TC Energy (TSX:TRP): Evaluating the Stock’s Fair Value After Recent Gains

See our latest analysis for TC Energy.

TC Energy’s stock has gathered momentum lately, with a 10% gain over the past three months and a 6% year-to-date share price return that adds to the company’s solid track record. Its 1-year total shareholder return of nearly 16%, along with a remarkable 93% over five years, shows just how much long-term investors have benefited as sentiment has improved.

If this steady climb has you wondering about other potential growth stories, it might be the perfect moment to explore fast growing stocks with high insider ownership.

After such strong returns, the crucial question remains: is TC Energy’s current share price reflecting its true long-term value, or is there still potential for meaningful upside that the market has yet to recognize?

Most Popular Narrative: Fairly Valued

TC Energy’s recent closing price sits just below the narrative's fair value estimate, indicating that analysts see little mispricing at current levels. This sets the stage for the core logic behind the prevailing consensus.

Analysts are assuming TC Energy's revenue will grow by 6.3% annually over the next 3 years.

Analysts assume that profit margins will shrink from 29.7% today to 23.4% in 3 years time.

Want to know the quantitative backbone behind this fair value? The narrative is anchored by higher forward growth projections paired with lower profit margins. Curious how those trade-offs shape the price target? Dive in to see which assumptions really drive the current consensus on TC Energy’s valuation.

Result: Fair Value of $74.48 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural growth in North American natural gas demand or successful project execution could still propel TC Energy’s earnings well beyond current expectations.

Find out about the key risks to this TC Energy narrative.

Another View: Looking Through a Different Lens

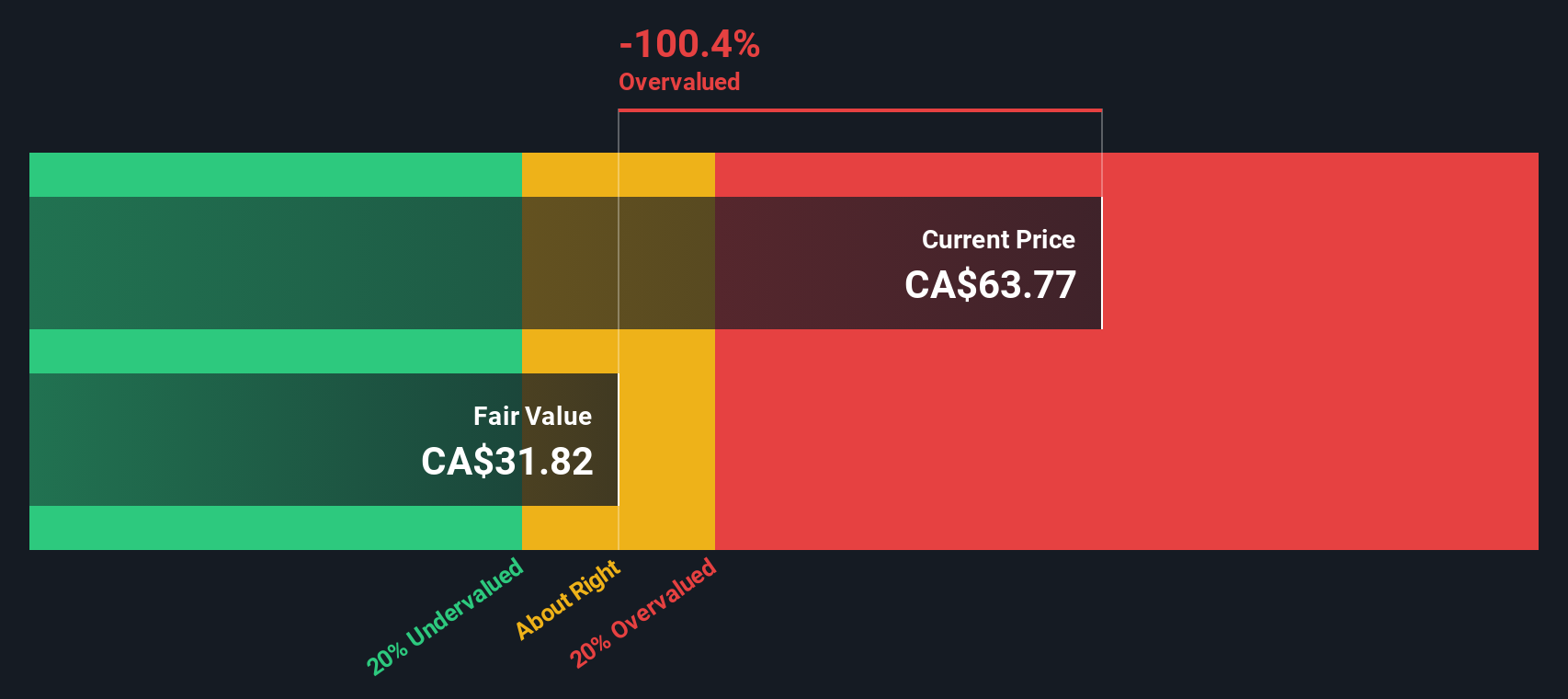

While the consensus points to a fair price near current levels, our DCF model presents a much more conservative perspective. It suggests TC Energy’s shares could be considerably overvalued, highlighting a wide gap between market optimism and cash flow-based fundamentals. Which outlook will prove right as conditions evolve?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TC Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TC Energy Narrative

If you see things differently, or want to dig deeper into the numbers yourself, you can craft your own story about TC Energy in just a few minutes. Do it your way

A great starting point for your TC Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass by. Take the next step in your investing journey and uncover unique stocks beyond your current watchlist with these hand-picked ideas:

- Boost your income strategy and spot reliable sources of yield when you check out these 20 dividend stocks with yields > 3% with proven dividends over 3%.

- Seize opportunities among innovative disruptors shaping the future of healthcare by reviewing these 33 healthcare AI stocks.

- Capitalize on powerful growth trends by seeking out these 872 undervalued stocks based on cash flows primed for potential upside based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal