Why Saizeriya (TSE:7581) Is Up 11.4% After Raising Dividend and Issuing New Guidance

- Saizeriya Co., Ltd. recently announced an increase in its annual dividend to ¥30 per share for the year ended August 2025, up from ¥25 per share a year earlier, and provided updated earnings and dividend forecasts for the fiscal year ending August 2026.

- The company’s move to both boost its dividend and issue new financial guidance highlights its commitment to shareholder returns and transparency in its expected business performance.

- We'll explore how Saizeriya's combination of a dividend hike and forward-looking forecasts may influence the company's investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is SaizeriyaLtd's Investment Narrative?

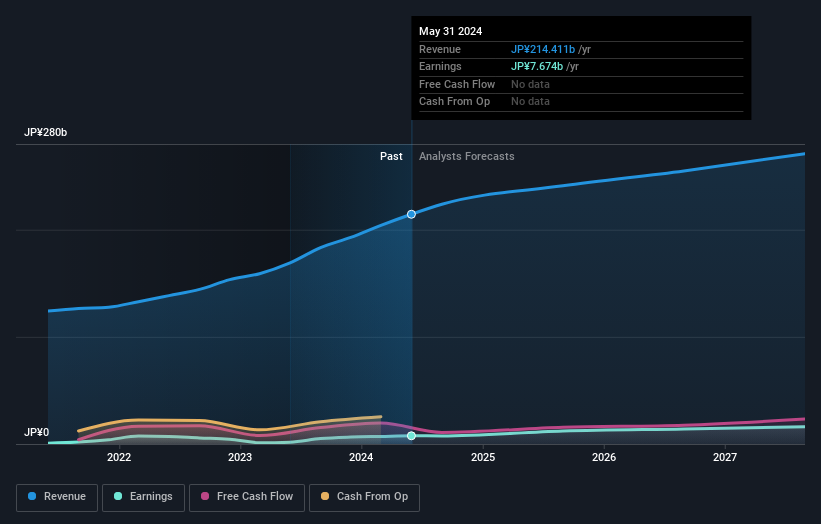

To own shares in Saizeriya Ltd. right now, an investor needs to believe in the company’s ability to balance steady growth with sustained shareholder returns, even as it expands into new international markets. The recent dividend boost and reaffirmed earnings guidance signal confidence in stable cash flow and operational performance, which may provide near-term support to the investment case. However, Saizeriya’s moderate revenue and earnings growth, both lower than broader market trends, suggest that the dividend announcement is unlikely to materially shift the short-term catalysts for the stock. The recent pop in share price shows the market has already digested much of this positive news. The key risks remain unchanged: management’s limited experience and low return on equity, as well as the challenge of executing overseas expansion while maintaining profitability. In this context, the news helps reinforce existing strengths but does little to address the fundamental vulnerabilities.

But beware, management’s short average tenure is a risk investors shouldn’t overlook. SaizeriyaLtd's shares are on the way up, but they could be overextended by 48%. Uncover the fair value now.Exploring Other Perspectives

Explore 2 other fair value estimates on SaizeriyaLtd - why the stock might be worth as much as ¥4273!

Build Your Own SaizeriyaLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SaizeriyaLtd research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free SaizeriyaLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SaizeriyaLtd's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal