What Do Recent Earnings Reveal About Mattel’s Share Price in 2025?

If you’re feeling indecisive about Mattel stock right now, you’re definitely not alone. Navigating the world of toy stocks can feel like child’s play one week and a roller coaster the next. Mattel’s share price has spent the past month in a bit of a tug-of-war, with a slight dip of 3.0% over the last week and a bounce of 2.5% in the last 30 days. This follows some longer-term ups and downs, including a modest 0.7% gain year-to-date, a slight loss at -4.5% over the past year, and an impressive 43.5% gain over five years. The market’s mood around Mattel seems to shift with each new headline about changing consumer trends, big entertainment deals, or global supply chain chatter.

When it comes to evaluating whether Mattel still offers potential value, it helps to turn down the market noise and focus on the basics. Here is something worth noting: on a standard valuation screen covering six different metrics, Mattel checks every box for a perfect valuation score of 6 out of 6. Does that mean Mattel is categorically undervalued, or is there more beneath the surface? Let’s dig into exactly how these valuation methods work, and stay tuned for an even smarter way to look at valuation that will be discussed at the end.

Approach 1: Mattel Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the true worth of a business by forecasting its future cash flows and discounting them back to today’s value. In simple terms, it projects what Mattel is expected to earn in the future and calculates what those dollars are worth right now, considering risk and the time value of money.

For Mattel, the current Free Cash Flow stands at $558.3 million. Analysts project Free Cash Flow through 2027, with Simply Wall St extrapolating estimates out another few years. In 2027, Free Cash Flow is forecast to reach about $501 million. By 2035, the model estimates it could climb to roughly $566 million, based on modest annual growth rates.

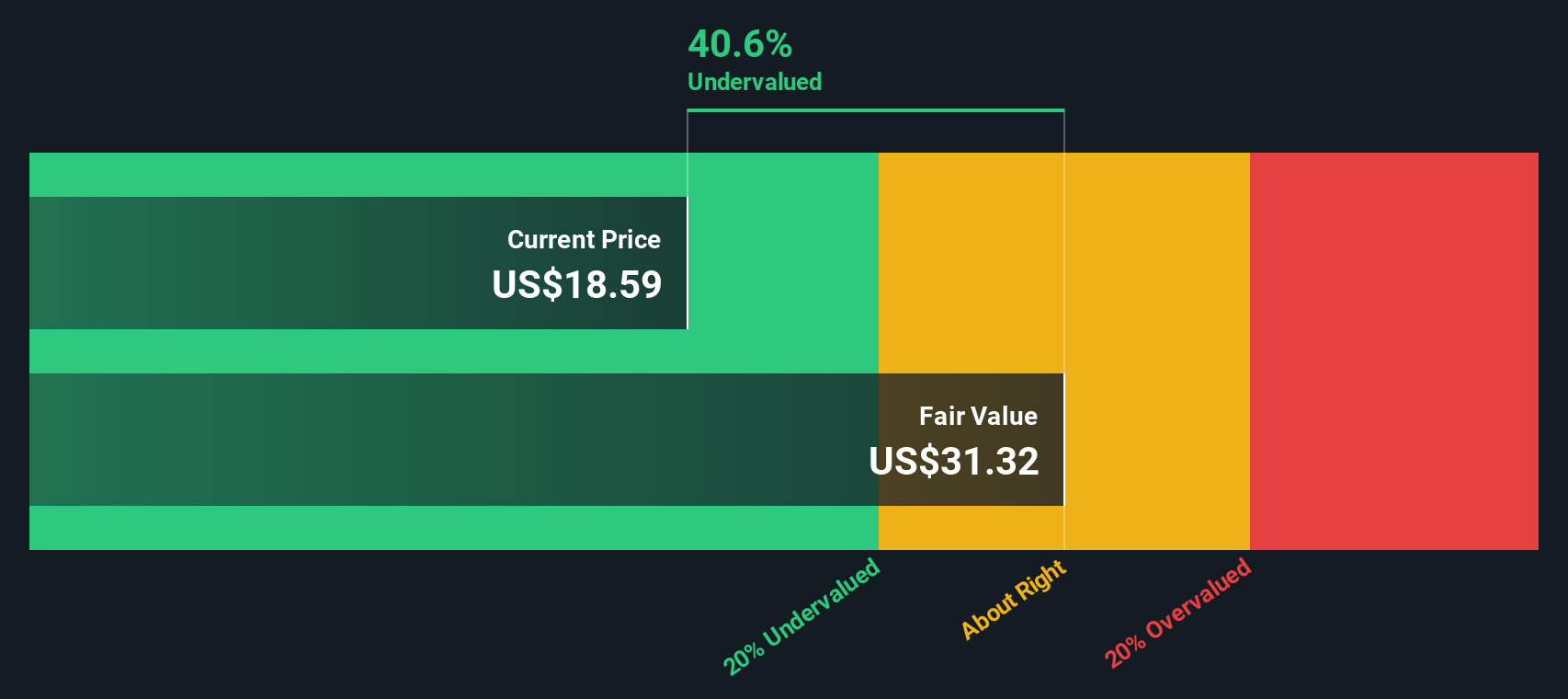

According to the DCF model, Mattel’s intrinsic value is $27.10 per share. With this measure, Mattel stock appears 34.1% undervalued compared to its current market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mattel is undervalued by 34.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Mattel Price vs Earnings (PE Ratio) Analysis

For profitable companies like Mattel, the Price-to-Earnings (PE) ratio is a widely used and practical way to assess valuation. The PE ratio tells investors how much they are paying for each dollar of the company’s earnings. This makes it especially relevant when a business generates consistent profits. A higher PE can signal strong growth expectations or lower risk. In contrast, a lower PE often points to either slower growth prospects, higher risk, or overlooked value.

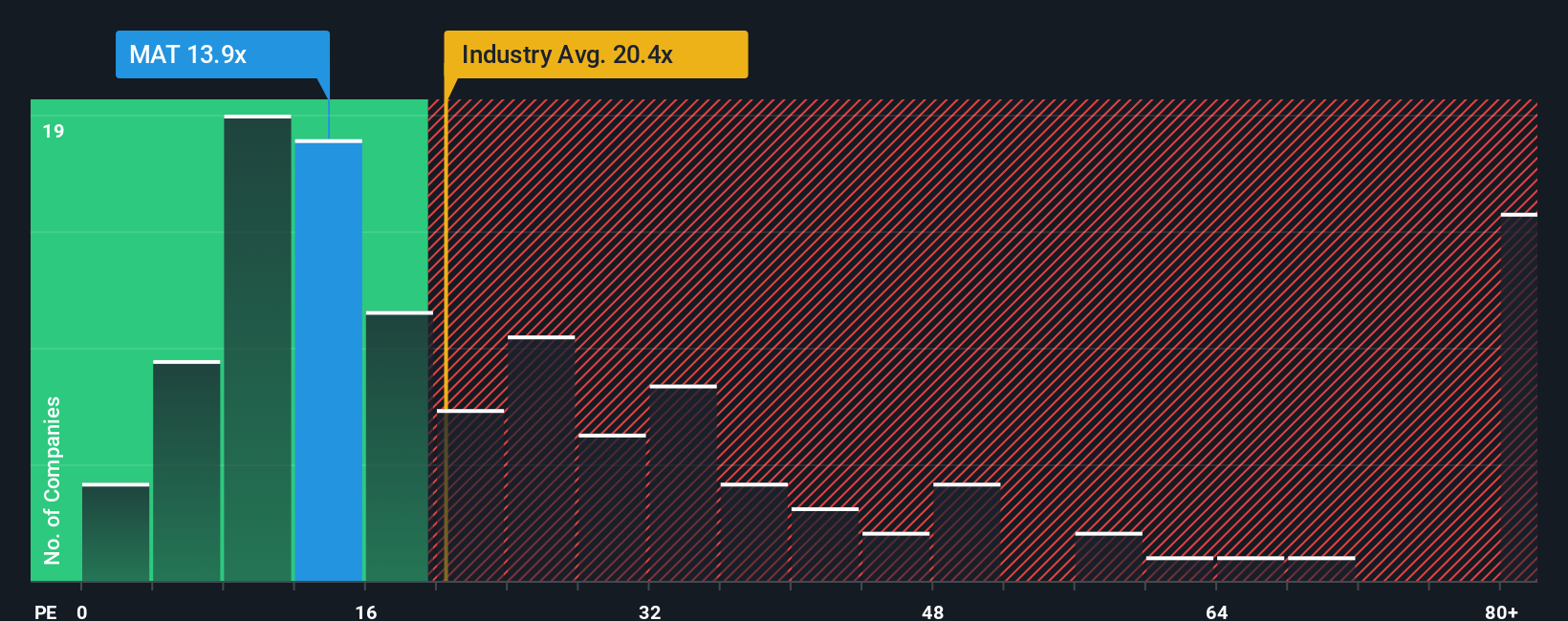

Mattel currently trades at a PE ratio of 10.9x. Compared to the average PE of its Leisure industry peers, which sits at 20.8x, and the peer group average of 60.3x, Mattel appears undervalued in a pure peer comparison. However, simply comparing to these industry numbers can miss important factors like future growth, profit margins, and risk profile that affect what a "normal" or "fair" PE should really be for Mattel.

That is where Simply Wall St’s proprietary Fair Ratio comes in. This benchmark is custom-calculated for Mattel and sets a PE ratio of 15.2x, based on its earnings growth, industry, profit margin, market cap and risk score. The Fair Ratio method provides a more nuanced, company-specific benchmark than broad industry averages because it blends these critical factors. With Mattel trading at 10.9x against a Fair Ratio of 15.2x, the shares look undervalued on this metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mattel Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative connects your personal story or belief about Mattel’s future, such as how you expect its revenue, profit margins, and strategy to play out, with a financial forecast and a fair value estimate. Instead of just looking at numbers in isolation, Narratives put your perspective front and center, letting you factor in the context behind the numbers.

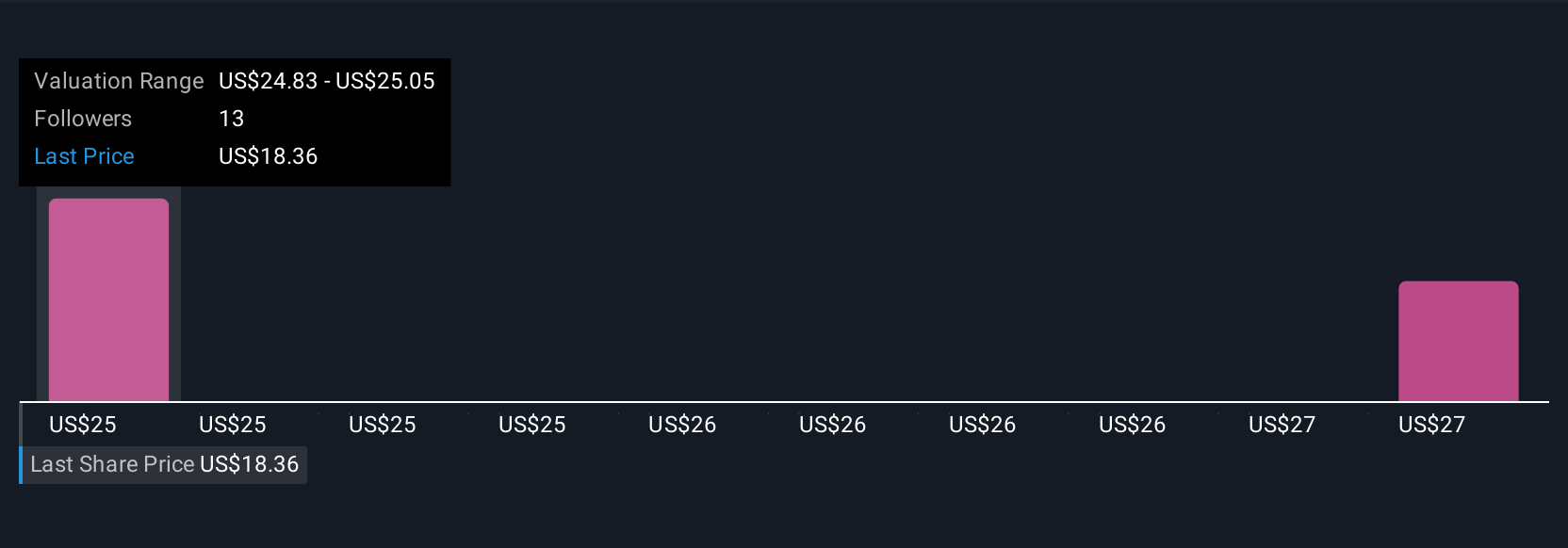

On Simply Wall St’s Community page, Narratives are easy to access and use. They help millions of investors express, track, and update their investment stories as new information, ranging from news headlines to earnings results, comes in. Narratives make it simple to see how your forecast compares with others, and they automatically update valuation models whenever key assumptions or company developments change.

With Narratives, you can anchor your buy or sell decisions by comparing your fair value to the current share price. This helps make investing less about guesswork and more about insight. For instance, some Mattel investors believe rising international demand and digital expansion could drive a fair value as high as $30.00 per share, while others see ongoing risks and set fair value closer to $21.00.

Do you think there's more to the story for Mattel? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal