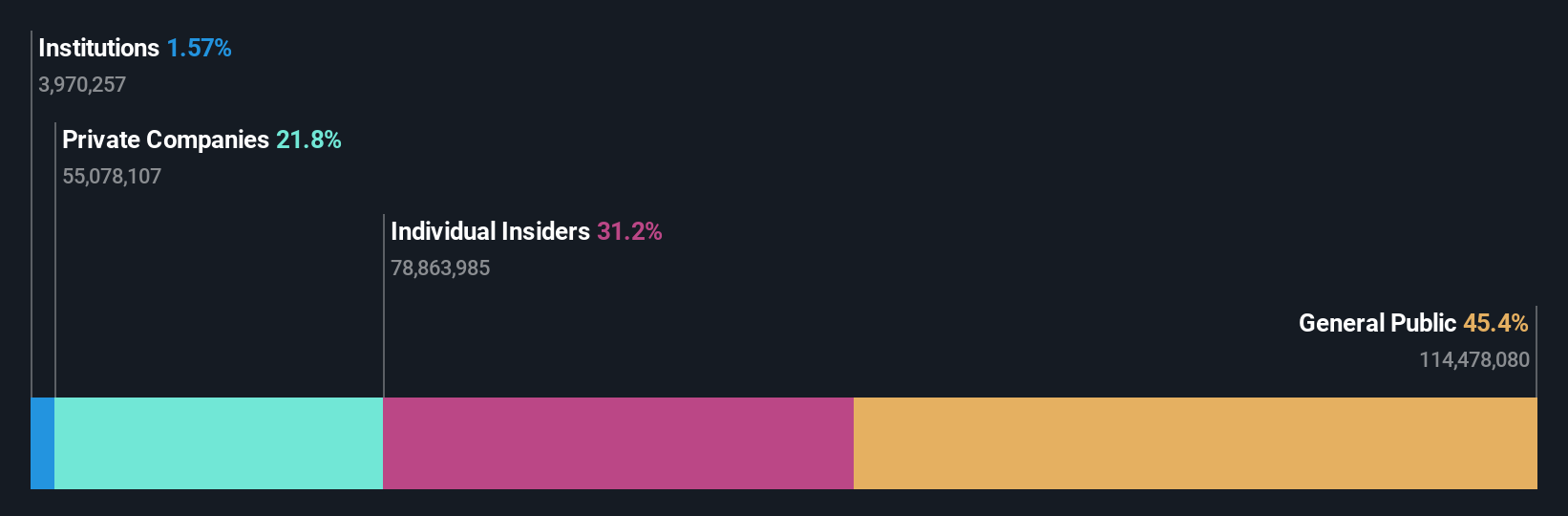

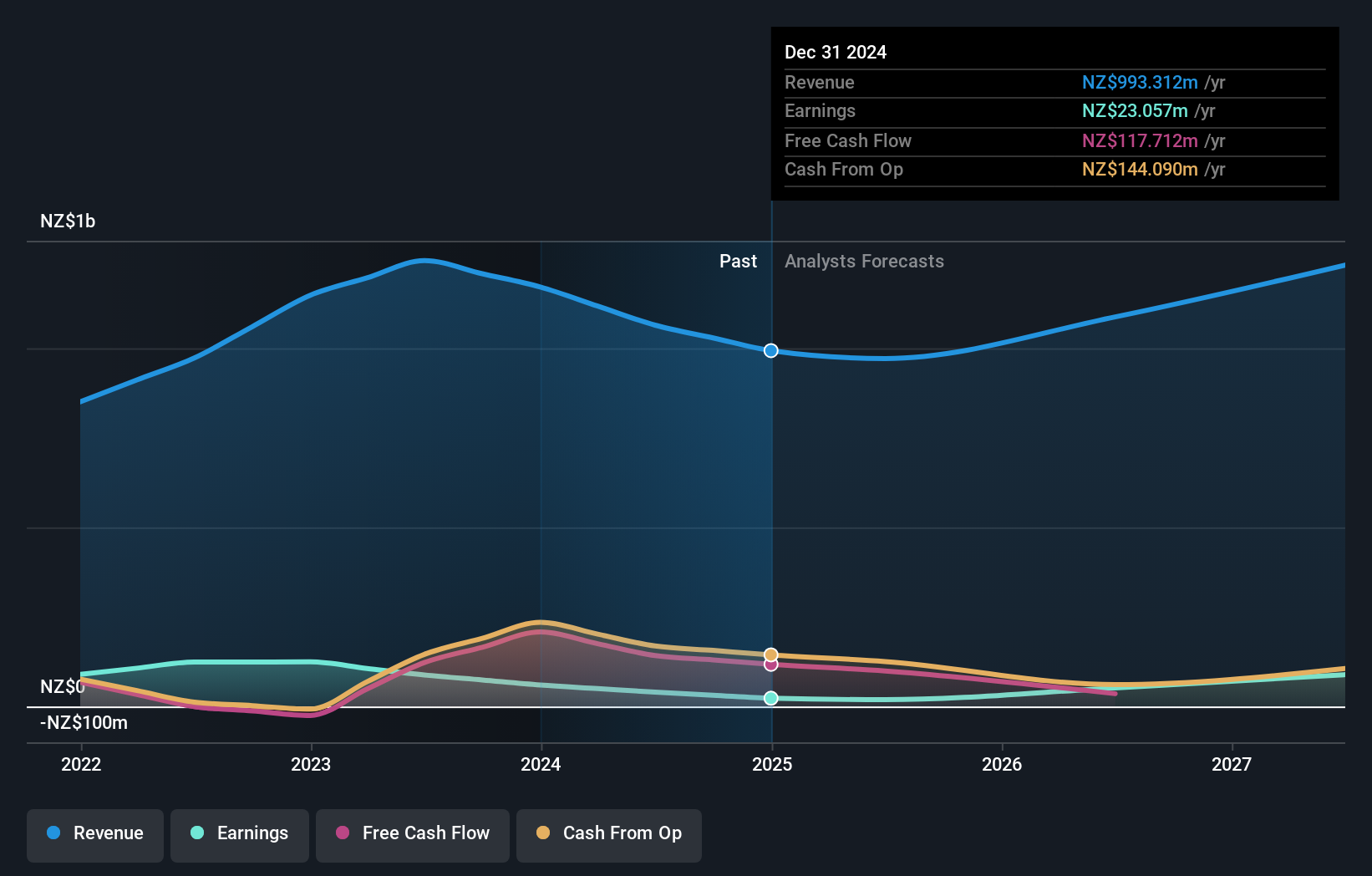

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vulcan Steel Limited, with a market cap of A$1.06 billion, operates in New Zealand and Australia focusing on the sale and distribution of steel and metal products.

Operations: Vulcan Steel's revenue segments include NZ$409.74 million from steel and NZ$538.41 million from metals in New Zealand and Australia.

Insider Ownership: 33.9%

Earnings Growth Forecast: 33.6% p.a.

Vulcan Steel's earnings are forecast to grow significantly at 33.6% annually, surpassing the Australian market average of 11.7%. Despite a recent drop from the S&P Global BMI Index and a decline in net income to NZD 15.7 million, insider buying has been substantial over the past three months, indicating confidence in future prospects. The company completed an A$87.13 million follow-on equity offering recently, which could support its growth initiatives despite current financial challenges.

- Click here to discover the nuances of Vulcan Steel with our detailed analytical future growth report.

- Our valuation report here indicates Vulcan Steel may be overvalued.

Summing It All Up

- Access the full spectrum of 108 Fast Growing ASX Companies With High Insider Ownership by clicking on this link.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal