What Sinch (OM:SINCH)'s AI Growth and Buyback Program Means For Shareholders

- Earlier this year, Sinch AB announced steady organic net sales growth of 2% and a 6% increase in gross profit for Q2 2025, supported by advancements in AI integration and expanded partnerships with major platforms such as Salesforce and Microsoft.

- A share buyback program was also activated, highlighting management's confidence in Sinch's financial outlook and long-term focus on sustainable, profitable growth.

- We'll examine how Sinch’s progress in AI-driven communications is influencing its investment narrative and growth prospects in the coming years.

Find companies with promising cash flow potential yet trading below their fair value.

Sinch Investment Narrative Recap

To be a Sinch shareholder today, you need confidence in its ability to accelerate organic net sales growth above its recent 2% pace by capitalizing on AI integration and large platform partnerships. The latest results do not materially shift the most important catalyst, delivering on meaningful revenue growth from new channels, while the biggest risk remains limited progress in turning new products into strong, margin-accretive revenue.

The activation of a major share buyback stands out among recent announcements, signaling Sinch's ongoing efforts to support its capital structure and long-term shareholder returns. However, it does not directly address concerns around near-term revenue stagnation or the pace at which next-generation messaging channels could drive broader financial improvement.

In contrast, investors should be aware of continued risks if Sinch's top-line growth remains below its...

Read the full narrative on Sinch (it's free!)

Sinch's narrative projects SEK30.1 billion in revenue and SEK1.1 billion in earnings by 2028. This requires 1.3% yearly revenue growth and an earnings increase of SEK7.5 billion from current earnings of SEK -6.4 billion.

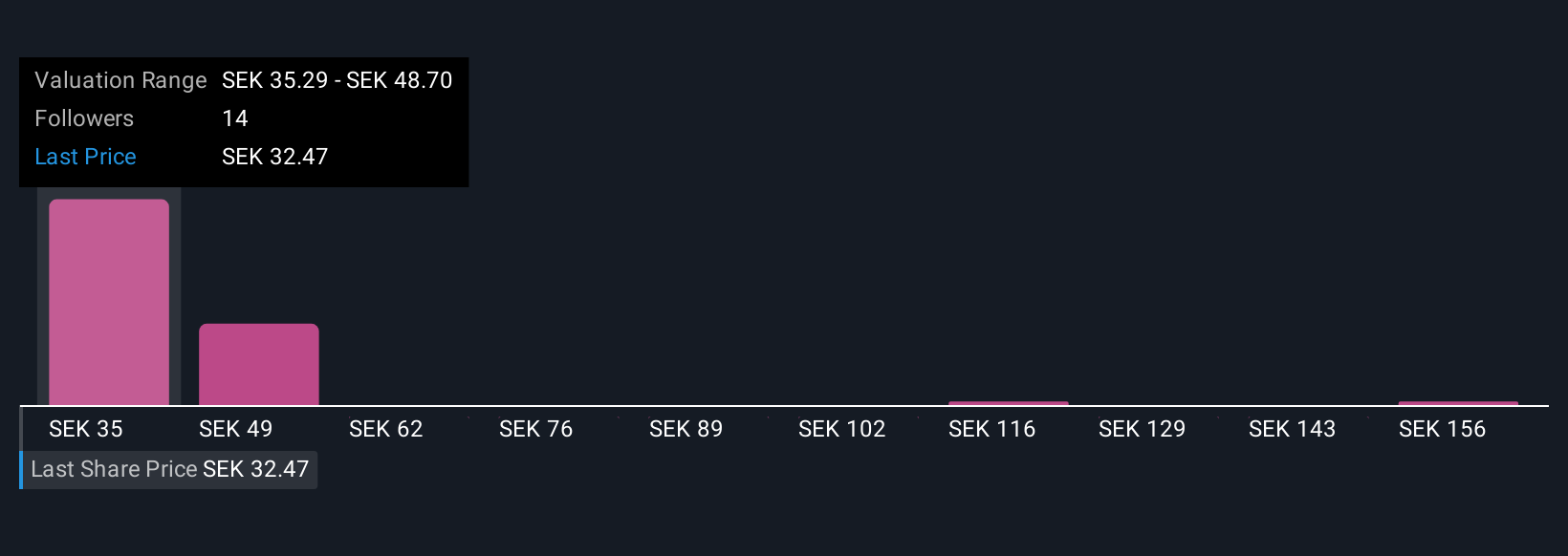

Uncover how Sinch's forecasts yield a SEK35.29 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Four distinct Sinch fair value estimates from the Simply Wall St Community span from SEK35.29 up to SEK169.38 per share. Yet, with organic net sales growth at just 2%, the variety of opinions shows how market participants weigh short-term growth risks differently, explore how your own outlook compares.

Explore 4 other fair value estimates on Sinch - why the stock might be worth over 5x more than the current price!

Build Your Own Sinch Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sinch research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sinch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sinch's overall financial health at a glance.

No Opportunity In Sinch?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal