Assessing Marsh & McLennan (MMC) Valuation After Cost-Savings Launch, Rebrand, and Strong Q3 Results

Marsh & McLennan Companies (NYSE:MMC) has been in the spotlight following several key moves, including the launch of its Thrive cost-savings program, a sweeping rebrand, and solid third-quarter results.

See our latest analysis for Marsh & McLennan Companies.

Between strategic acquisitions, a fresh brand identity, and a new focus on cost savings, Marsh & McLennan Companies has stayed busy this year. But even with the company’s ongoing buybacks and robust Q3 results, momentum hasn’t translated into share price gains, as the stock has slipped and posted a -10% year-to-date share price return and a -13% total shareholder return over the past year. Despite this recent dip, long-term holders remain well ahead, with total shareholder returns of nearly 30% over three years and 85% over five years. This reflects the company’s proven ability to create value through its transformation efforts.

If you’re weighing where to look beyond Marsh & McLennan’s latest moves, now is the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With all these strategic updates and analyst attention, is Marsh & McLennan’s recent share price decline an opportunity to buy at a discount, or are investors already pricing in the company’s next stage of growth?

Most Popular Narrative: 16.9% Undervalued

Investors are taking note as the most followed narrative pegs Marsh & McLennan Companies’ fair value well above its last closing price of $189.91. The gap points to meaningful upside potential, if the underlying assumptions hold true, and has kept this narrative front and center in valuation debates.

Strategic investments in digital transformation, advanced analytics, and AI (for example, proprietary data tools for risk modeling and agentic interfaces) are expected to enhance operational efficiency and improve product and service offerings. These changes could enable margin expansion and net earnings growth through improved client retention and lower cost to serve.

Wondering what powers such a confident fair value? There is a crucial set of future estimates behind the headline. One number in particular might surprise you, and it could be the swing factor in this valuation battle. Only the full narrative reveals what’s driving these targets and why they diverge from current market pessimism.

Result: Fair Value of $228.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in property pricing and rising sector competition could serve as catalysts that challenge Marsh & McLennan's bullish longer-term outlook.

Find out about the key risks to this Marsh & McLennan Companies narrative.

Another View: The Market’s Price Multiple

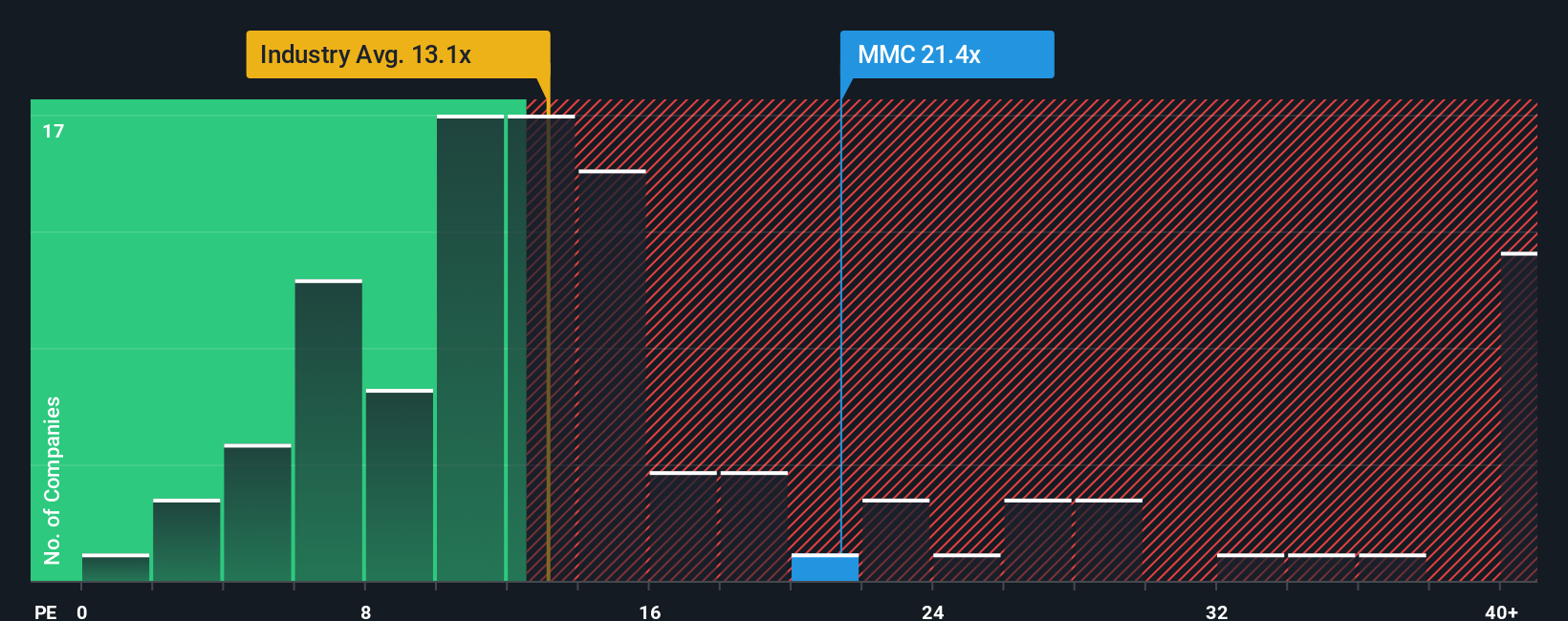

Looking through the lens of a price-to-earnings multiple, Marsh & McLennan trades at 22.5x, noticeably higher than both the US Insurance industry average (13.9x) and even its fair ratio of 16.5x. This premium suggests investors are baking in higher expectations. Does the company warrant that kind of confidence?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marsh & McLennan Companies Narrative

If you see things differently, or want to dive into the numbers yourself, you can craft your own perspective on Marsh & McLennan in just minutes. Do it your way

A great starting point for your Marsh & McLennan Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunity is everywhere if you know where to look. Get ahead of the curve with these handpicked stock screens that help you spot trends other investors might miss.

- Uncover growth potential with these 24 AI penny stocks focused on artificial intelligence and automation, which are changing how industries operate.

- Capture cash flow bargains by targeting these 875 undervalued stocks based on cash flows to pinpoint companies priced well below their fair value.

- Boost your portfolio income by choosing these 17 dividend stocks with yields > 3%, featuring high-yield stocks paying dividends above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal