5 Analysts Assess Rambus: What You Need To Know

5 analysts have expressed a variety of opinions on Rambus (NASDAQ:RMBS) over the past quarter, offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 0 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

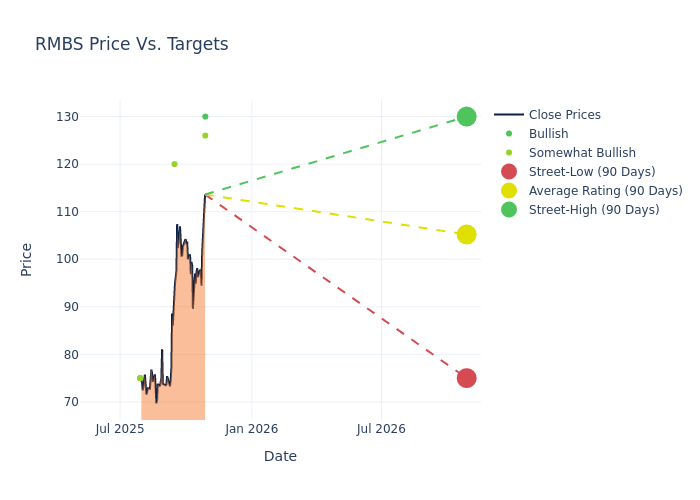

Analysts have recently evaluated Rambus and provided 12-month price targets. The average target is $124.0, accompanied by a high estimate of $130.00 and a low estimate of $114.00. Witnessing a positive shift, the current average has risen by 22.77% from the previous average price target of $101.00.

Investigating Analyst Ratings: An Elaborate Study

In examining recent analyst actions, we gain insights into how financial experts perceive Rambus. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kevin Cassidy | Rosenblatt | Maintains | Buy | $130.00 | $130.00 |

| Daniel Markowitz | Evercore ISI Group | Raises | Outperform | $126.00 | $114.00 |

| Kevin Cassidy | Rosenblatt | Raises | Buy | $130.00 | $90.00 |

| Daniel Markowitz | Evercore ISI Group | Raises | Outperform | $114.00 | $81.00 |

| Tristan Gerra | Baird | Raises | Outperform | $120.00 | $90.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Rambus. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Rambus compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Rambus's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Rambus's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Rambus analyst ratings.

Delving into Rambus's Background

Rambus Inc is a semiconductor solutions provider offering high-speed, high-security computer chips and Silicon intellectual property. The company's key products include memory interface chips, built for high speed and efficiency; silicon IP, providing high-speed memory and chip-to-chip connection technology; and architecture licenses, which allow customers to use portions of Rambus' patented inventions for their own digital electronics. The firm receives the majority of its revenue from the United States, Taiwan, Asia, Japan, and Singapore.

Understanding the Numbers: Rambus's Finances

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Rambus's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 30.33%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Rambus's net margin is impressive, surpassing industry averages. With a net margin of 33.64%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.85%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Rambus's ROA excels beyond industry benchmarks, reaching 4.07%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.02, Rambus adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal