A Fresh Look at HubSpot (HUBS) Valuation After This Week’s Share Price Uptick

See our latest analysis for HubSpot.

Looking beyond this week’s uptick, HubSpot’s 1-year share price return remains deeply negative, which highlights how much momentum has faded since the start of 2024, even as some investors continue to eye the company’s longer-term prospects. However, with a three-year total shareholder return still sitting above 60%, there is evidence that those who held on could benefit if sentiment swings again.

If you’re curious what else is surging or shifting in today’s market, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With HubSpot’s share price still well below analyst targets while recent gains hint at renewed interest, investors are left to ask whether the stock offers genuine value now or if the market has already priced in future growth.

Most Popular Narrative: 30.5% Undervalued

HubSpot’s fair value, based on the most tracked narrative, is notably above the latest closing price, suggesting significant upside if the story holds true. The fair value estimate stands at $687.88, compared to a recent close of $478.01. This gives the narrative a bullish tilt for those weighing up potential returns.

Ongoing movement upmarket into larger enterprise customers, combined with a seat-based pricing model and cross-sell of premium platform capabilities (Core Seat, Smart CRM), is leading to larger deals and higher gross margins, which should boost earnings power as operating leverage increases.

Want to see what’s fueling this valuation leap? The narrative’s fair value hinges on bold financial targets and ambitious margin expansion. Are the projections behind this number as aggressive as they sound? Uncover the numbers and the logic powering this price target with just one click.

Result: Fair Value of $687.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as intensifying AI competition and challenges to HubSpot’s traditional lead-generation strategies. These factors could disrupt growth momentum ahead.

Find out about the key risks to this HubSpot narrative.

Another View: How Do Multiples Stack Up?

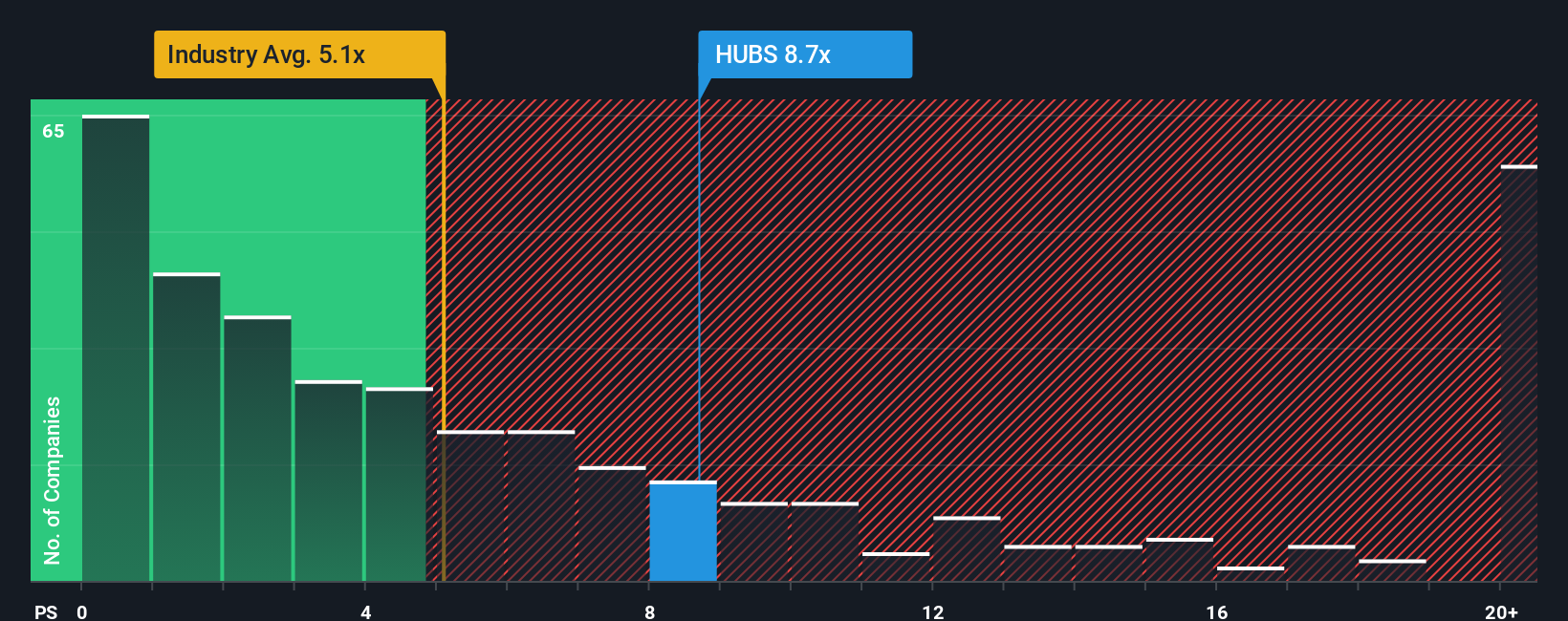

Looking at HubSpot’s valuation through the lens of its price-to-sales ratio brings a different perspective. The company currently trades at 8.8 times sales, which is much pricier than the US Software industry’s 5.1x average. However, this figure is still below the peer group’s 12.7x and under the fair ratio of 11.7x. This suggests that despite the premium, the gap offers a potential opportunity if the market moves closer to that fair ratio. Is this premium justified by future growth, or does it mean extra valuation risk ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HubSpot Narrative

If you’re inspired to dig into the numbers and craft your own story, you can easily piece together a personal view in just minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding HubSpot.

Looking for More Smart Investment Ideas?

Make your next portfolio move count by navigating fresh market opportunities with Simply Wall Street’s powerful Screener. Miss out now and you could regret it later.

- Tap into reliable income by scanning the market for companies offering stable yields above 3%. Start your search with these 17 dividend stocks with yields > 3%.

- Zero in on future-defining technology as you track the surge of innovation in artificial intelligence. Begin with these 24 AI penny stocks.

- Step ahead of the curve by uncovering undervalued stocks based on strong cash flows with the help of these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal