Should Berkshire Hathaway’s Stake Sale and CEO Stock Sales Prompt Action From VeriSign (VRSN) Investors?

- In October 2025, VeriSign announced the appointment of Matthew J. Desch, CEO of Iridium Communications Inc., to its board of directors and confirmed that Berkshire Hathaway would reduce its ownership below 10% via a sale of 4.3 million shares, while CEO D. Bidzos sold US$2.37 million worth of company shares.

- Such significant share sales by a major institutional investor and the CEO may influence investor sentiment and raise questions about the company's short-term outlook.

- We'll explore how Berkshire Hathaway’s decision to trim its stake may reshape VeriSign’s investment narrative and long-term prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

VeriSign Investment Narrative Recap

To be a shareholder in VeriSign today, you need to believe in the resilience of domain registration trends and the company’s ongoing ability to generate stable cash flows, supported by dividends and buybacks. The recent sale of shares by Berkshire Hathaway and the CEO does not appear likely to affect VeriSign’s key catalyst, sustained demand for domain names, though it does bring near-term attention to the risk of shifting investor confidence.

Of the recent announcements, the appointment of Matthew J. Desch to the board is most relevant, marking an expansion in governance as the company faces market scrutiny. While this addition brings further executive experience, the fundamental factors driving VeriSign remain rooted in its core business performance and ability to adapt through ongoing board oversight as catalysts and risks alike evolve.

Yet, investors should be aware that, despite continued growth in domain name registrations, one risk is...

Read the full narrative on VeriSign (it's free!)

VeriSign's outlook anticipates $1.9 billion in revenue and $1.0 billion in earnings by 2028. This scenario is based on a projected annual revenue growth rate of 6.4% and a $200 million earnings increase from current earnings of $799.5 million.

Uncover how VeriSign's forecasts yield a $309.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

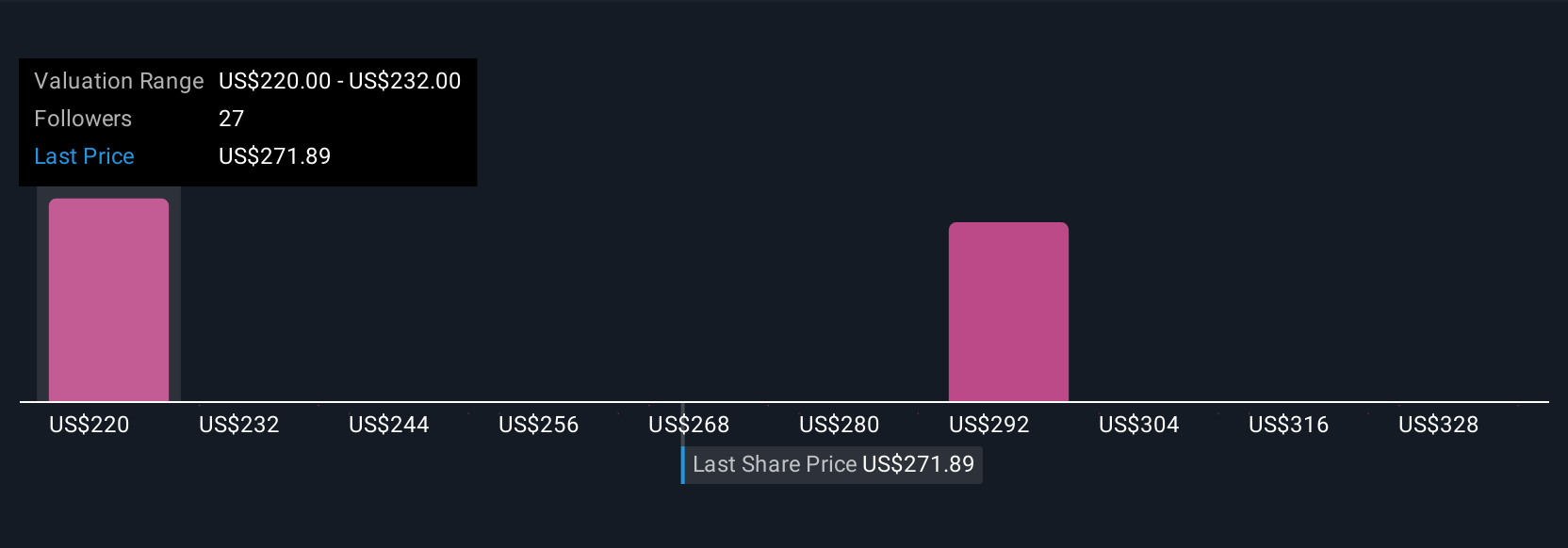

Retail investors in the Simply Wall St Community see fair value estimates for VeriSign ranging from US$218 to US$340, generated from seven viewpoints. With insider share sales raising concerns about short term sentiment, these varying outlooks highlight just how differently market participants assess business risk and upside, compare and consider multiple perspectives for a fuller picture.

Explore 7 other fair value estimates on VeriSign - why the stock might be worth 18% less than the current price!

Build Your Own VeriSign Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VeriSign research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free VeriSign research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VeriSign's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal