Where Does Arista Networks Stand After Recent 4.5% Pullback in 2025?

Trying to figure out what’s next for Arista Networks? You’re not alone. Whether you’re already holding shares or just eyeing this tech heavyweight from the sidelines, there’s plenty to consider. With Arista’s stock closing recently at $138.79, it’s hard to ignore its eye-popping track record. The stock is up more than 900% over the past five years and has jumped 41.5% in just the last year. Those kinds of long-term gains can make anyone wonder if the momentum will continue, especially when the past week’s dip of 4.5% has snapped some of that run.

There have been some shifts in market sentiment recently, as investors digest demand trends and updates from the broader data center industry. Arista’s exposure to fast-growing networking markets has likely contributed to its significant share price moves, but as with most high-profile tech names, concerns about valuation have started to appear.

When it comes to being “undervalued,” Arista scores just 1 out of 6 on our valuation checklist. This suggests there’s only a single area where the stock might be trading below its fair value using traditional metrics. That makes it more important than ever to look under the hood and see what those different valuation approaches are really telling us. Let’s break them down, piece by piece, and talk about a smarter way to wrap it all together at the end.

Arista Networks scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Arista Networks Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation technique that estimates a company's true worth by projecting its future cash flows and then discounting them back to today’s value. This approach helps investors figure out whether a stock is trading above or below its intrinsic value.

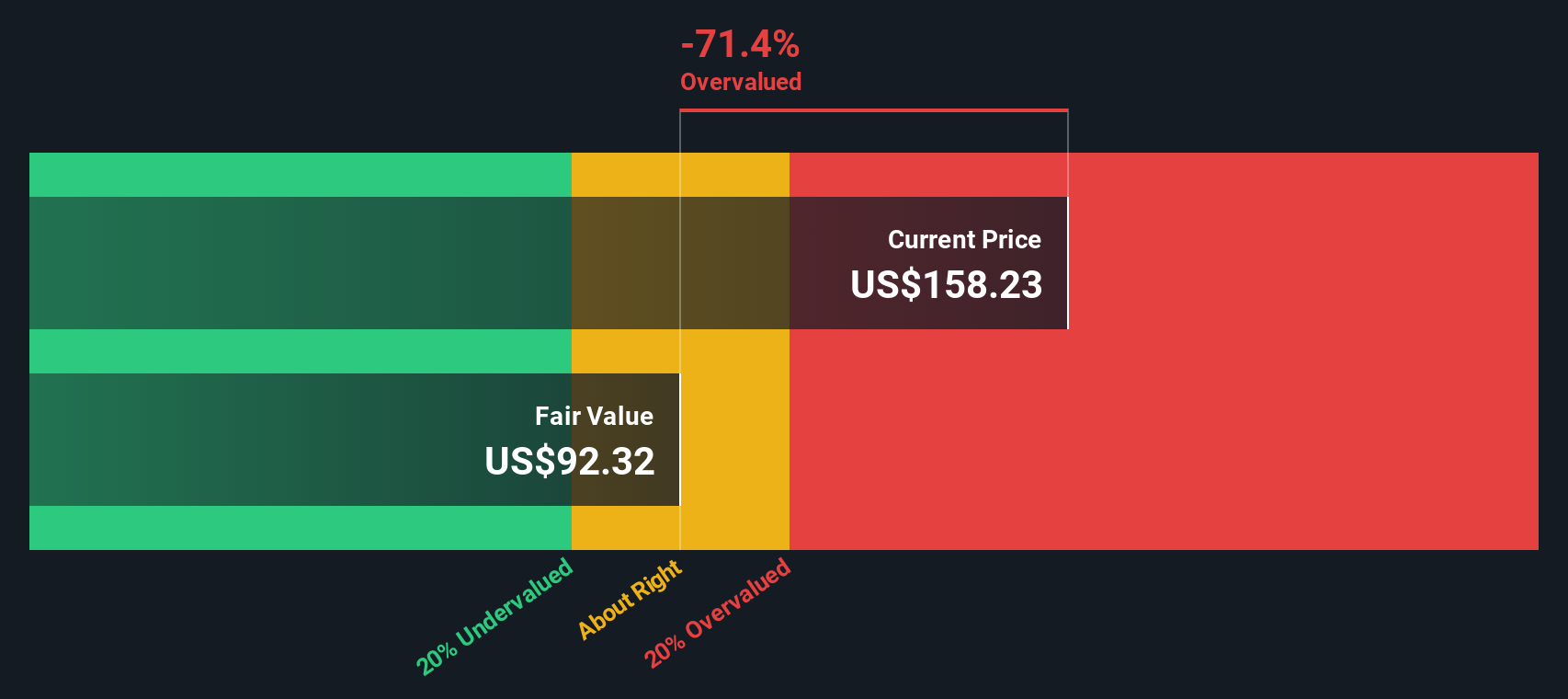

For Arista Networks, the DCF analysis begins with its recent Free Cash Flow, which stands at $3.99 billion. According to available analyst estimates and extrapolations, Arista’s cash flow is expected to continue climbing, reaching a projected $7.75 billion by 2035. While analyst estimates only look out about five years (with forecasts like $6.12 billion in 2028), further growth beyond that is modeled using industry trends and conservative assumptions by Simply Wall St.

Despite this robust growth picture, the DCF model values Arista at an intrinsic fair value of $92.56 per share. Compared to the current share price of $138.79, this signals that the stock is about 49.9% overvalued based on cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arista Networks may be overvalued by 49.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Arista Networks Price vs Earnings (PE)

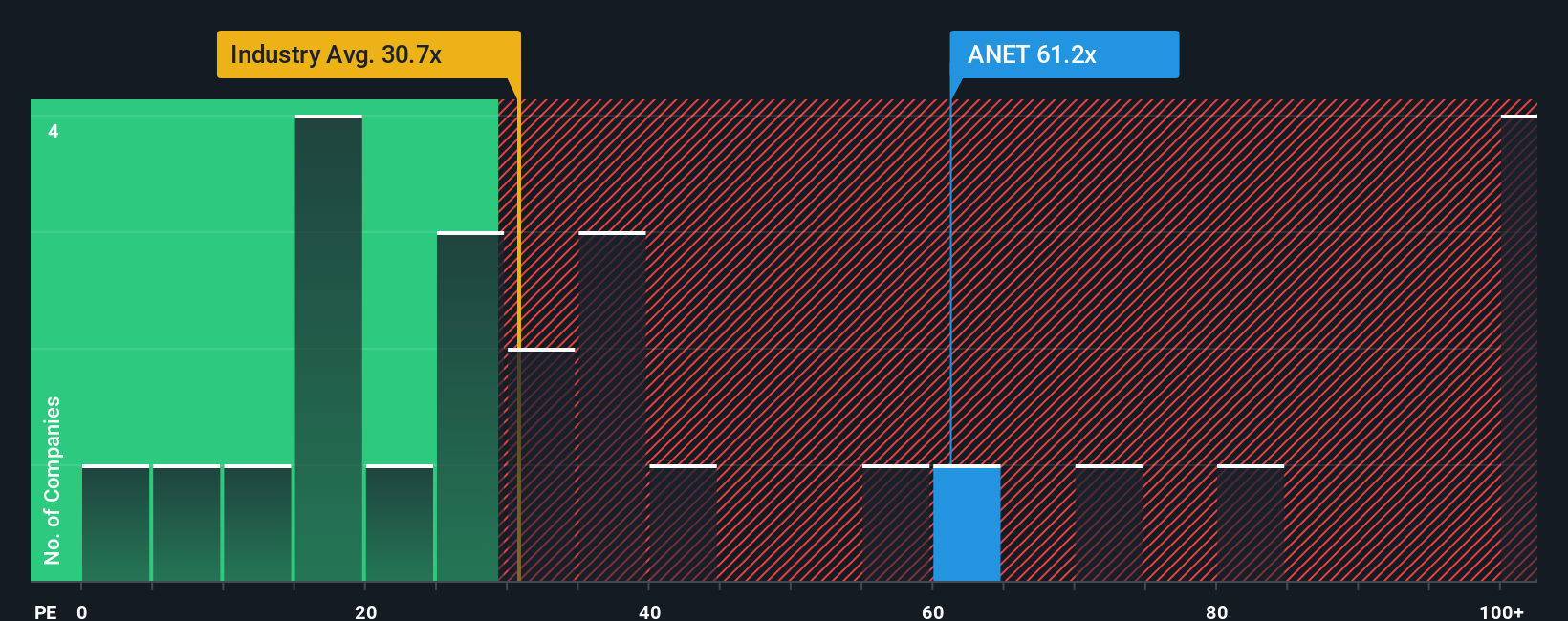

The Price-to-Earnings (PE) ratio is one of the most popular ways to value profitable companies like Arista Networks, as it shows how much investors are willing to pay for each dollar of earnings. Generally, a higher PE ratio can reflect expectations of stronger growth ahead or simply indicate the stock is more expensive relative to its earnings.

It is important to remember that what counts as a “normal” or “fair” PE often depends on how quickly a company is expected to grow earnings and how risky its business is. Fast-growing or lower-risk companies can justify higher multiples. Market or industry averages also serve as useful benchmarks for context.

Currently, Arista Networks trades at a PE ratio of 53.6x. This is well above the broader Communications industry average of 30.7x and also above its peer average of 73.0x. Rather than just comparing against industry or peers, Simply Wall St applies a proprietary Fair Ratio for Arista, calculated at 42.6x. This Fair Ratio adjusts for specifics such as Arista’s earnings growth, profit margins, industry backdrop, company size, and unique risks, making it a more holistic measure than simple industry or peer comparisons.

Since Arista's actual PE (53.6x) is noticeably above its Fair Ratio (42.6x), this approach suggests the stock is significantly overvalued using earnings multiples.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arista Networks Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter, more dynamic way to make investment decisions that is now available on Simply Wall St’s Community page.

A Narrative is your own story or thesis about a company, where you set out your expectations for its future, such as fair value, revenue growth, earnings, and margins, based on how you see the business evolving, the risks, and the opportunities ahead.

Unlike static ratios, Narratives empower you to connect Arista Networks' real-world story to a financial forecast and ultimately to a fair value estimate. This approach helps ensure your decision to buy or sell is always grounded in your view of what the company is truly worth, not just the latest headlines or analyst reports.

This tool is easy to use and accessible to millions of investors, allowing you to compare your fair value directly with the current share price. As Narratives update automatically when new information emerges, your view keeps pace with reality.

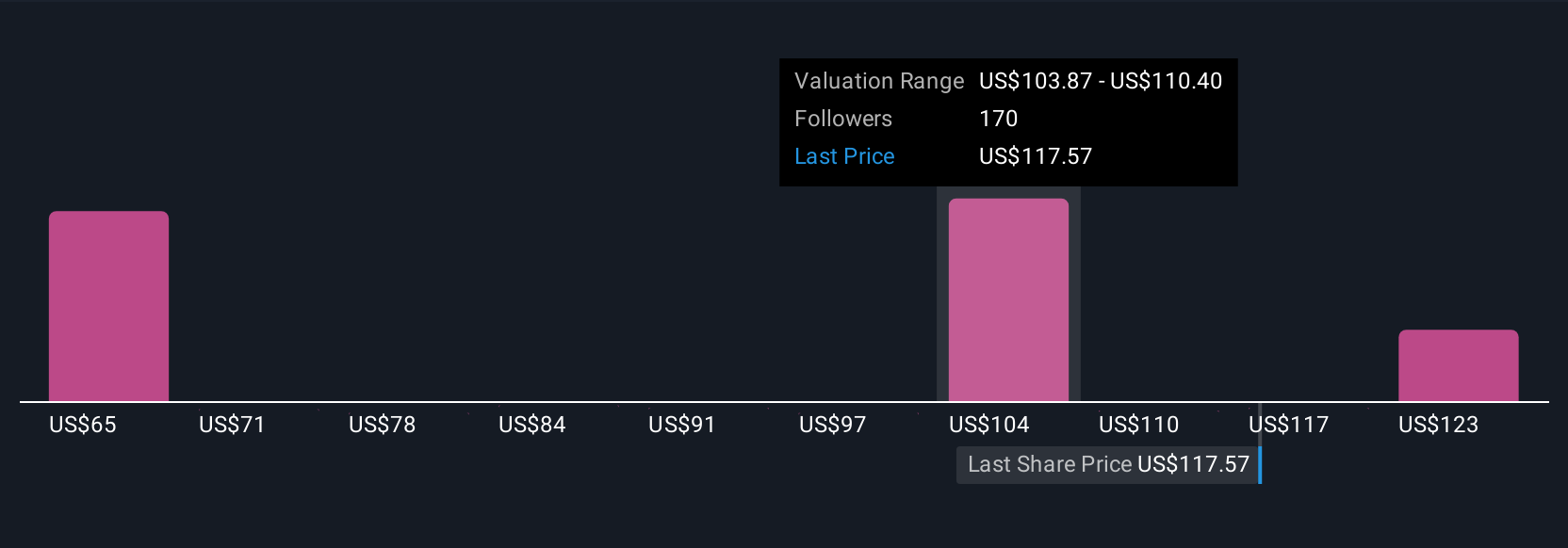

For example, one investor may see Arista Networks’ fair value as $130, forecasting rapid AI-driven growth, while another might estimate $156 by projecting even stronger cloud infrastructure adoption and market share gains. This demonstrates that your investment decisions should reflect your own Narrative and assumptions.

For Arista Networks, we’ll make it easy for you with previews of two leading Arista Networks Narratives:

Fair value estimate: $156.38

Currently undervalued by approximately 11.3%

Projected revenue growth: 20.6%

- Leadership in open networking and AI infrastructure, combined with increased focus on software and automation, is expected to expand market share and drive recurring revenue growth.

- Analysts project sustained multi-year revenue increases fueled by AI data center buildouts, migration to open Ethernet, and robust enterprise expansion stemming from product innovation and strategic acquisitions.

- Major risks include revenue concentration from a few customers, intensifying competition from large tech rivals, and fast-changing technology trends that could threaten margins and future stability.

Fair value estimate: $127.06

Currently overvalued by approximately 9.2%

Projected revenue growth: 15.0%

- Arista is seen as an agile, debt-free disruptor with strong equity and return on equity, successfully challenging incumbents like Cisco in high-speed data center networking.

- The company’s perfect hardware-software integration boosts customer satisfaction and loyalty, but its current valuation already prices in much of the future growth and high free cash flow expectations.

- While ongoing free cash flow growth is possible, the narrative stresses that achieving projected financial targets will require accelerating performance in an increasingly competitive environment.

Do you think there's more to the story for Arista Networks? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal