Assessing Howmet Aerospace After a 72.6% Surge and New Partnerships in 2025

If you’ve been watching Howmet Aerospace stock lately and wondering whether now is the time to jump in, you’re definitely not alone. Investors everywhere are taking note after a strong run that sees the shares up an eye-popping 72.6% year-to-date and a staggering 1,061.5% over the last five years. Even with a modest dip of -0.5% in the past week and past month, the long-term performance is hard to ignore.

This kind of growth naturally raises a big question: is the stock still undervalued, or have the easy gains already passed? Some of the excitement lately has been fueled by global discussions about the aerospace supply chain and new partnerships that could extend Howmet’s reach into emerging markets. These developments have investors rethinking risk and reward, leading to both some profit-taking and fresh interest from those who see more room to run.

To anchor our analysis, let’s look at Howmet’s value score. Out of six tests for being undervalued, Howmet Aerospace comes in with a score of zero. In other words, based on those standard valuation checks, the stock doesn’t flash any obvious “discount” signs. At least for now.

Of course, numbers alone are only part of the story. Let’s dig into the specific valuation approaches analysts use, and keep in mind there’s another perspective on value that may be even more telling as we wrap up the article.

Howmet Aerospace scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Howmet Aerospace Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today based on expected future free cash flows, which are projected forward and then discounted back to their present value. This method tries to answer the big question: what is Howmet Aerospace actually worth if we take all the cash it could generate in the years to come?

Currently, Howmet Aerospace reports Free Cash Flow (FCF) of $1.1 Billion over the last twelve months. Analyst projections extend out five years, estimating FCF to rise to $2.5 Billion by the end of 2029. Beyond the five-year window, further FCF growth is modeled by extrapolation with the aim of capturing a realistic trajectory for the business’s long-term earnings power.

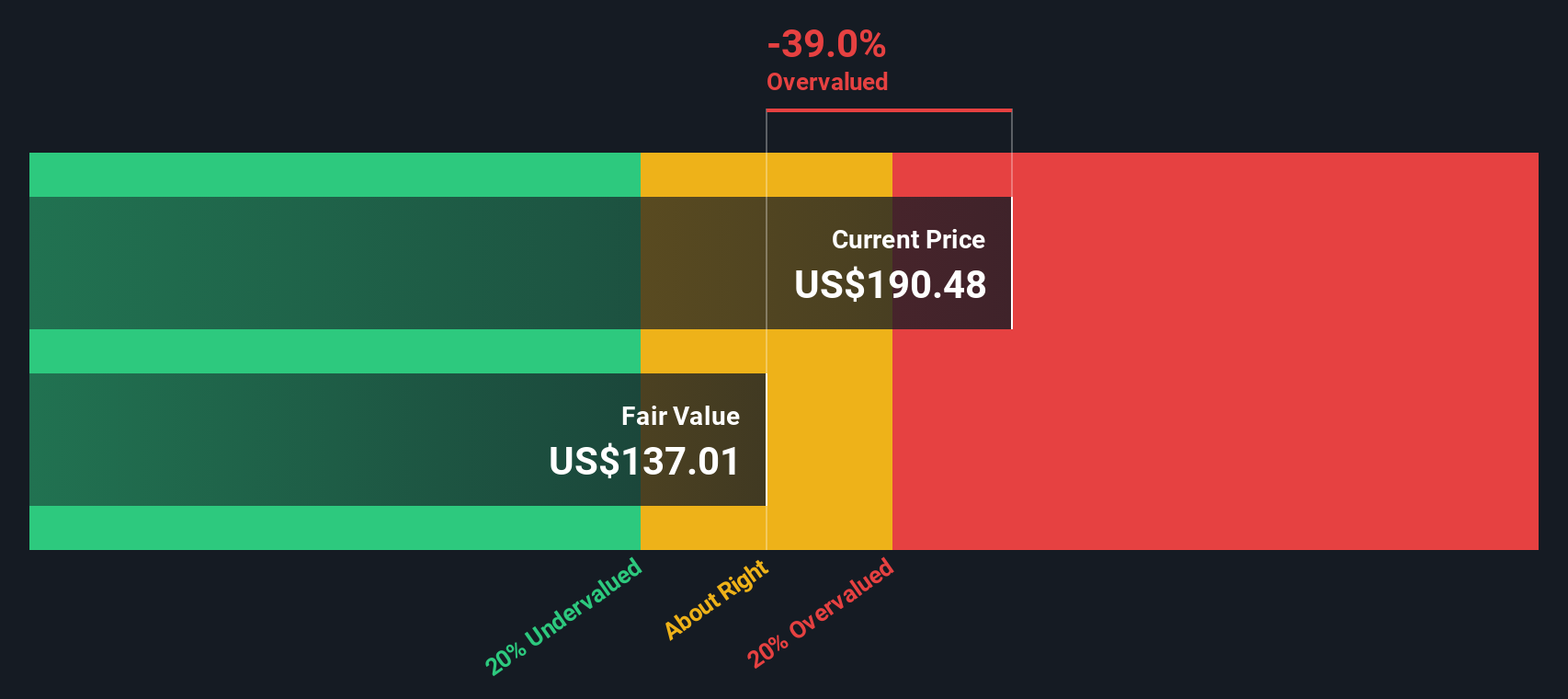

Running these numbers through the DCF framework, we estimate an intrinsic fair value of $136.82 per share. Compared to the current share price, the implied discount suggests the stock is actually trading at 39.8% above this intrinsic value. In plain language, DCF suggests Howmet Aerospace is significantly overvalued at today's prices.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Howmet Aerospace may be overvalued by 39.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Howmet Aerospace Price vs Earnings

For profitable companies like Howmet Aerospace, the Price-to-Earnings (PE) ratio remains a cornerstone of stock valuation. This multiple captures how much investors are willing to pay today for each dollar of a company’s earnings, making it especially useful for businesses with consistent profits.

The appropriate or “fair” PE often hinges on a company's future growth prospects and risk profile. Fast-growing, stable businesses can command higher PE ratios, while slower-growth or riskier companies typically trade at lower multiples.

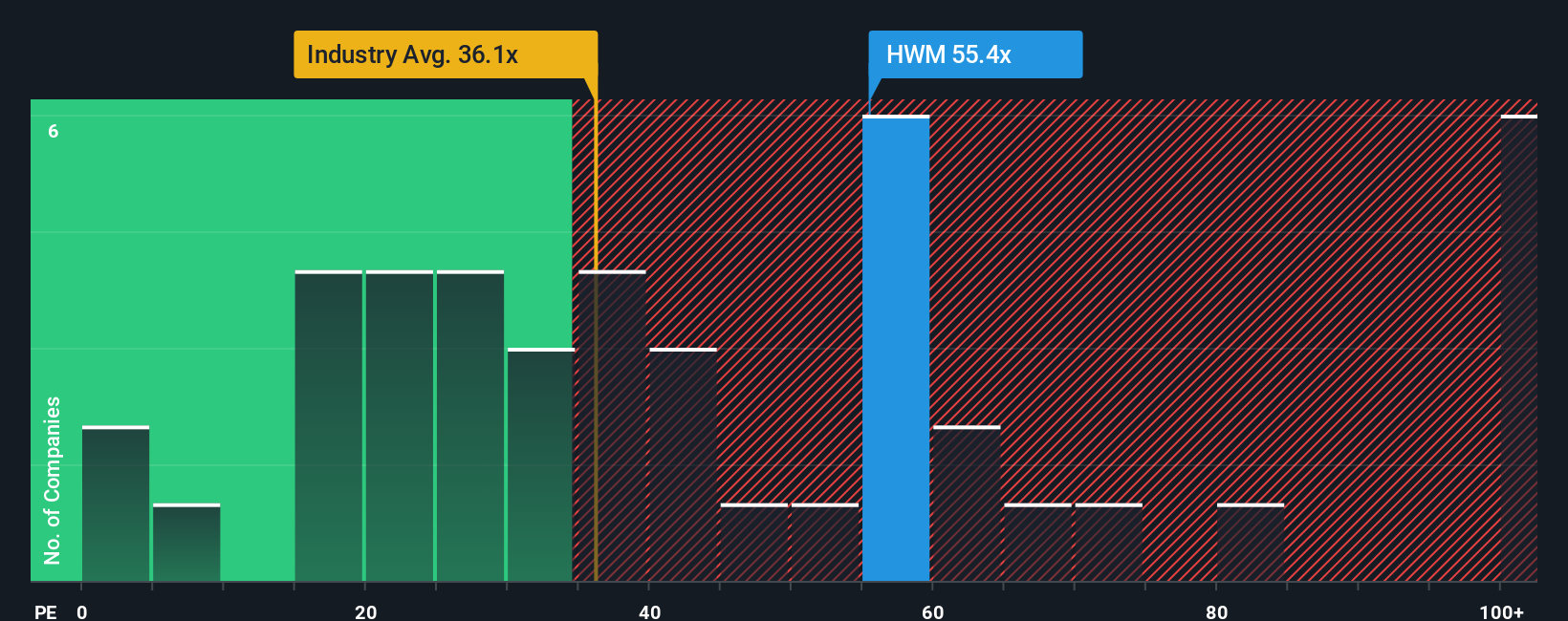

Currently, Howmet Aerospace trades at a PE of 55.26x. For context, the average across the Aerospace & Defense industry is 37.78x, and the average among its closest peers is 29.39x. At first glance, Howmet’s valuation looks stretched compared to both benchmarks.

This is where Simply Wall St’s proprietary Fair Ratio offers deeper perspective. Incorporating factors like Howmet’s expected earnings growth, industry positioning, profit margins, market capitalization, and risk, the Fair Ratio refines what would be reasonable to pay for the stock beyond simple peer or industry comparisons. For Howmet, the Fair Ratio is calculated at 35.84x, which is well below its current PE.

Because Howmet’s actual PE is materially above this Fair Ratio, the stock looks expensive through this lens. Investors should note that, while high-quality companies can justify premium valuations for a time, the current figure points to clear overvaluation on a PE basis even after adjusting for its growth and profitability.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Howmet Aerospace Narrative

Earlier, we hinted at an even more insightful way to assess value, so let's introduce you to Narratives. A Narrative goes beyond financial ratios; it's your personal story or viewpoint about Howmet Aerospace, connecting what you believe about its future to concrete numbers like revenue, margins, and fair value estimates.

This approach lets you blend your own research or perspective on the company’s catalysts, risks, and outlook, then link that story directly to financial forecasts and an actionable fair value. All of this is powered by the Simply Wall St platform’s Community page, which millions of investors already use.

Narratives make it easy to spot whether your investing logic sees Howmet as a buy, hold, or sell, as you can instantly compare your calculated Fair Value with today's Price. With each new earnings announcement or news update, your Narrative updates automatically in real time.

For example, some investors may see Howmet’s long-term capacity expansions and robust airline demand justifying a bullish fair value above $225 per share. Others focus more on supply chain risks and margin pressures, setting their fair value closer to $186. The platform lets you track and learn from these different perspectives with clarity and confidence.

Do you think there's more to the story for Howmet Aerospace? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal