Microchip Technology (MCHP): Exploring Valuation as New AI Products Launch and Restructuring Efforts Unfold

Microchip Technology (MCHP) is catching investors’ attention after announcing advanced products spanning AI system connectivity and timing infrastructure. The company is also working through restructuring and shifting demand patterns in the lead-up to its next earnings report.

See our latest analysis for Microchip Technology.

Momentum around Microchip Technology’s latest product launches is helping the share price regain ground. After sliding sharply through much of the year, the stock has rebounded over 14% year-to-date. However, even with these recent gains, the company’s 1-year total shareholder return remains in the red, reflecting both ongoing restructuring and the longer road to sustained growth.

If these infrastructure advancements have you thinking bigger picture, it could be the perfect time to explore what’s next in high-performance tech. See the full lineup of standout companies with our See the full list for free..

The rebound has sparked debate among investors, raising the question of whether Microchip Technology’s current valuation underestimates its renewed momentum and innovation, or if the market has already reflected expectations for future growth in its share price.

Most Popular Narrative: 14.3% Undervalued

Microchip Technology's narrative fair value of $76 sits nearly $11 above the last close. The narrative paints a picture of upside, contingent on future demand and profit rebound.

The accelerating adoption of edge computing and proliferation of AI-enabled, connected devices is fueling demand for Microchip's portfolio of microcontrollers, analog, and FPGA solutions, including recent design wins in AI/data center infrastructure and the expansion into secure, power-efficient edge AI products, supporting incremental revenue opportunities as these trends continue.

Earnings power, future margins, and bold revenue growth are front and center in this narrative’s fair value math. Want the inside story on which forecasts set Microchip’s price apart? Drama and detail await. See which numbers tip the scale in this highly-followed valuation.

Result: Fair Value of $76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high inventory levels and ongoing factory underutilization could continue to weigh on Microchip Technology’s margins, which may challenge the upbeat recovery narrative.

Find out about the key risks to this Microchip Technology narrative.

Another View: Multiple-Based Valuation

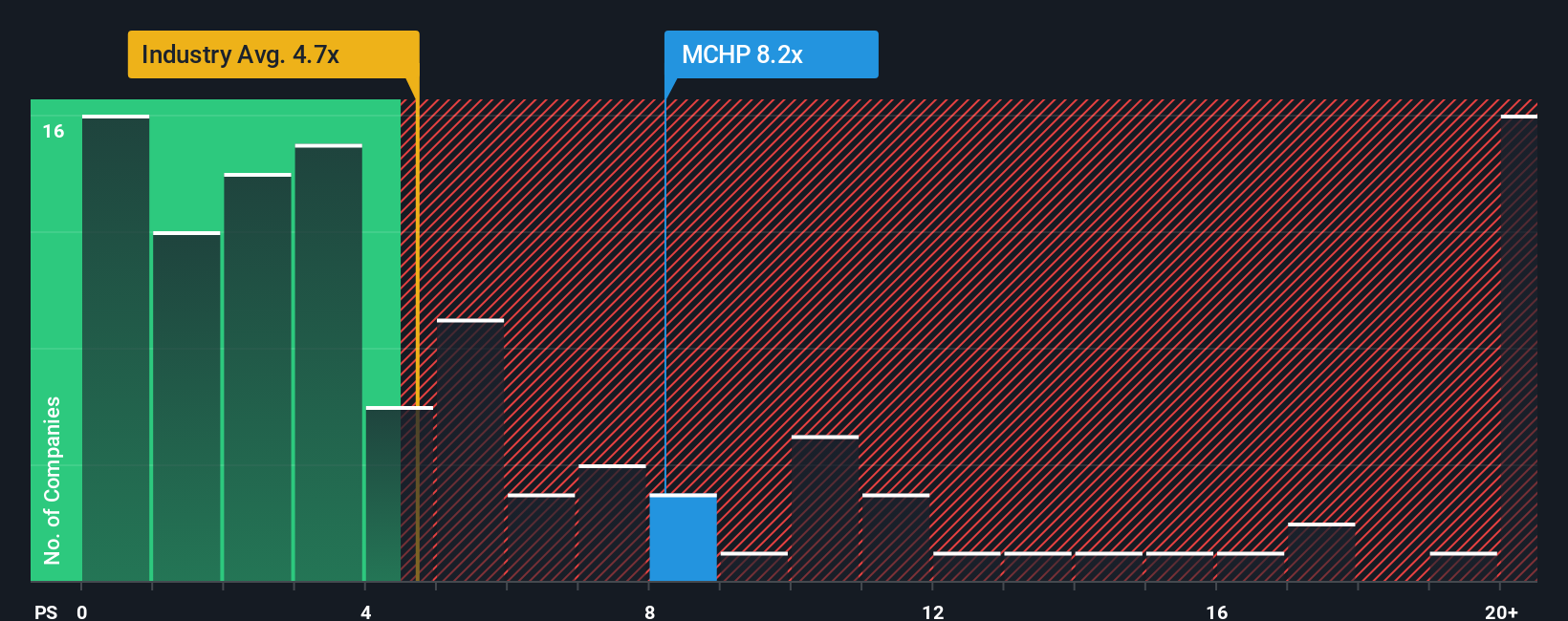

Looking through the lens of sales multiples, Microchip Technology trades at 8.3 times sales, notably above the US Semiconductor industry average of 5.2 but almost in line with its fair ratio of 8.4. This suggests the stock's premium versus peers might be justified by the market’s expectations; however, is it a sign of strength or a risk to watch?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Microchip Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Microchip Technology Narrative

If you want to challenge the crowd or dig into the numbers yourself, you can craft a fresh Microchip Technology narrative in just a few minutes, your way with Do it your way.

A great starting point for your Microchip Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss out on the brightest up-and-comers or hidden gems Simply Wall St has surfaced. Take action now and find your next opportunity among these standout stock picks:

- Boost your income potential with these 18 dividend stocks with yields > 3%, which offers high yields and consistent returns.

- Tap into the power of artificial intelligence by exploring these 24 AI penny stocks, making waves with innovative market-changing tech.

- Catch undervalued opportunities early and strengthen your portfolio with these 878 undervalued stocks based on cash flows, identified for strong fundamentals and attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal