Eramet (ENXTPA:ERA): Exploring the Stock’s Valuation After Recent Share Price Rally

See our latest analysis for ERAMET.

After a notable rally in the past month, ERAMET’s 1-month share price return has surged 15.8%, lifting its overall performance this year and indicating that market momentum is returning. The company’s 12-month total shareholder return stands at 16.6%. Although three- and five-year total returns show a more modest trend, these figures highlight the shifting sentiment as investors weigh both recent gains and longer-term stability.

If you’re curious what else is gaining attention, now’s a great time to broaden your investing search and discover fast growing stocks with high insider ownership

This raises a key question for investors: Is ERAMET’s recent rebound a sign the stock remains undervalued, or has the market already accounted for future potential, leaving little room for further upside?

Price-to-Sales Ratio of 0.6x: Is it justified?

ERAMET’s last close at €59.60 puts it at a price-to-sales (P/S) ratio of 0.6x, well below both peer and industry averages. This suggests investors are pricing in low expectations despite recent momentum.

The price-to-sales ratio divides a company’s market value by its revenue, providing a sense of how much investors are willing to pay for each euro of sales. In capital-intensive sectors like Metals and Mining, where profits can be cyclical, the P/S ratio is often used as a reality check on market sentiment.

At 0.6x, ERAMET is trading at a steep discount versus its European Metals and Mining peers (average 0.7x) and the sector’s peer average of 1x. More strikingly, the P/S ratio is far below the estimated fair value P/S of 3.4x. The market could move towards this level if expectations improve or revenue growth continues to accelerate.

Explore the SWS fair ratio for ERAMET

Result: Price-to-Sales of 0.6x (UNDERVALUED)

However, ongoing net losses and a price target below the current level remain concerns. These factors highlight potential downside if momentum fades.

Find out about the key risks to this ERAMET narrative.

Another View: What Does the SWS DCF Model Say?

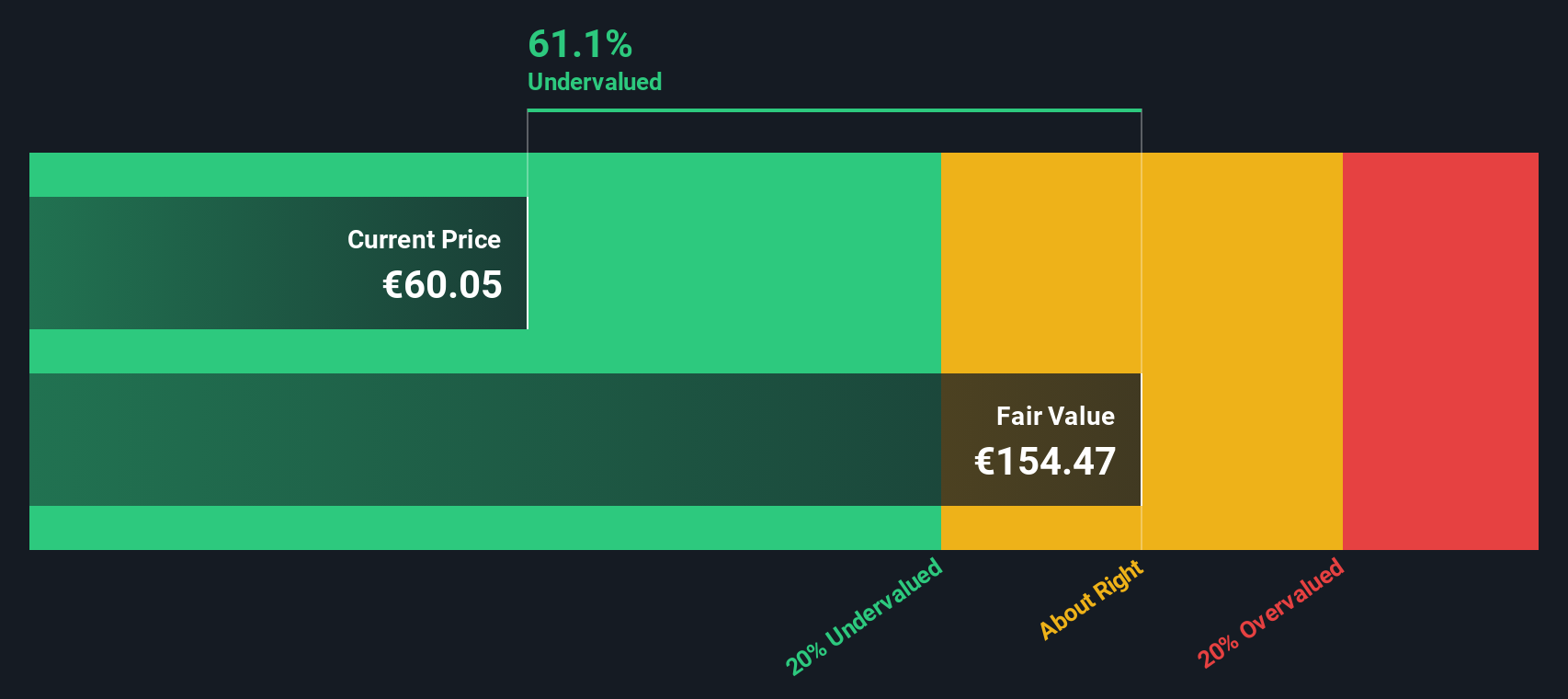

While ERAMET’s price-to-sales ratio points to an undervalued stock, our DCF model offers an even more striking perspective. According to this method, the shares are trading about 61.8% below estimated fair value. This suggests the upside could be much larger than what the market currently prices in. However, the question remains whether the business can deliver results quickly enough to justify that gap.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ERAMET for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ERAMET Narrative

If you see things differently, or would rather dive into the numbers yourself, you can quickly craft your own perspective on ERAMET. Simply set aside a few minutes and Do it your way.

A great starting point for your ERAMET research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your opportunities. Take action now and target stocks with momentum, resilience, and growth in the market leaders you might have missed.

- Accelerate your returns by tracking high-yield opportunities within these 17 dividend stocks with yields > 3%, perfect for boosting your passive income while markets shift.

- Seize the tech revolution by targeting emerging players in artificial intelligence via these 24 AI penny stocks, staying ahead of the curve in innovation and automation.

- Capitalize on market mispricings by searching for hidden gems with potential upside through these 876 undervalued stocks based on cash flows, and gain an edge before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal