Is Verizon’s 5G Expansion Signaling a Shift in the Company’s 2025 Value?

Wondering what to do with Verizon Communications stock right now? You are not alone. With so much noise in the market, it is easy to get stuck in analysis paralysis, especially when a household name like Verizon seems to be sitting at a crossroads. Over just the past month, shares have drifted down 6.2%, followed by a mild rebound of 0.6% this week. On a longer timeline, the story is more nuanced: up 1.5% year-to-date and gaining 5.1% in the last year, but still down 4.1% over the last five years. This kind of price action makes investors ask whether the risk profile or growth prospects are truly shifting.

Recent headlines have focused on Verizon’s push to streamline its consumer offerings, including renewed network investment and expanded 5G coverage. These moves hint at both renewed ambition and competitive pressure. The stock’s movement suggests investors are cautiously weighing these factors, especially as the telecom space shifts in response to evolving demand for mobile and broadband services. These dynamics matter for valuation, which we will explore next.

On that front, here is the number everyone wants to see: Verizon lands a valuation score of 5 out of 6 by standard value checks, underscoring that it is undervalued in most key metrics compared to its peers. But as we explore each method of assessing value, keep in mind there is an even sharper way to appraise Verizon’s worth, which we will cover before we wrap up.

Why Verizon Communications is lagging behind its peers

Approach 1: Verizon Communications Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating the future cash flows a company will generate, then discounting those amounts back to today’s value to find what a rational investor might pay for the business now. This process centers on the core idea that a company’s worth is based on what cash it can actually return to shareholders over time.

For Verizon Communications, the latest reported Free Cash Flow (FCF) stands at $15.28 billion. Analyst estimates project steady growth, with FCF forecast to reach $24.54 billion by 2029. Beyond analyst coverage, further projections for the next decade are extrapolated by Simply Wall St, expecting the FCF to keep ticking upwards and ultimately reaching about $30.66 billion by 2035.

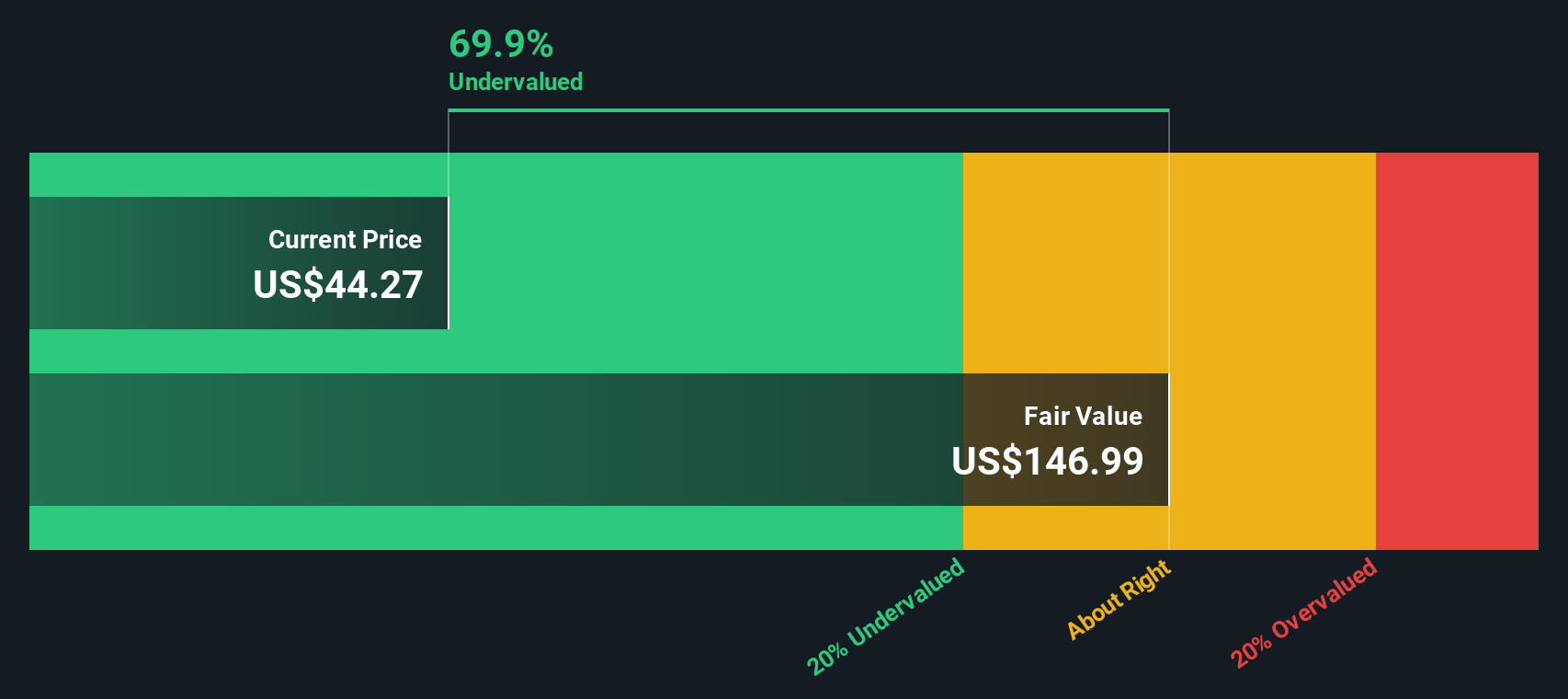

Putting these numbers into the DCF formula, Verizon’s intrinsic value is estimated at $133.72 per share. Based on the implied DCF discount of roughly 69.5%, the stock appears to be significantly undervalued compared to its current market price. This sizable gap suggests that either the market is pessimistic about Verizon’s future or the opportunity is being overlooked.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Verizon Communications is undervalued by 69.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Verizon Communications Price vs Earnings

For companies like Verizon Communications that are consistently profitable, the Price-to-Earnings (PE) ratio remains one of the clearest ways for investors to gauge valuation. The PE ratio shows how much investors are willing to pay for a dollar of earnings, and is especially relevant when earnings are stable and significant, as is the case here.

What counts as a “normal” or “fair” PE ratio, however, depends on important context. Future growth prospects, the likelihood of risks materializing, and industry conditions all shape investor expectations. In general, faster-growing companies or those with less risk can justify higher PE ratios. Slower-growing or riskier businesses tend to trade at lower multiples.

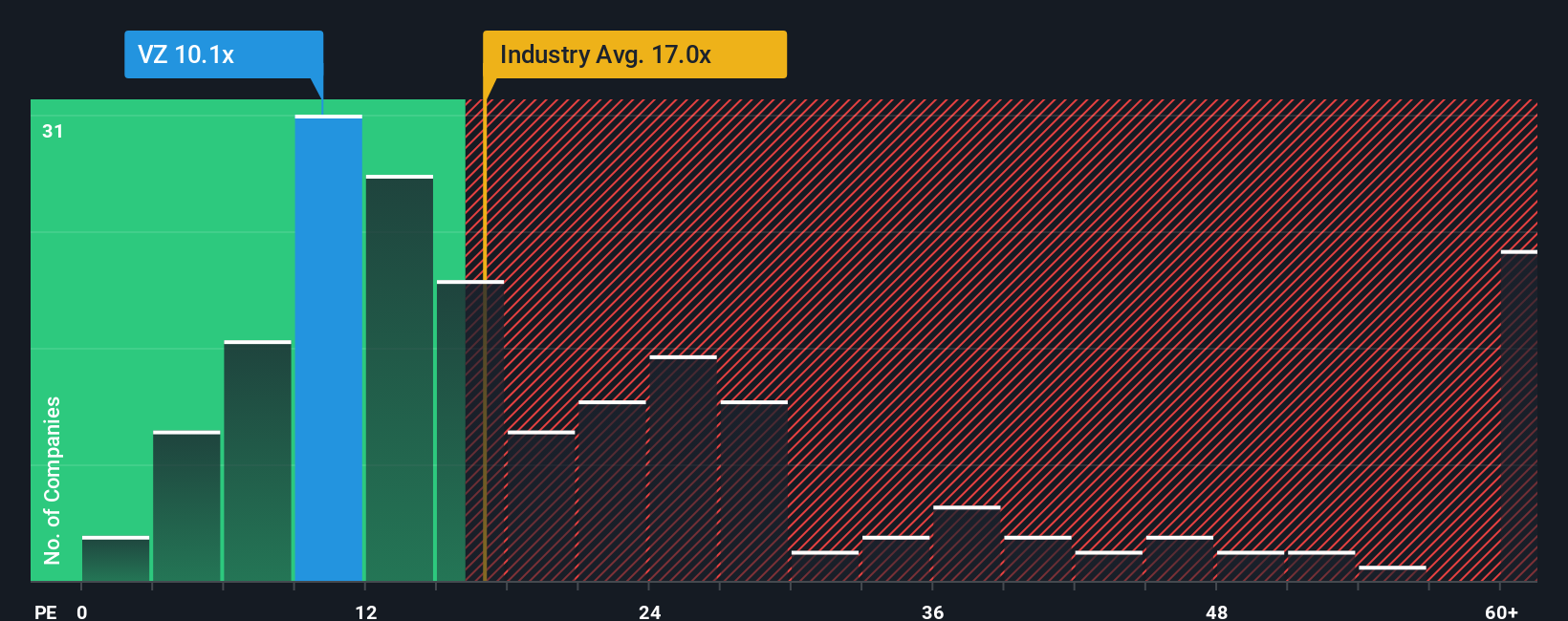

As of now, Verizon trades at a PE ratio of 9.46x, which is well below the telecom industry’s average PE of 17.03x and the peer group’s average of 23.86x. While these benchmarks are useful, they do not fully account for Verizon’s unique profit margins, growth rate, scale, and risk profile.

That is exactly what Simply Wall St’s Fair Ratio attempts to solve. The Fair Ratio for Verizon comes in at 15.69x, calculated using proprietary analysis of the company’s specific growth, risk, and profitability metrics relative to its sector and market cap. This nuanced approach provides a more tailored benchmark than simply comparing PE ratios in isolation. In Verizon’s case, the Fair Ratio is notably higher than its actual PE. This suggests investors are undervaluing its steady earnings power in light of these characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Verizon Communications Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives, a powerful framework that helps you connect the story of a company like Verizon Communications to its numbers and future potential.

A Narrative is your perspective on a company's future, pairing your story (what you believe will drive Verizon’s success or struggles) with your assumptions for revenue, earnings, profit margins, and ultimately, fair value.

This approach bridges the gap between headline numbers and deeper conviction. It makes it easier for you to see not just what the company is worth, but why you believe it, all within an easy-to-use tool on Simply Wall St’s Community page that millions of investors rely on.

Narratives empower you to make clearer buy or sell decisions by comparing your own Fair Value estimate with the current market price. This allows you to instantly judge whether Verizon shares line up with your outlook.

Best of all, as soon as new information, like earnings updates or major news, hits the market, Narratives update dynamically to reflect how each storyline (and your fair value) might shift in real time.

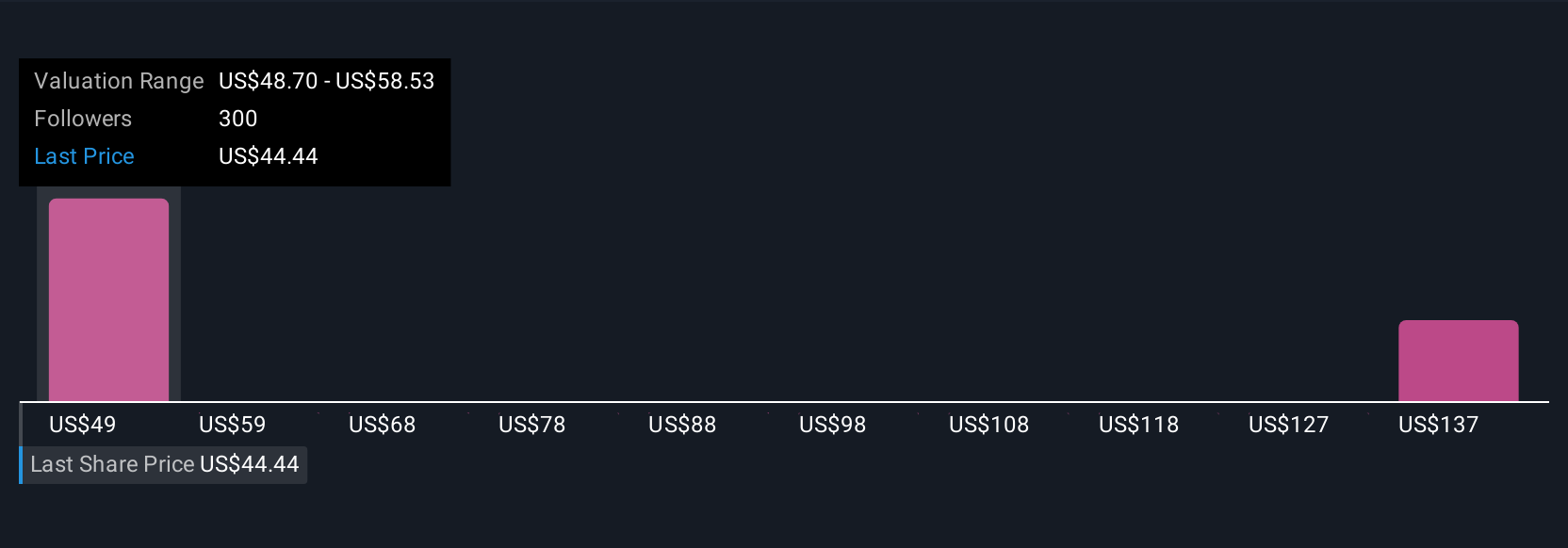

- For example, some investors may believe Verizon is primed for growth as fixed wireless and fiber expansion drive future revenue, justifying a fair value of $58.00 per share. Others may focus on margin pressures and heavy debt, seeing only $42.00 as fair.

Do you think there's more to the story for Verizon Communications? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal