CME Group (CME) Margin Beat Reinforces High-Quality, Lower-Growth Narrative

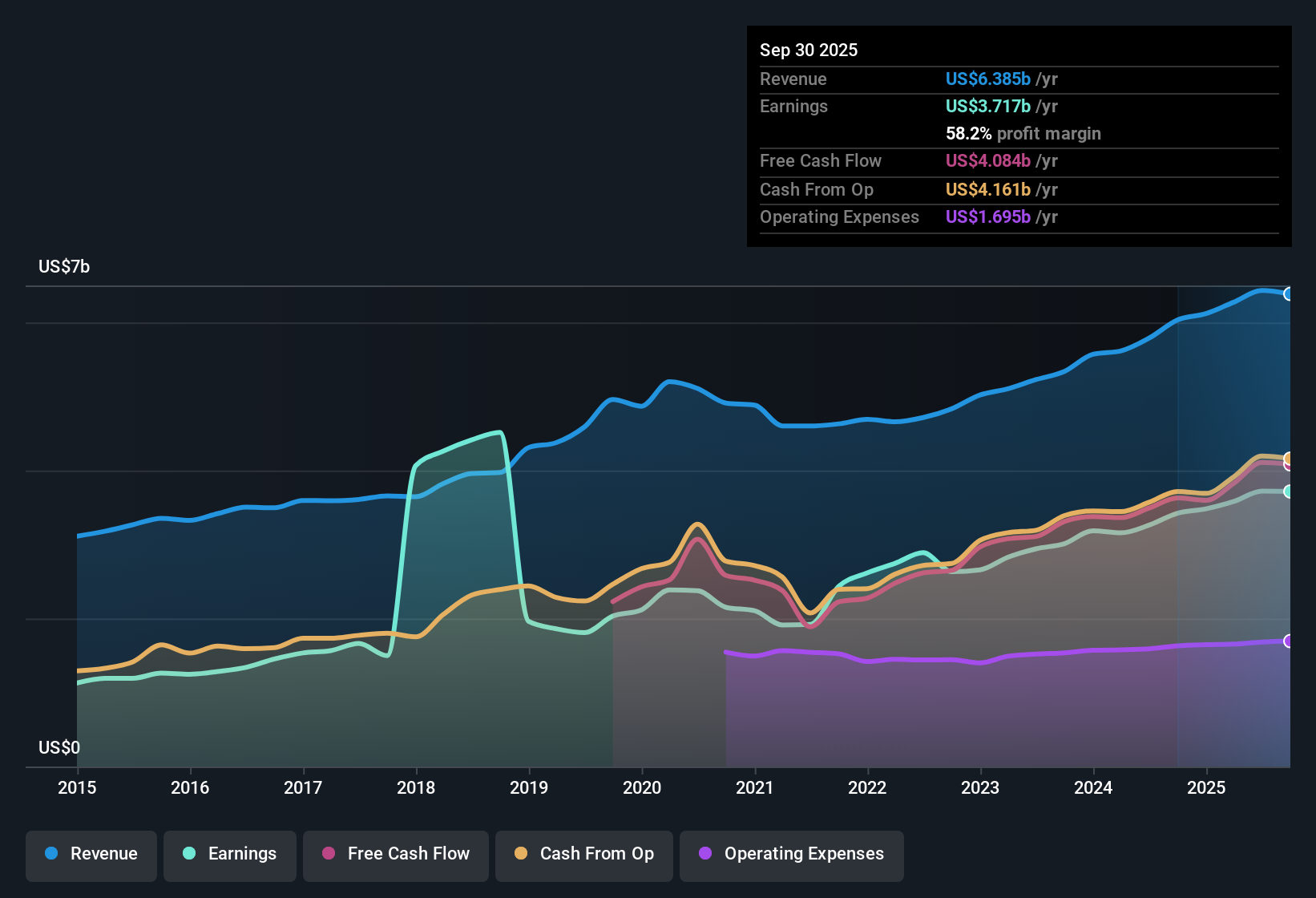

CME Group (CME) reported net profit margins of 57.9%, up from 56.4% a year ago, signaling profitability has edged higher. The company’s EPS grew 14.1% over the last year, topping its five-year annual average growth rate of 12.4%. With revenue and earnings expected to grow modestly compared to the US market, investors will note these results position CME as a highly profitable, quality operator, but with a lower growth outlook than some peers.

See our full analysis for CME Group.Next, we’ll see how these headline numbers stack up against the most widely discussed narratives for CME Group, and whether the earnings results confirm or challenge the story so far.

See what the community is saying about CME Group

Profit Margins Outpace Peers

- CME's net profit margin climbed to 57.9%, well ahead of typical industry levels and supporting analyst forecasts that margins could edge up to 58.5% in the next three years.

- Analysts' consensus view notes the combination of strong existing margins with ongoing product innovation and cost efficiency, such as cloud migration and tech-driven initiatives, heavily supports the narrative that CME can sustain industry-leading profitability.

- The resilience in margin expansion, even as revenue growth trails the US market, highlights how operating leverage and international client diversification are offsetting competitive headwinds.

- Despite high profit margins, consensus narrative cautions that future growth will be modest. Revenue is expected to grow at just 4.4% annually, slower than most US capital markets peers.

- This view is grounded in CME's forecasted earnings increase from $3.7 billion to $4.3 billion by 2028, but at a pace that lags the broader market's double-digit growth expectations.

- Volume gains from international expansion and new retail clients offer tailwinds, yet exposure to cyclical swings in contract activity and competitive threats from DeFi limit the bullish case for outsized long-term upside.

Consensus sees these margins as a quality edge, though not a solo driver for major share price gains. 📊 Read the full CME Group Consensus Narrative.

Share Price Near Analyst Targets

- With the share price at $267.81, CME trades just 5.3% below the current analyst consensus target of $282.56, signaling that analysts see limited further upside in the near term for new investors.

- Consensus narrative highlights that the $14.75 gap to target price is smaller than many large-cap peers, suggesting the market already prices in CME's high-quality earnings, stable profit margins, and modest growth outlook.

- Bulls point to the strong fundamentals and earnings quality justifying this premium, while skeptics argue that upside may be capped unless future growth re-accelerates beyond current projections.

- Analyst models assume the company maintains a premium multiple, forecasting a 2028 PE ratio of 30.0x versus 25.3x today, well above the US Capital Markets industry at 26.7x.

- This premium valuation reflects CME's status as a global leader with robust profitability, but creates risk if sector multiples compress or growth surprises on the downside.

- Consensus narrative urges investors to carefully sense-check these optimistic assumptions against evolving industry conditions and trading activity trends before expecting major price appreciation from here.

DCF Fair Value Suggests a Premium

- CME’s current share price of $267.81 stands significantly above its DCF fair value estimate of $194.50, highlighting that investors are willing to pay a steep premium for the company’s recurring revenues and margin stability.

- Analysts' consensus view contends that while CME's reliable profitability justifies a valuation above purely mathematical fair value, this gap also means there is little margin for error if volumes or transaction fees falter unexpectedly.

- Record-breaking growth in international contracts and retail account openings are positive contributors, yet the valuation gap leaves little room for disappointment from competitive or regulatory shocks.

- The consensus narrative also emphasizes that CME’s robust client diversification and high-margin business mix are strengths, but acknowledges that the rich valuation could become a headwind if the US capital markets sector skews toward faster-growth, lower-multiple peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CME Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the results? In just a few minutes, you can shape these numbers into your unique perspective. Do it your way

A great starting point for your CME Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

CME Group’s premium valuation and modest growth projections may limit future upside. This is especially true if sector multiples compress or revenue misses expectations.

If you want potential value upside with more reasonable pricing, check out these 873 undervalued stocks based on cash flows to discover companies trading below intrinsic value and offering stronger upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal